Finding a Good Small Business Job is Getting Harder Small businesses are doing a lot more without having to hire new workers.

By Scott Shane Edited by Dan Bova

Opinions expressed by Entrepreneur contributors are their own.

For Americans who prefer the small-business environment to the big-company atmosphere, I've got some bad news for you. It's getting harder and harder to obtain a good-paying small-business job. Sure, you can still find one if you look hard enough, but statistically, the trends are against you.

To begin with, more small businesses are doing without workers than at any time since the government began collecting data on the question back in the early 1980s. While 27.7 percent of small companies had employees in 1980, only 15.2 percent did in 2011, the most recent year federal government data are available.

Some businesses are automating and doing without labor, while others are shifting to non-employment labor arrangements. Reliance on contract labor has been rising rapidly in recent years. Between 2003 and 2010, sole proprietors' spending on contract labor increased from 3.5 percent of total expenditures to 6.1 percent of spending.

Employment has been growing more slowly at small companies than large ones since the late 1980s – a point often missed in all the feel-good rhetoric about small business being spouted by our nation's pundits and politicians. The slower job growth at smaller entities means that small business's share of private-sector employment is shrinking. Businesses with fewer than 500 employees accounted for only 48.9 percent of the private sector labor force in 2012, down from 54.8 percent in 1987, Census Bureau data reveal.

Related: Greater National Competitiveness Doesn't Lead to More Entrepreneurship

Not only are small businesses employing fewer workers, but compensation at these firms also has been getting relatively worse. Wages themselves have been stagnant. Pay at businesses employing between one and 99 workers has risen only 0.9 percent in inflation-adjusted terms betwen 1990 and 2013.

And fewer small companies are providing benefits. Over the past two decades, the share of small-business jobs that offer retirement and vacation benefits has remained significantly lower than the share of big business jobs offering those benefits. The situation is even worse for health insurance. Not only are the odds of getting employer-based coverage lower in small businesses than in big ones, but also the fraction of small company jobs with health benefits has declined over time. According to the Kaiser Family Foundation, 65 percent of businesses with between one and 199 employees offered employee health care coverage in 1999. By 2014, that share had declined to 54 percent. By contrast, the fraction of businesses with 200 or more employees offering employee health insurance had dropped only one percentage point, from 99 to 98 percent, over the same period.

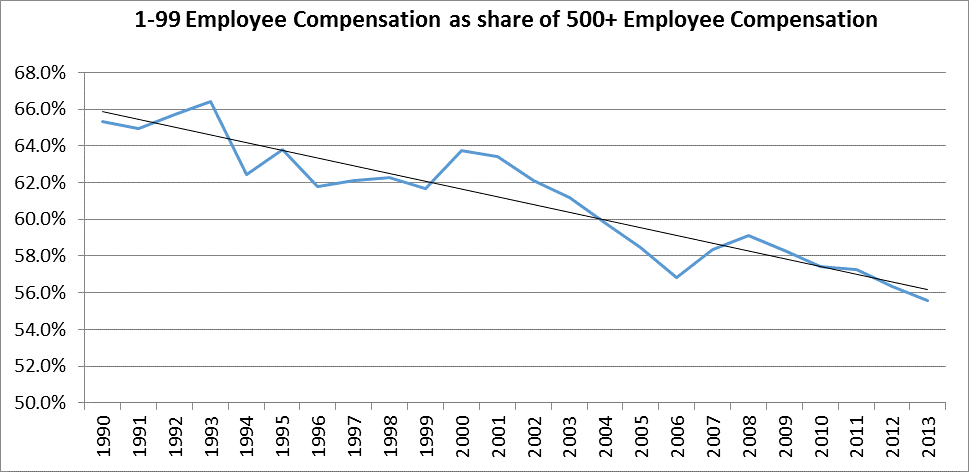

Because wages are growing faster at larger companies, the pay gap between small and large firms is rising. Total compensation at businesses with fewer than 100 workers has shrunk to 55.6 percent of the level at organizations with 500 or more employees, from 65.3 percent in 1990, as the figure below reveals. Moreover, the trend (shown in the black line in the figure) is clearly downward.

The combination of slower wage growth and lesser job creation at small businesses has meant that companies with 500 or more employees have been accounting for an increasing share of private-sector payrolls. The fraction of business payrolls accounted for by companies with fewer than 500 employees has shrunk from 48.6 percent in 1988 to 42 percent in 2011.

With fewer companies hiring anyone at all, and smaller businesses adding jobs at a slower pace than their big-business brethren, getting any small-business job has become more difficult in recent years. Add to that slower wage growth and declining willingness to offer benefits at small companies, and it becomes clear that finding a good, high-paying small-business job isn't as easy as it was a generation ago.