6 Key Trends That Will Shape Startup Funding Going Forward As we bid farewell to 2023, some prominent investors share their thoughts on capital availability and sectors they will continue to focus on

By S Shanthi •

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

A roller-coaster ride! That's what defines the startup game for both investors and entrepreneurs. Even though building or backing a startup has never been child's play, their journeys since the pandemic have been unstable with many ups and downs. The business models or sectors that investors considered to be safest turned out to be the most fragile. And, the sectors that were considered slow, suddenly took off and showcased resilience, such as agritech, e-commerce, edtech, D2C, OTT, among others.

Once the pandemic-induced lockdowns were lifted, some sectors and businesses that were on the verge of shutting down came back on track, some that picked up the pace and achieved habit formation during the lockdown days continued to excel, while some others that shined during lockdown had even to shut shop.

Due to all these inconsistencies, the investor community has also seen many ups and downs. In addition to that, due to frauds at GoMechanic, BharatPe and Zilingo, they had to also relook at their due diligence strategies. Further, the uncertainties witnessed in the last decade, have also raised awareness about being mindful and that made ESG a priority for Indian funds and investors.

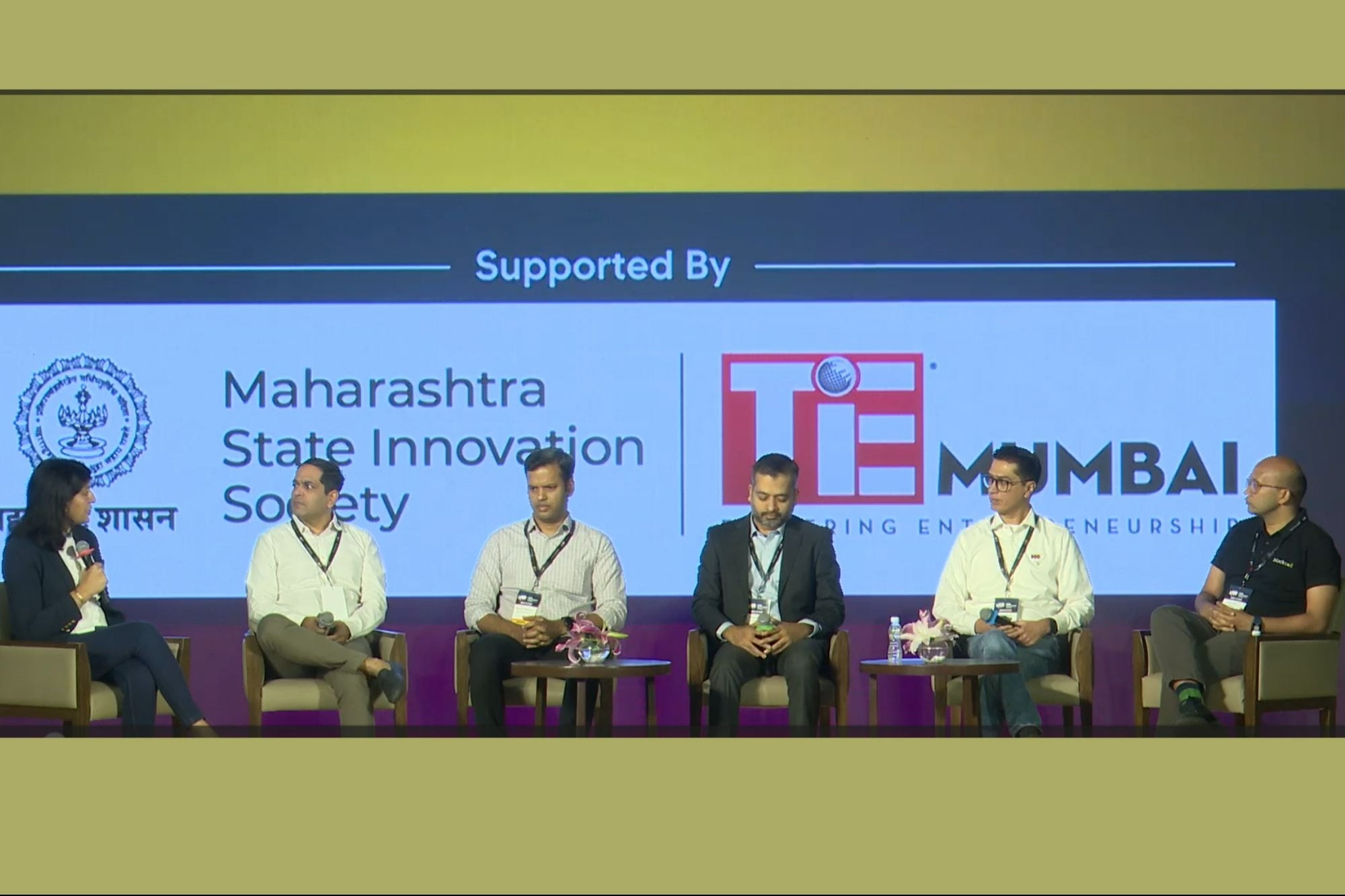

As the year comes to a close, there is more clarity in the minds of both entrepreneurs and investors. Here are some trends we will see going forward, as shared by some prominent investors at Entrepreneur India's recently concluded E Live x India Investment Forum 2023 in Mumbai.

Niche, the new normal

Industry stakeholders believe that highs and lows are part of the growth of the startup ecosystem. However, in all this chaos, they also feel that there will always be some niche sectors or companies that will gain prominence. "People have seen the highs of some sectors like edtechs and suddenly today they are boring. However, there will always be some gems in even the so-called boring sectors. Similarly, many niche sectors like manufacturing tech and cleantech have come to the fore today. That will also happen," said Mitesh Shah, co-founder, Inflection Point Ventures. The fund continues to be sector-agnostic while keeping an eye on good performers. Shah believes that cleantech has good potential and some some players emerging in manufacturing tech are offering value addition to the manufacturing industry. its about identifying great entrepreneurs within these sectors, he added.

Offline is gold

While the pandemic propelled the adoption of online tools across sectors, offline continues to be the leader, especially in the consumer brands space. So, for the next decade or so, hybrid, with a strong focus on offline, will continue to scale, believe investors. Hariharan Premkumar, Managing Director and Head of India at DSG Consumer Partners explains with an example. "As a consumer fund, we are super excited about the next two decades for India as a country. Stars are aligned well in terms of the consumer boom that is set to happen here. We are excited to support consumer founders, but