What You Need to Know About the Corporate Transparency Act to Avoid Stiff Penalties Watch our webinar as our tax and legal experts dive into the critical details of the Corporate Transparency Act and how you can protect your business from fines and legal problems.

Originally aired Jan 25, 2024

If you own a small business, new legislation could require you to report ownership details to the federal government. Failing to do so could result in fines and even jail time.

Watch our exclusive webinar as tax experts Mark J. Kohler and Mat Sorensen explain the critical details of the Corporate Transparency Act and what it means for you and your business.

Key Talking Points:

What is the Corporate Transparency Act?

The law is meant to close a loophole that allows criminals to hide their identities using shell companies. But the legislation will also affect nearly every small business, including family offices, independent contractors, and LLCs used by mom-and-pop shop owners.

What Every Small Business Owner Needs to Know

Learn how the Corporate Transparency Act will directly impact your business structure, and which businesses are exempt.

The Consequences of Non-Compliance

The potential penalties for non-compliance are huge, including a daily fine of $500 and the possibility of a two-year prison term.

What You’ll Need to Disclosure

Understand what personal information you’ll be asked to provide and why, including home addresses, social security numbers, and dates of birth.

Business Owner Information (BOI) Form Details

Instructions and explanations to properly fill out the intricate Business Owner Information (BOI) form to avoid costly mistakes and delays.

Timeline and Deadlines

Understand the timeline for compliance with the Corporate Transparency Act and ensure your business is well-prepared.

This webinar is essential to understand and comply with the Corporate Transparency Act. Empower yourself with the knowledge to protect your business from fines and legal problems. Register now to safeguard your business's future.

About the Speakers:

Entrepreneur Press author Mark J. Kohler, CPA, attorney, co-host of the Podcast “Main Street Business”, and a senior partner at both the law firm KKOS Lawyers and the accounting firm K&E CPAs. Kohler is also the author of “The Tax and Legal Playbook, 2nd Edition”, and “The Business Owner’s Guide to Financial Freedom".

Mat Sorensen is an attorney, CEO, author, and podcast host. He is the CEO of Directed IRA & Directed Trust Company, a leading company in the self-directed IRA and 401k industry and a partner in the business and tax law firm of KKOS Lawyers. He is the author of "The Self-Directed IRA Handbook".

Upcoming Webinar

Protecting Your Brand in the Age of AI: What Founders Need to Know Now

Join us for this free webinar to learn about protecting your brand, safeguarding your intellectual property, and navigating the gray areas of AI—before they turn into costly mistakes.

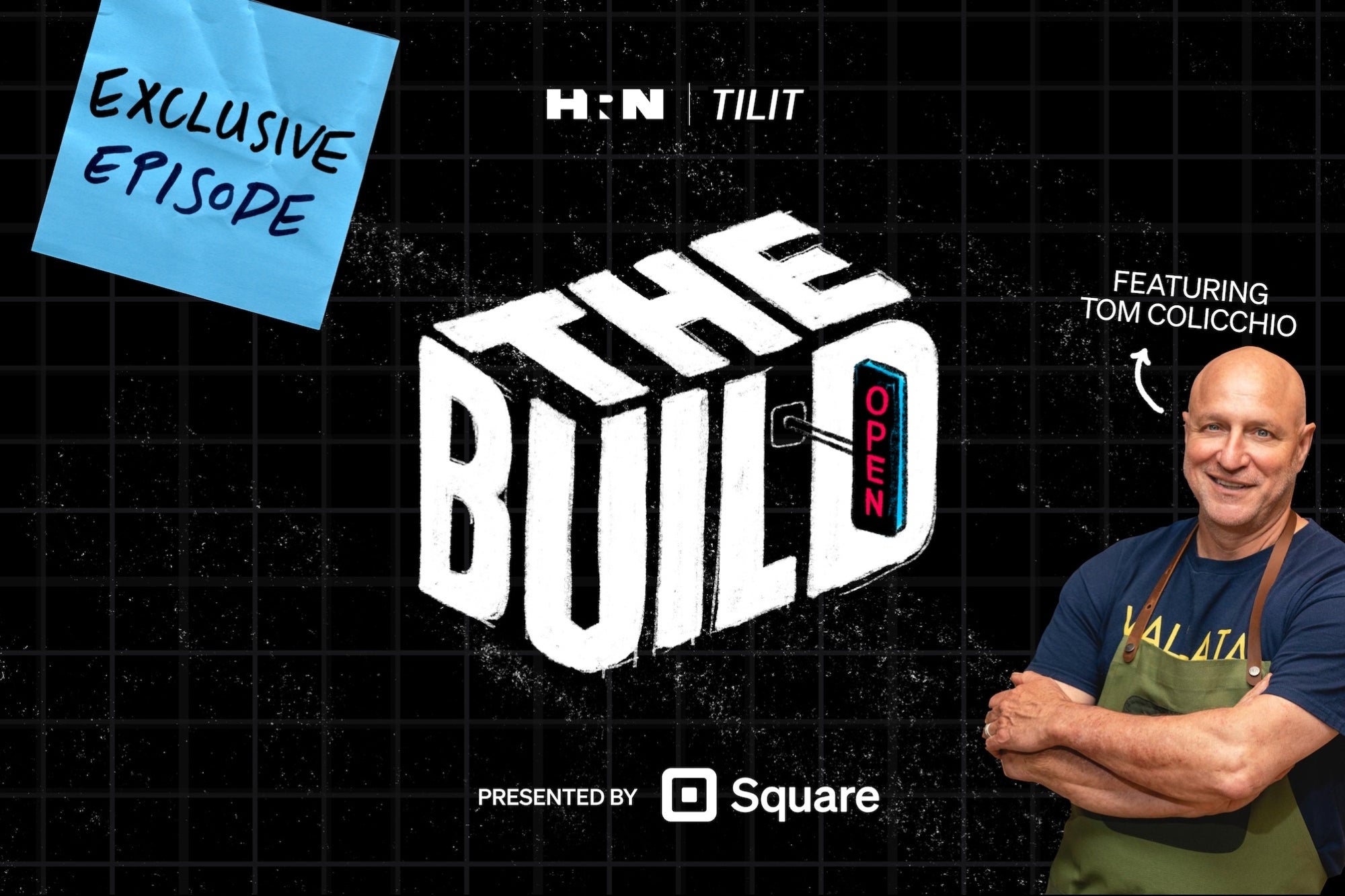

On Demand: How a Restaurant is Made

Opening a restaurant? Get insights and advice from chefs Rasheeda Purdie and Tom Colicchio on a bonus video episode of The Build, brought to you by TILIT and Square. Watch now.