How Recent Tax Changes Impact Solopreneurs and Small Business Owners Join us for a free webinar with Lisa Greene-Lewis, Principal Communications Manager and tax expert at Intuit TurboTax.

Originally aired Feb 04, 2026

Tax laws changed. Your competition isn't paying attention. You should be.

The one constant in business is that nothing ever stays the same. Products evolve. Services expand. Employees and customers come and go. The same goes for taxes. Recent changes to federal tax law are opening valuable planning opportunities for entrepreneurs and small-business owners and solopreneurs.

We'll uncover everything you need to know in a free webinar, Stop Leaving Money on the Table: How Recent Tax Changes Create New Opportunities for Solopreneurs and Small-Business Owners, presented by Intuit TurboTax and Entrepreneur.

Moderated by business consultant Terry Rice, this webinar will feature insights from Intuit's Lisa Greene-Lewis, CPA and Principal Communications Manager, who will discuss the recent tax law changes that could put thousands of dollars back in your pocket if you know where to look.

This webinar is perfect for solopreneurs, freelancers, sole proprietors, single-member and multi-member LLCs, early-stage S-corps, and any small-business owner who is tired of wondering if they're leaving money on the table.

Attendees of this webinar will learn:

Which recent tax changes matter most for your business. The Qualified Business Income deduction extension, increased Section 179 limits, and 100% deduction opportunities aren't just technical updates. They're cash flow opportunities most solopreneurs are missing.

The surprising deductions you're not claiming. Did you know you can take a full Section 179 deduction on certain business vehicles? Or that there are enhanced employee benefit credits you might qualify for? Greene-Lewis will break down the money-savers hiding in plain sight.

Why your books are sabotaging your tax return. The biggest reason small businesses file extensions isn't procrastination. It's inaccurate books. Learn how to fix this now (even if you didn't track anything all year) and prevent it from happening again.

When DIY stops making sense. Getting help isn't failure. It's smart business. Greene-Lewis will explain the difference between Expert Assist and Full-Service, how industry-matched tax experts can save you money, and why year-round support beats scrambling in March.

Greene-Lewis will also cover the most common misconception that costs solopreneurs money (hint: it involves jumping into LLC formation too early) and share practical ways to catch up if your books are a mess.

Upcoming Webinar

Protecting Your Brand in the Age of AI: What Founders Need to Know Now

Join us for this free webinar to learn about protecting your brand, safeguarding your intellectual property, and navigating the gray areas of AI—before they turn into costly mistakes.

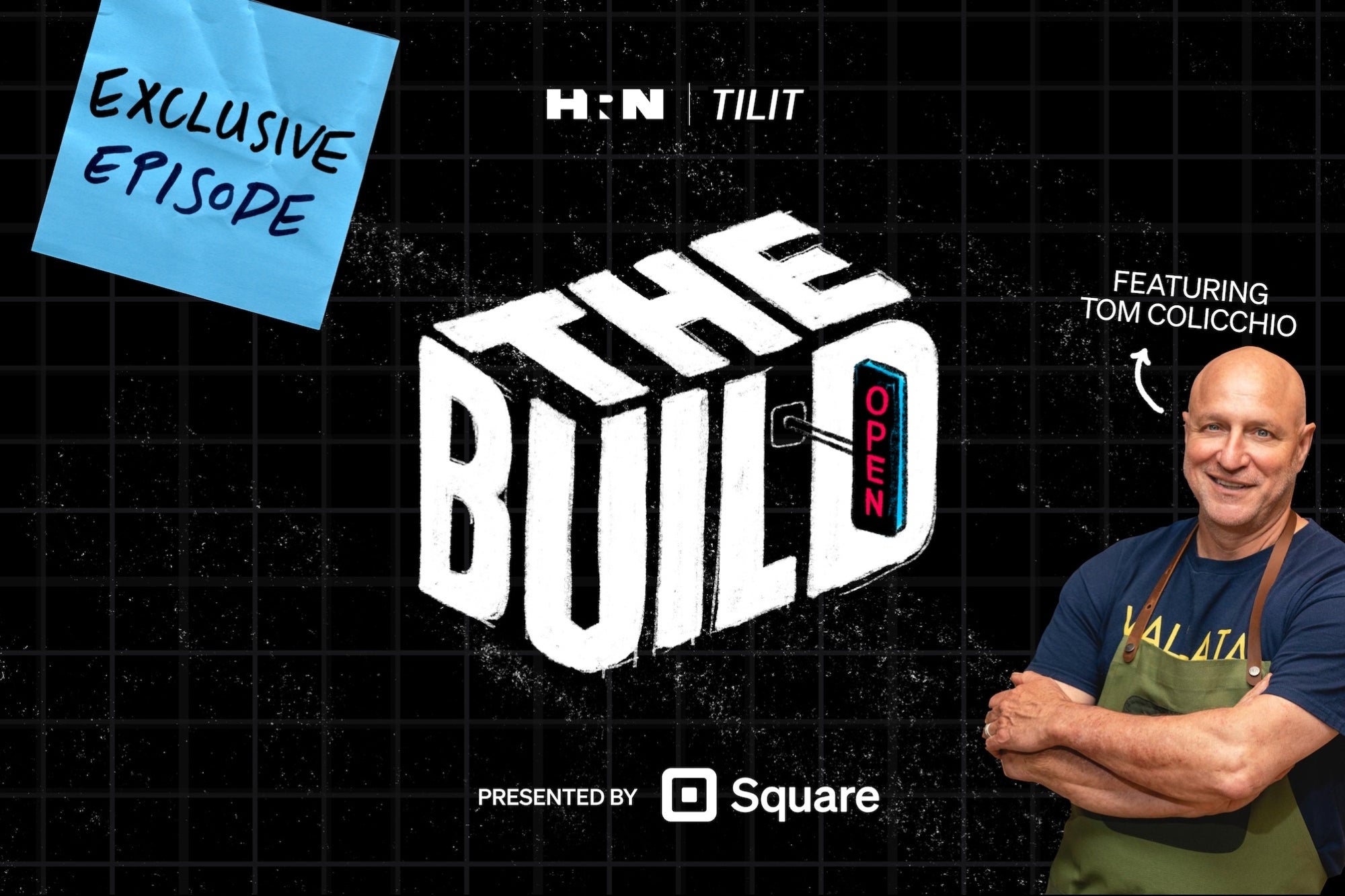

On Demand: How a Restaurant is Made

Opening a restaurant? Get insights and advice from chefs Rasheeda Purdie and Tom Colicchio on a bonus video episode of The Build, brought to you by TILIT and Square. Watch now.