SunPower Stock is a Value Solar Play Solar energy systems and solutions provider SunPower (NYSE: SPWR) stock has been beaten up losing more than half its value since the start of 2021.

By Jea Yu •

This story originally appeared on MarketBeat

Solar energy systems and solutions provider SunPower (NYSE: SPWR) stock has been beaten up losing more than half its value since the start of 2021. The provider of solar energy solutions to residential, commercial, and enterprise segments is growing its business well, just not as well as analyst expectations. The drop in share prices may be presenting a value play in one of the largest well-known players in the solar energy provider ecosystem. The Company is involved in selling power under purchase agreements in addition to solar systems through its third-party dealer network and resellers as well as direct-to-consumer (DTC) customer channels. The Company is a beneficiary of the infrastructure spending bill when it gets passed and a benefactor of the global decarbonization and clean energy movement. Prudent investors seeking a value play in the adoption and growth of solar energy can watch for opportunistic pullbacks in shares of SunPower.

Q2 2021 Earnings Release

On Aug. 3, 2021, SunPower released Q2 2021 results for the quarter ending in June 2021. The Company reported earnings per share (EPS) of $0.06 excluding non-recurring items, versus consensus analyst estimates for a profit of $0.04, a $0.02 beat. Revenues rose 41.9% year-over-year (YoY) to $308.93 million, missing analyst estimates for $391.67 million. SunPower CEO Peter Faricy commented, ""Consumer demand for better, more resilient energy is increasing and with more than 100 million homes in the U.S. that could benefit from solar and storage, we see a significant opportunity to meet that demand," said Peter Faricy, CEO of SunPower. To lead in customer adoption and growth we are focused on delivering world-class customer experiences and continuing to invest in strategic priorities that will make solar easy, reliable, and affordable. We believe this long-term strategic approach will position SunPower as a leader as the market continues to expand. Our solid second-quarter results reflect continued execution in both our residential and commercial businesses as year over year megawatts grew 40 percent and we doubled our gross margin per watt," said Faricy. "We also made material progress on a number of our key initiatives to expand our addressable market during the quarter including increasing our dealer footprint, expanding our financial platform to include loan servicing as well as announcing our strategic alliance with leading EV solutions provider Wallbox. This alliance will enable us to offer our residential customers a simple and cost-effective integrated solar, storage and EV solution that will lower overall energy costs while reducing strain on the grid. Looking forward, we remain on track to achieve our 2021 financial outlook and are well-positioned to drive growth and profitability in 2022 and beyond."

Lowered Guidance

SunPower lowered guidance for Q3 2021 with revenues expected to come in between $325 million to $375 million versus $391.67 million. Revenues for full-year 2021 were lowered to come in between $1.41 billion to $1.49 billion versus $1.5 billion consensus analyst estimates.

Conference Call Takeaways

CEO Faricy commented, " In Q2, we increased the proportion of full system loan and lease bookings by 500 basis points to 63% of our total buyers. Full system loan and lease sales provide not only better unit economics, but a closer relationship with the end customer than our component sales. These trends give us confidence in our second half targets while providing better visibility as we look into 2022. We also remain very bullish about the future of our SunVault storage solution as demand remains quite high with attach rates reaching 23% in our direct sales channel. As we mentioned last quarter, we took actions to improve the customer experience and have made significant strides in reducing lead times over the past few months. As a result, we expect SunVault growth to accelerate in the second half of the year as we have resumed the full rollout of the product to additional dealers beginning in June." He commented on the Wallbox partnership, "As part of the partnership, we are also Wallbox's preferred solar partner and charging installation partner. This will help us reach additional customers. This agreement is part of our larger strategy to offer customers a fully integrated solar, storage and EV solution that provides 100% clean EV charging at home. Both companies will also collaborate on differentiated charging products for the home that will further expand our addressable market. We expect to start rolling out this program the second half of this quarter and are encouraged by the early feedback from both our customers and dealers."

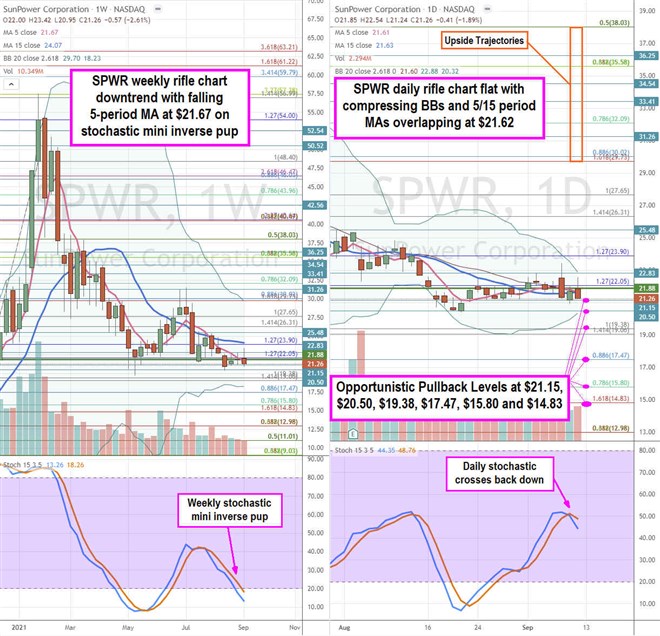

SPWR Opportunistic Pullback Levels

Using the rifle charts on weekly and daily time frames provides a broader view of the landscape for SPWR stock. The weekly rifle chart peaked at the $57.38 Fibonacci (fib) level at the start of 2021 and has sold off as down as $19.75 before staging a rally back to the $30s. Shares have fallen back down again. The weekly rifle chart has a downtrend with a falling 5-period moving average (MA) at $21.67 with a stochastic mini inverse pup. The weekly lower Bollinger Bands (BBs) sit at $18.23. The daily rifle chart has been in a consolidation with overlapping 5-period and 15-period MAs at $21.62. The daily BBs have been compressing which precedes a price expansion. The question is direction afterward. The daily market structure low (MSL) buy triggers on a breakout above $21.88. Prudent investors can watch for opportunistic pullback levels at the $21.15 level, $20.50 sticky 5s level, $19.38 fib, $17.47 fib, $15.80 fib, and the $14.83 fib. The upside trajectories range from the $29.73 fib up towards the $38.03 fib level.