An Early Investor in iTunes and Pandora Shares His Views on the Direction of the Music Business An early investor in iTunes and Pandora weighs in on what makes an online music company a hit.

By Gwen Moran •

Opinions expressed by Entrepreneur contributors are their own.

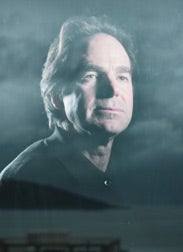

Jim Feuille has great taste in music. Or, rather, he has great taste in the companies in the online music realm that have the best chance for success. Feuille, general partner of San Francisco VC firm Crosslink Capital, was an early investor in Apple's iTunes for Windows and the lead on the team that invested in Pandora Radio back in 2005, when it was still a fledgling music genome invention. He helped shepherd Pandora to the free online radio service it is today, with market valuation, by some estimates, in the hundreds of millions. Feuille shares his insight on online music, foreign markets and what gets his attention.

How did you become aware of Pandora?

Early on, we bought a lot of Apple, believing in this trend of analog to digital. That was our bet on the purchase of music. Then we asked, "Where else is there an opportunity to disintermediate music?" So, we spent the next two years trying to find every private company we could that was doing something in digital music. We invested in a digital jukebox company called Ecast that's done OK. We looked at Internet radio services--when we first met Pandora, they were a company called Savage Beast Technologies. It was early 2005 and, at the time, they had built a music genome project and they had a music recommendation engine. They hadn't launched their service, but they had a vision for turning that music genome project into a consumer-facing Internet radio service that would create personalized radio. It took two years of effort and review of 30 to 40 companies to find them. Online radio as a category is very large and holds a lot of opportunity.

The rest of this article is locked.

Join Entrepreneur+ today for access.

Already have an account? Sign In