Tax Mistakes for Entrepreneurs to Avoid As your company grows, make sure you understand how to put the right tax mechanisms in place.

To continue watching log in or create your free Entrepreneur account.

Login to continue Create an accountOriginally aired Jul 30, 2019

There’s an old adage in business: What got you here won’t get you there. You have a great idea, you start your business, and soon, you’re making money. That’s fantastic, but nothing can quite prepare you for a huge tax bill that you weren’t expecting.

Bruce Willey -- who has years of experience working with small and midsize businesses at American Tax and Business Planning -- offers some simple tips that can help you hold off the high tax bills and set your company up for strong growth.

Key Takeaways:

- Discover some of the the most common tax mistakes entrepreneurs make

- Understand why accountants might set you up in your new business as an LLC, and why that may not be the right call

- Learn why there's no reason to panic if you get a notice that you'll be audited

Upcoming Webinar

Protecting Your Brand in the Age of AI: What Founders Need to Know Now

Join us for this free webinar to learn about protecting your brand, safeguarding your intellectual property, and navigating the gray areas of AI—before they turn into costly mistakes.

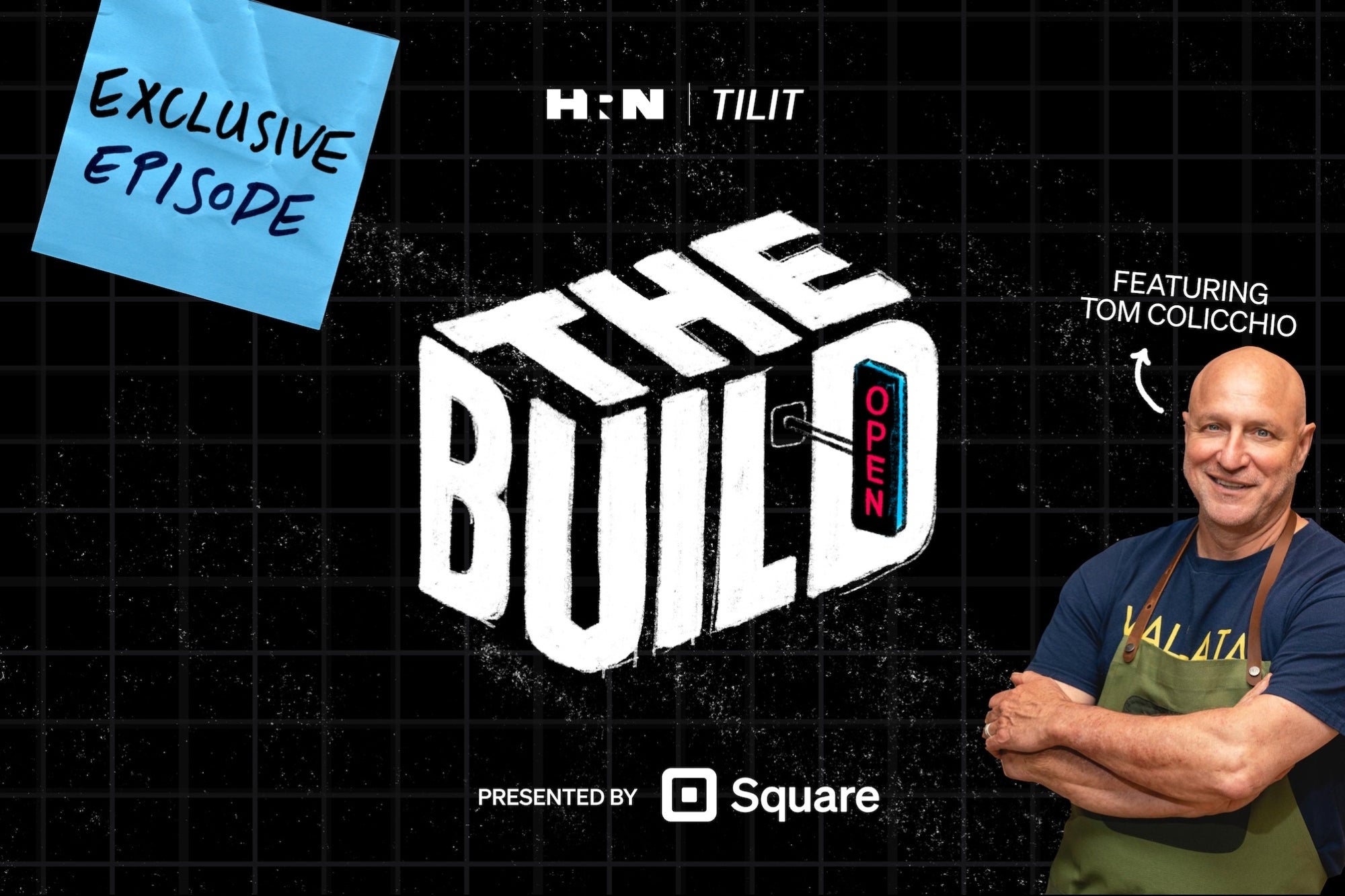

On Demand: How a Restaurant is Made

Opening a restaurant? Get insights and advice from chefs Rasheeda Purdie and Tom Colicchio on a bonus video episode of The Build, brought to you by TILIT and Square. Watch now.