8 Ways Business Owners Can Take Advantage of the Federal Stimulus Package Our experts, Mark J. Kohler and Mat Sorensen, nationally respected tax lawyers, will guide you to maximize your benefits from the stimulus package.

Originally aired Apr 07, 2020

There is a strategy to maximizing all the benefits of Congress's recent $2 trillion stimulus package in response to the COVID-19 pandemic. It’s not just applying for the Paycheck Protection Program (PPP) or tapping into your 401k. In fact, there are actually eight key pieces to the legislation that can assist business owners in one form or another. Also, realize that the definition of a ""small-business owner"" encompasses a lot of people, including you!

Our experts, Mark J Kohler and Mat Sorensen, Nationally respected tax lawyers, will guide you to maximize your benefits from the stimulus package.

Entrepreneur Press author Mark J. Kohler, CPA, attorney, co-host of the Podcast “Refresh Your Wealth”, and a senior partner at both the law firm KKOS Lawyers and the accounting firm K&E CPAs. Kohler is also the author of “The Tax and Legal Playbook, 2nd Edition”, and “The Business Owner’s Guide to Financial Freedom.

Mat Sorensen is an attorney, CEO, author, and podcast host. He is the CEO of Directed IRA & Directed Trust Company, a leading company in the self-directed IRA and 401k industry and a partner in the business and tax law firm of KKOS Lawyers. He is the author of The Self-Directed IRA Handbook.

Upcoming Webinar

Protecting Your Brand in the Age of AI: What Founders Need to Know Now

Join us for this free webinar to learn about protecting your brand, safeguarding your intellectual property, and navigating the gray areas of AI—before they turn into costly mistakes.

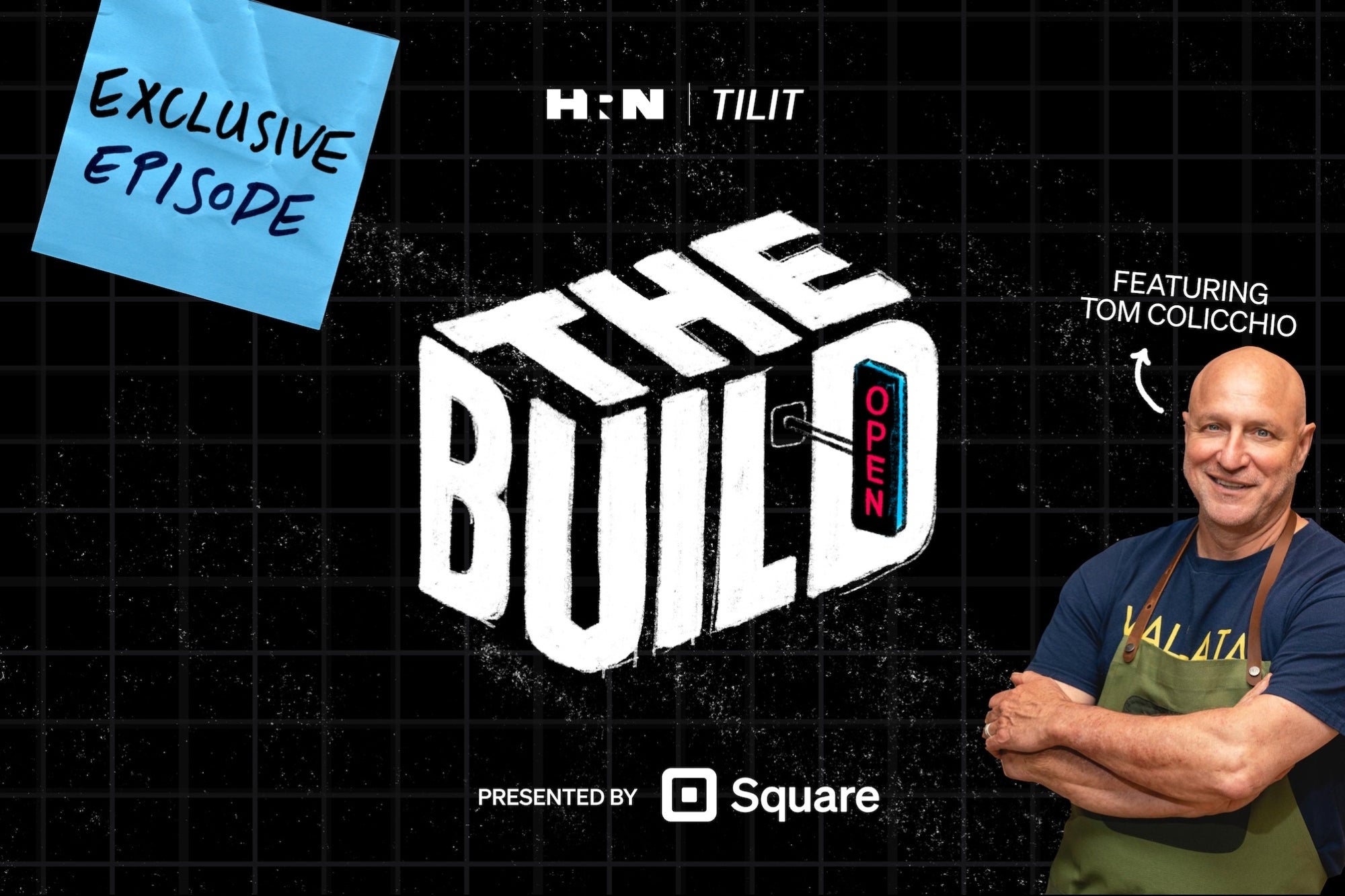

On Demand: How a Restaurant is Made

Opening a restaurant? Get insights and advice from chefs Rasheeda Purdie and Tom Colicchio on a bonus video episode of The Build, brought to you by TILIT and Square. Watch now.