Salesforce Stock is Rebounding Customer relationship management (CRM) giant Salesforce (NASDAQ: CRM) shares have taken a beating since peaking at $311.40 last year.

By Jea Yu •

This story originally appeared on MarketBeat

Customer relationship management (CRM) giant Salesforce (NASDAQ: CRM) shares have taken a beating since peaking at $311.40 last year. The Company had the best quarter in its history and raised its fiscal 2023 guidance but could not withstand the overall selling in the benchmark indices. Salesforce has been ranked the number one CRM software provider for eight years in a row by IDC. The Company is "on track" to become the top enterprise cloud and software applications provider in the world. The Company's 360 portfolios including Sales, Service, Marketing, and Commerce Cloud along with Slack, Tableau, and MuleSoft are used by literally every company in the Fortune 500. The Company is also bolstering its carbon relationship management services to help organizations better address climate change. Prudent investors seeking exposure to a leading enterprise cloud player with solid fundamentals at a discount can look for opportunistic pullbacks in shares of Salesforce.

Fiscal Q4 2022 Earnings Release

On March 1, 2022, Salesforce released its fiscal fourth-quarter 2022 results for the quarter ended January 2022. The Company reported earnings-per-share (EPS) profits of $0.84 versus a profit of $0.75 consensus analyst estimates, an $0.09 beat. Revenues grew 25.9% year-over-year (YoY) to $7.33 billion, beating analyst estimates for $7.24 billion. RPO ended Q4 at approximately $43.7 billion, a 21% YoY increase. Current RPO ended Q4 at $22 billion, up 22% YoY. Salesforce Co-CEO Mark Benioff commented, "As we continue to see tremendous demand from customers, we're raising our FY23 revenue guidance to $32.1 billion at the high-end of the range, with a non-GAAP operating margin of 20%, and operating cash flow growth of 22% year-over-year."

Conference Call Takeaways

Co-CEO Benioff believes that COVID is behind them now despite Omicron and BA.2 being "very serious" viruses. He has met with over 45 CEOs in the past 90-days. Salesforce has capped off a phenomenal fiscal 2022 and continues to see tremendous demand from clients across every geography, every industry, and every product category. Every CEO he spoke with is going through digital transformations and it's Salesforce's job to help progress this transformation. Revenues rose 26% to $7.3 billion in the quarter making it one of the fastest-growing top 5 enterprise companies in history. The Company remains on track to becoming the world's number one enterprise cloud and software applications company. The operating market was 15% for the quarter and 18.7% for the year. The Company hit a milestone of $6 billion of cash flow for fiscal 2022, up 25% YoY. This has prompted the Company to raise fiscal 2023 revenues to $32.1 billion with a 20% operating margin. CEO Benioff stated, "And our product innovation is providing customers with the resilience they need to navigate these, I would say, grim and uncertain times. And that's why Salesforce has been ranked by IDC as the number one CRM for 8 years in a row. We have a tremendous focus here, being the number one CRM." He went on to illustrate a case study with Ford (NYSE: F) in developing the Ford Pro business unit to bolster their B2B business to complement its B2C unit to target professionals targeting productivity. Salesforce is a carbon net-zero company and fully renewable across its entire value chain with 100% renewable energy for its global operations. This has opened up a whole new segment of carbon relationship management, the other CRM. Salesforce provides analytics and information management to enable its clients to get the needed carbon as CEO Benioff believes every organization can be a "platform for addressing climate change".

