How to Pick the Right Bank for Your Business

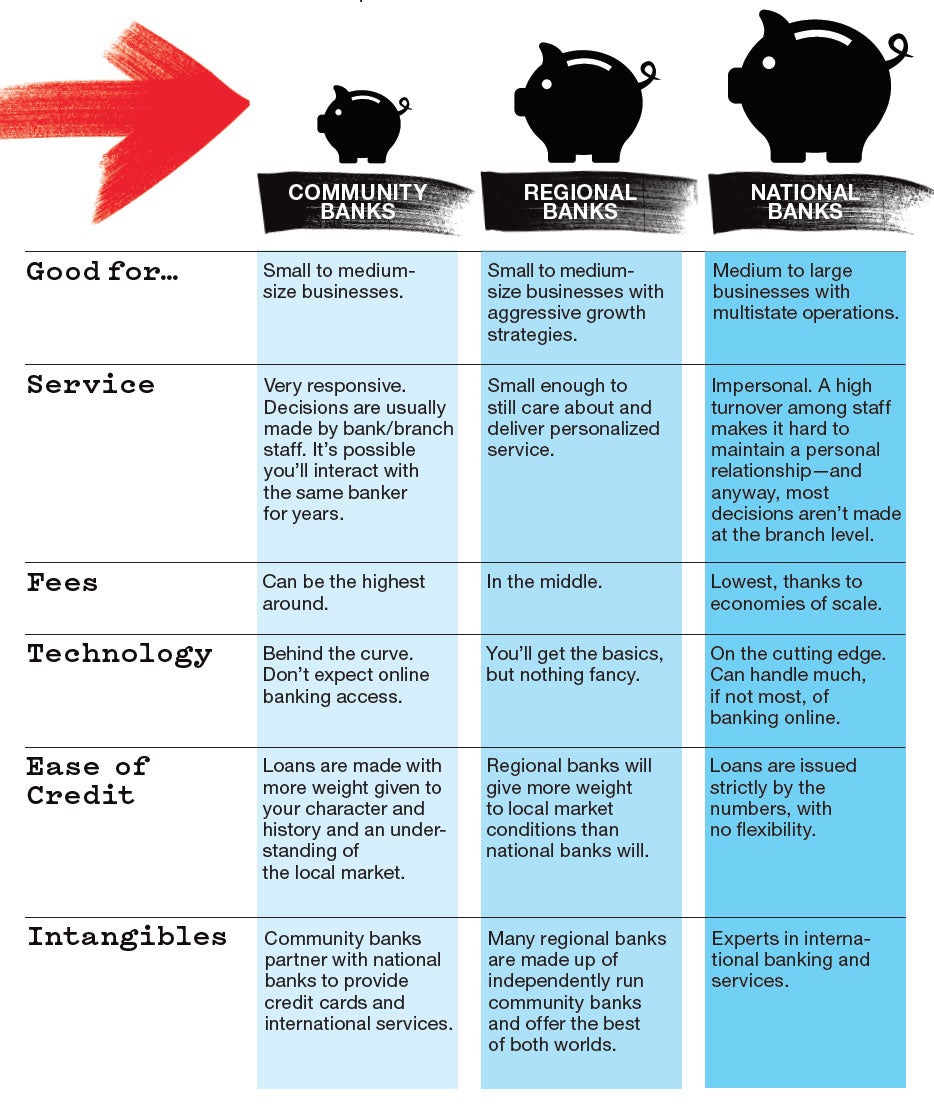

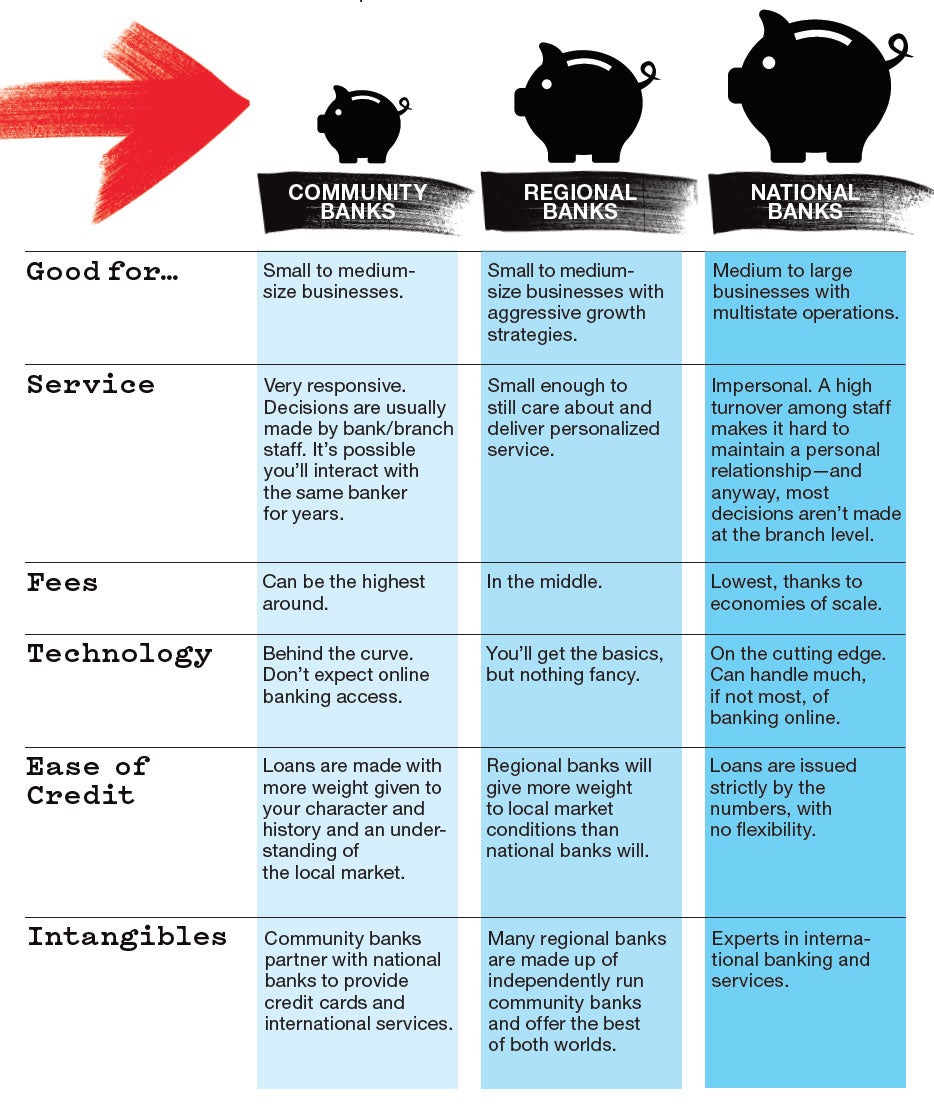

So, how do you decide?

First, make a list of the services you want. Are you looking for low fees, easy credit, an SBA loan or a combination of these and other services? Now rank the items in order of importance, and start shopping.

At each bank, ask for the business banker; that’s usually the loan officer assigned to commercial customers. Talk through your priorities. Then ask two key questions: 1) How high a lending limit can they authorize without needing approval from higher authority? 2) Do they offer SBA loans, do they like to make them, and what volume of them do they close? (And if you’re serious about taking out a SBA loan, look for banks that are Preferred SBA Lenders and have the authority to underwrite and approve these loans on their own.) The answers will give you a good indication of how much the bank wants to work with you.

Of course, the ultimate test is to apply for a line of credit. Recently, I helped a client apply at eight banks. Two didn’t respond. Four came back with uncompetitive offers. Two gave us detailed terms sheets. We went with the one that offered us more money than we asked for.

So, how do you decide?

First, make a list of the services you want. Are you looking for low fees, easy credit, an SBA loan or a combination of these and other services? Now rank the items in order of importance, and start shopping.

At each bank, ask for the business banker; that’s usually the loan officer assigned to commercial customers. Talk through your priorities. Then ask two key questions: 1) How high a lending limit can they authorize without needing approval from higher authority? 2) Do they offer SBA loans, do they like to make them, and what volume of them do they close? (And if you’re serious about taking out a SBA loan, look for banks that are Preferred SBA Lenders and have the authority to underwrite and approve these loans on their own.) The answers will give you a good indication of how much the bank wants to work with you.

Of course, the ultimate test is to apply for a line of credit. Recently, I helped a client apply at eight banks. Two didn’t respond. Four came back with uncompetitive offers. Two gave us detailed terms sheets. We went with the one that offered us more money than we asked for.