now there is a realization that D2C should be treated as a channel and understand the importance of offline to scale." He also spoke about the importance of offline for food brands. "The reason food has not seen many investment is that it is a sentiment that has been built in the offline channel. With the rise of quick commerce, a lot of food brands have been able to use quick commerce to get the trials going. However, any founder starting in the food space should have a flair for offline, to scale," he added.

Betting on entrepreneurs

Investors remain very excited about India as a growth destination. And, what builds this confidence is a combination of multiple factors, with the profile and zeal of entrepreneurs being one of the key factors. "If you look at the way the entrepreneurial ecosystem has evolved in India in the last five or six years, you can see that entrepreneurs are very passionate and thrilled to make things happen," said Niten Lalpuria, Partner, Paragon Partners.

He also added that the ecosystem built around entrepreneurs has helped them to reach a certain scale and touch certain revenue numbers. "But, to grow from say a 300 crore revenue to a listing stage, it would take extraordinary effort from their end, be it setting up a solid team, setting governance right from the beginning, or setting up the right systems and processes," he added.

Signs of maturity

Even though there has been a global downturn and funding winter, if one looks at the funding or growth scenario from a macro perspective, India has been growing year on year and experts believe that we will continue to shine in the coming years as well. "Companies are receiving funds and we are on a progressive path. On a quarterly basis, there is a downturn. But, overall, we are growing year on year and there is a sign of maturity of the ecosystem from both sides, bottom and top of the pyramid," said Shashank Randev, Founder VC, 100X.VC.

Rise of debt funding

According to Venture Intelligence, nearly 13 venture debt deals took place in the first half of 2023 and raised $ 174 million.

"As lenders, losing capital is not an option as returns are small. And, many investors have started realizing that is an interesting tool to have in the cap table. Because in the current times, it brings a lot of discipline. As lenders, for us, it's always about building sustainability, through multiple practices. We focus on businesses built on a good model with a strong focus on profitability," said Ankur Bansal, Co-Founder and Director, BlackSoil Capital.

Right DNA is key

Ruchira Shukla, Head for South Asia, Disruptive Technologies - Direct Equity and VC Funds, IFC - International Finance Corporation, World Bank Group believes that if a startup is planning to go for an IPO in the next 3 to 5 years, it is high time they started being transparent with the boards. "They should start bringing discussions that are critical and challenging to the board, data that are insightful to the board and start using the board to help them. A lot of founders don't do enough of that. They should remember that the board is actually a bunch of smart people whose interests are aligned with theirs. Right governance practices and the right DNA to go for an IPO that everyone receives well should be the goal," she said.