Top Year-End Tax Strategies To Save You Thousands Join our experts and learn tax-saving strategies that can save you and your business big bucks, including crucial deductions that you need to put on the books before the end of the year.

Originally aired Dec 10, 2024

As the year draws to a close, there’s still time to implement tax-saving strategies that can make a big difference in the size of your refund or what you owe. Join us on December 10th at 2 PM ET for an in-depth session featuring renowned tax experts Mark J. Kohler, CPA, and Mat Sorensen.

You’ll learn highly effective money-saving strategies for small business owners and investors, including crucial deductions that you need to put on the books before December 31. Take advantage of these tactics to minimize your tax burden and save big!

Key Points:

5 Essential Deductions to Claim Now: Identify key deductions to take before year-end.

Payroll Tips for Family Members: Learn the benefits and considerations of putting family on the payroll.

Setting Your S-Corp Salary: Discover how to ensure your salary is both reasonable and tax-efficient.

Smart Roth Conversions: Explore “chunking” strategies that could save you in taxes.

Sign up now to learn money-saving tax strategies and start the new year financially strong!

About the Speakers:

Mark J. Kohler, CPA, Senior Partner of KKOS Lawyers, Co-Founder of Directed IRA (no. 391 on Inc. 5000), and bestselling author, has built a career helping American small business owners and entrepreneurs achieve financial success. With over 25 years of experience and 10,000 client consultations, Mark’s insights have cemented his reputation as the top-tier tax & legal expert, disruptor, and advisory mogul in the industry. His unique expertise has also been featured in national media outlets, including Fox, NBC, Bloomberg, Yahoo! Finance, Entrepreneur, Wharton School of Business, and the Wall Street Journal. He was awarded Monaco Voice’s 40 over 40 and Tax Advisor of the Year at the Global Entrepreneur Festival.

Through the Main Street Tax Professional Certification, Mark is training thousands of CPAs, Financial Planners, Lawyers and Enrolled Agents to deliver the same transformative strategies to their clients with confidence. His mission is clear: to equip Main Street American business owners with the tools they need to build wealth, reach their financial goals, and drive economic growth.

Mat Sorensen is a wealth lawyer and award-winning entrepreneur. He is the CEO of Directed IRA by Directed Trust Company, the fastest-growing self-directed IRA provider with 20,000+ clients served and over $2.2B in assets. Mat is also a co-managing partner of KKOS Lawyers, a business and tax law firm dedicated to business owners and investors. He is the best-selling author of The Self-Directed IRA Handbook and is the foremost authority on using IRAs and 401Ks to invest in real estate and alternative assets. Mat co-hosts two podcasts, the Main Street Business Podcast and the Directed IRA Podcast, which have over 2.5M downloads.

Upcoming Webinar

Protecting Your Brand in the Age of AI: What Founders Need to Know Now

Join us for this free webinar to learn about protecting your brand, safeguarding your intellectual property, and navigating the gray areas of AI—before they turn into costly mistakes.

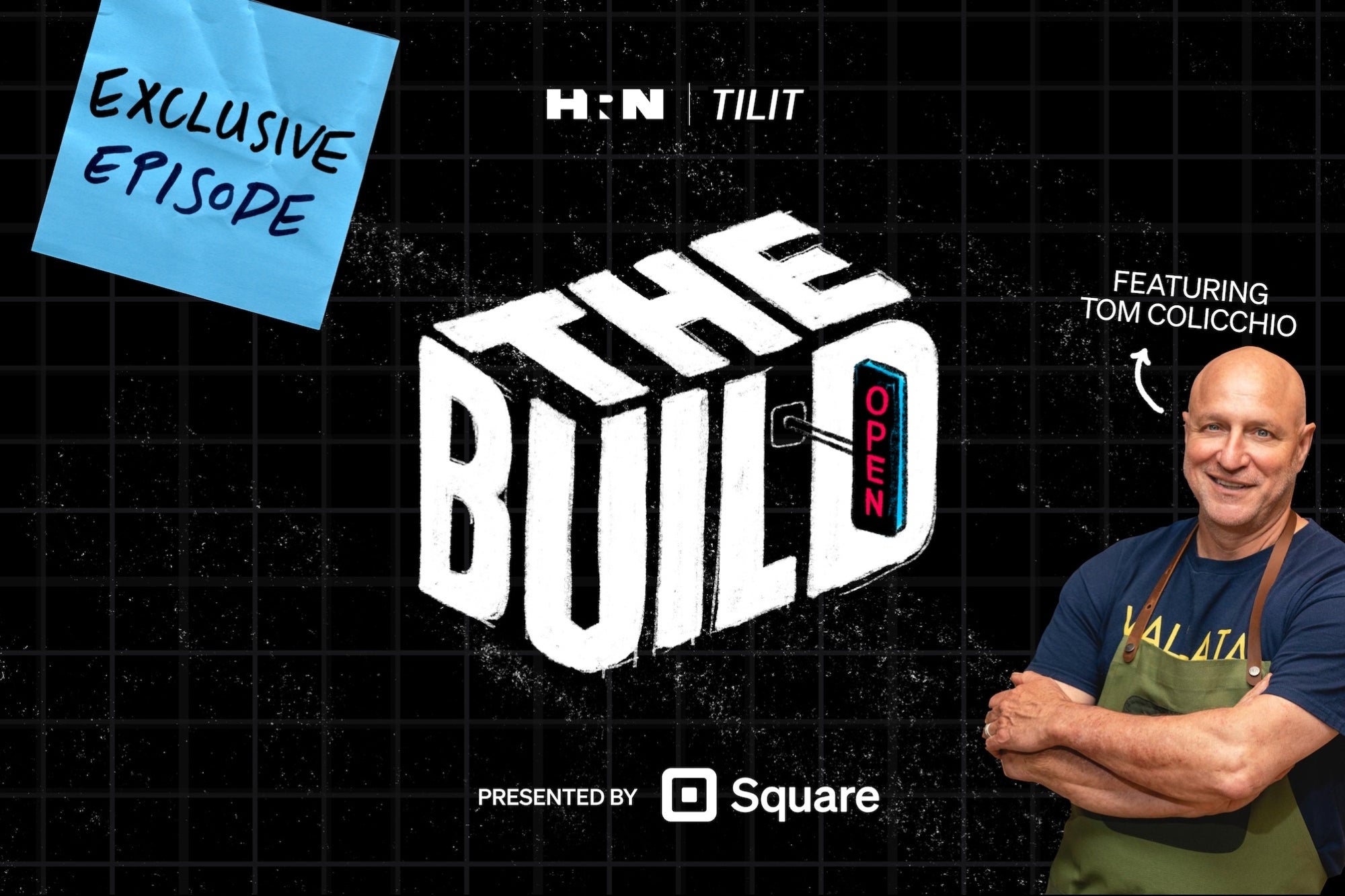

On Demand: How a Restaurant is Made

Opening a restaurant? Get insights and advice from chefs Rasheeda Purdie and Tom Colicchio on a bonus video episode of The Build, brought to you by TILIT and Square. Watch now.