CRM Opportunistic Pullback Levels

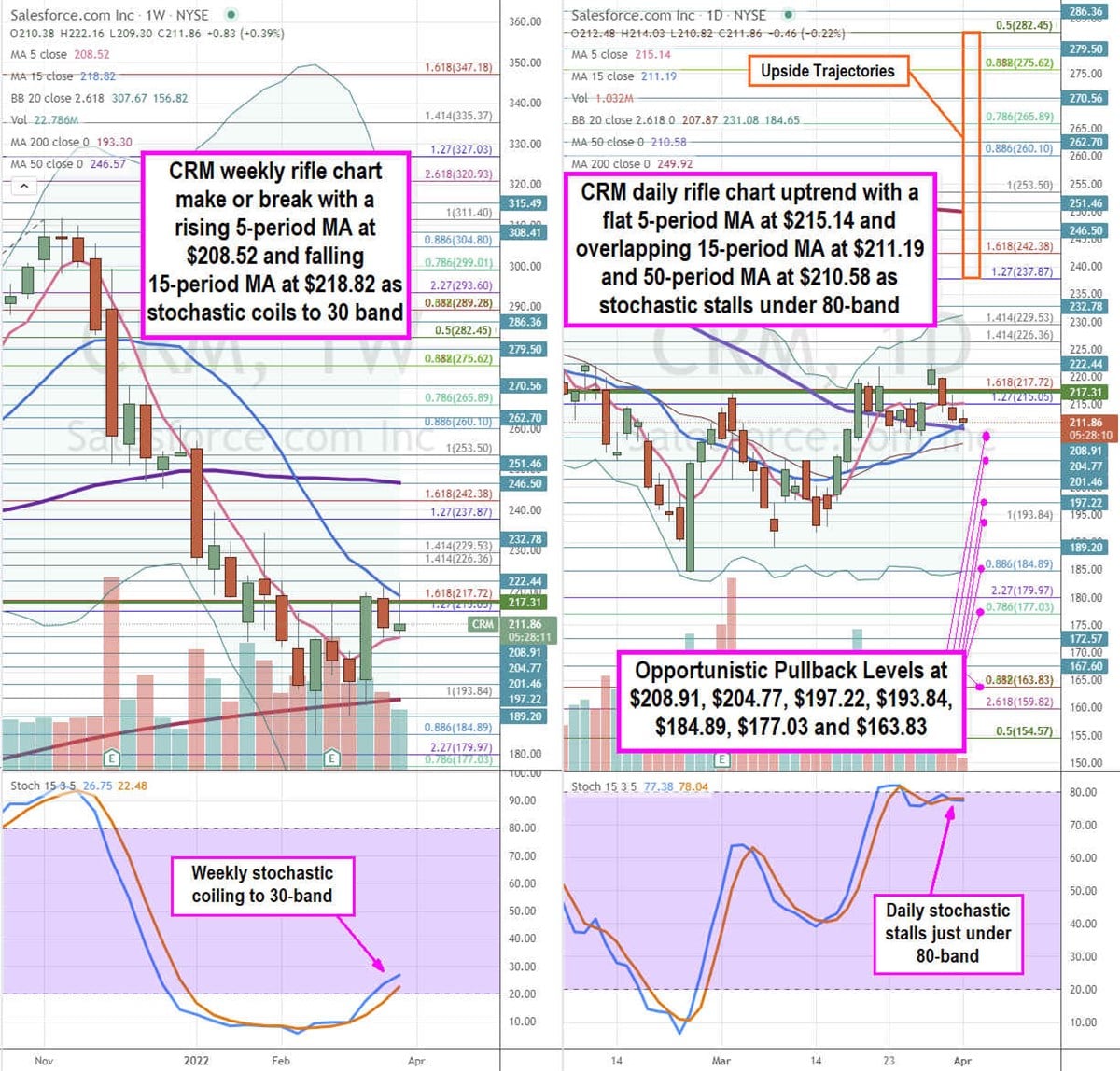

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for CRM stock. The weekly rifle chart made a near-term bottom at the $184.89 Fibonacci (fib) level before staging a rally attempt back up through the weekly 200-period moving average (MA). The weekly rifle chart downtrend stalled as the 5-period MA went flat at $208.52 on a falling 15-period MA at $218.82 as the stochastic bounced through the 20-band. The weekly 50-period MA sits at $246.57. The weekly market structure low (MSL) buy triggers on a breakout above $217.31. The daily rifle chart has an uptrend stalling out on the 5-period MA flattening at the $215.05 fib as the 15-period rises at $211.19 with 50-period MA at $210.58. The daily stochastic initially peaked at the 80-band and stalled for a potential mini inverse pup down or a pretzel mini pup on the cross up through the 80-band. Prudent investors can look for opportunistic pullbacks at the $208.91, $204.77, $197.22, $193.84 fib, $184.89 fib, $177.03 fib, and the $163.83 fib level. Upside trajectories range from the $237.87 fib level up to the $282.45 fib level.

salesforce.com is a part of the Entrepreneur Index, which tracks some of the largest publicly traded companies founded and run by entrepreneurs.