What You Need to Know About The PPP Updates Join our experts Mark Kohler and Mat Sorensen as they dive into the various ways you can can maximize your PPP loan and avoid major pitfalls.

Originally aired Jun 11, 2020

Congress recently passed the Paycheck Protection Flexibility Act of 2020 and improved the Paycheck Protection Program (PPP) for small business loans. The bill enhances the PPP by increasing the time small businesses can use funds and receive forgiveness from eight weeks to twenty-four weeks and by reducing the payroll cost rule from 75 percent to 60 percent.

Congress recently passed the Paycheck Protection Flexibility Act of 2020 and improved the Paycheck Protection Program (PPP) for small business loans. The bill enhances the PPP by increasing the time small businesses can use funds and receive forgiveness from eight weeks to twenty-four weeks and by reducing the payroll cost rule from 75 percent to 60 percent.

Join us in this live webinar, as our key experts Mark J. Kohler and Mat Sorensen, nationally respected tax lawyers, take you through the ins and outs of the updated PPP. Mark and Mat will dive into:

- How the new PPP law will benefit most small businesses seeking loan forgiveness.

- Taking advantage forgiveness period being extended from 8 to 24 weeks.

- How the new 60% payroll costs rule (was 75%) will benefit most but will hurt others who don’t plan.

- Determining when you need to bring back your workforce under new rules in order to receive maximum loan forgiveness.

- What you should be planning and doing now so that you can get total forgiveness of your PPP loan.

Upcoming Webinar

How to Build a Personal Brand That Grows Your Business

In this live session, discover how our guest built a personal brand that fueled a near-$100M acquisition, then leveraged that same trust to launch his next venture into 1,400+ stores. Register now!

5 Leadership Strategies from Someone Who Rescued His Business from the Brink of Collapse

Join us for this free webinar to learn how to lead a company through turbulence and find success on the other side.

How to Use Press & PR to Grow Faster Without a Big Budget

Get a step‑by‑step playbook for turning press coverage into one of your most powerful growth channels—without relying on a big ad budget. In this live session, Pace PR founder Annie Scranton breaks down exactly how to win earned media, boost credibility, and drive customers using the same strategies top brands use every day.

How Recent Tax Changes Create New Opportunities for Solopreneurs and Small-Business Owners

Join us for a free webinar with Lisa Greene-Lewis, Principal Communications Manager and tax expert at Intuit TurboTax.

How Restaurant Owners Can Win Back Profits in 2026

Learn how successful restaurant owners are adapting and thriving, using strategies ranging from menu overhauls to new marketing tactics to technology-driven dining experiences that give a competitive edge.

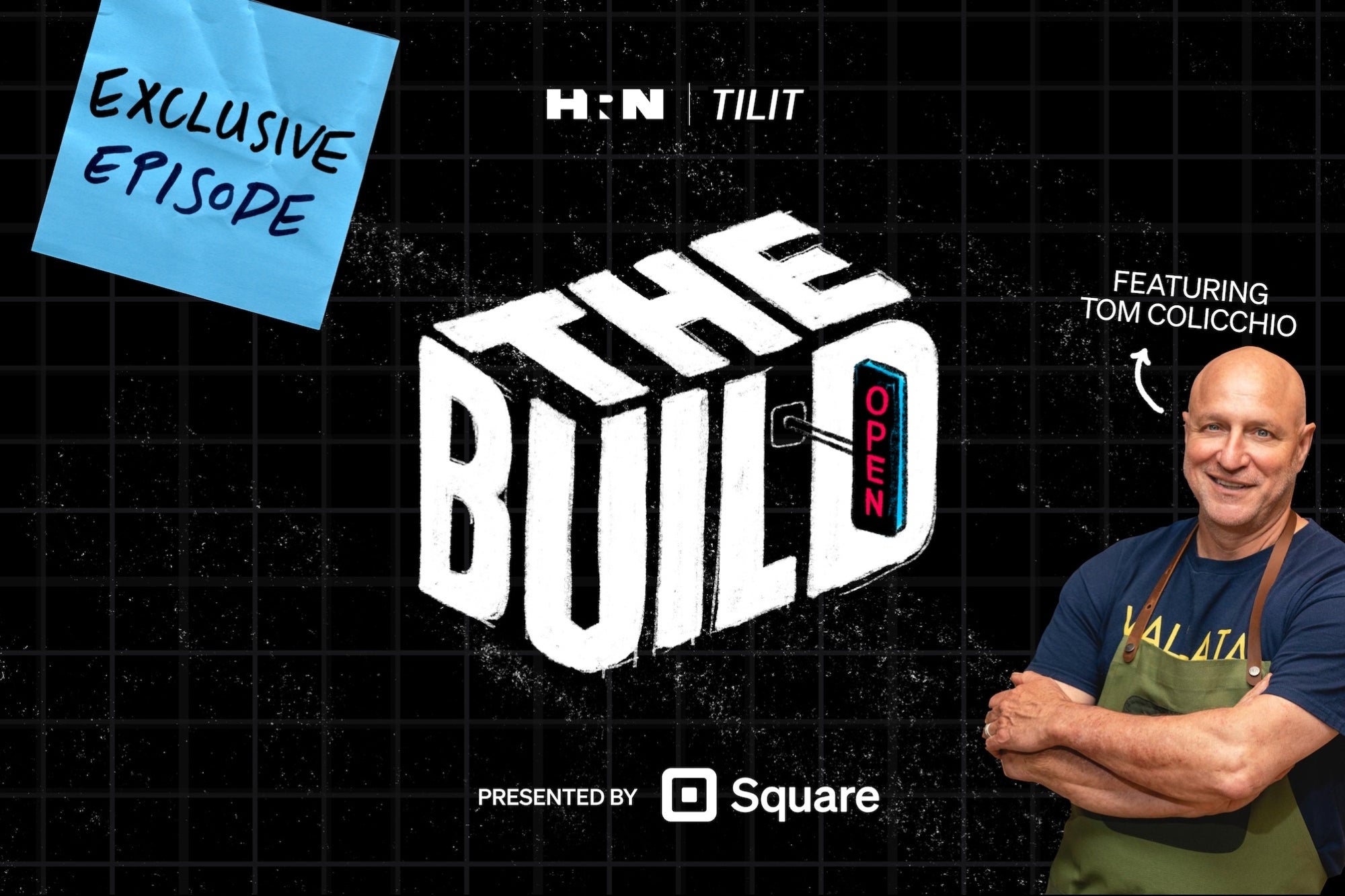

On Demand: How a Restaurant is Made

Opening a restaurant? Get insights and advice from chefs Rasheeda Purdie and Tom Colicchio on a bonus video episode of The Build, brought to you by TILIT and Square. Watch now.