With $23 million in its kitty, mobile payments firm Ezetap plans 5x mPOS activation in next few months

By Samiksha Jain •

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

Gone are the days when mobile transactions involved typing out complicated messages for making payments or one's dependency on the telecom network. Today, increased penetration of smartphones, mobile apps and digital wallets, has solved this problem to a great extent. In recent time, payment services industry has witnessed huge growth and this is largely driven by rising number of digital payments and ease in making payment.

As per the recent report by Growth Praxis, the market for mobile enabled payments in India has grown more than 15 times to reach its current size of $1.4 billion by the end of FY'15 from $90 million at the end of FY'12. Another root cause of this rise is emerging start-ups in this space. In past few years, many start-ups like Ezetap, Mswipe, iKaaz, Bijlipay and Paynear have come up and are also receiving huge investments from both, domestic and global investors.

Funding Raised

Recently, Bengaluru-based mobile point-of-sale (mPOS) start-up Ezetap has announced to secure Rs 150 crore ($23 million) in fresh round of funding from its current investors Social+Capital, Helion Advisors and Berggruen Holdings, with participation from Horizons Ventures, the private investment arm for Li Ka-Shing, and Capricorn Investment Group. With this funding, the venture aims to reach over 2 lakh merchants and agents across India in the next 12 months.

Commenting on the investment, Chamath Palihapitiya, Founder & Managing Partner, Social+Capital, said, "India is uniquely positioned to build an entirely new financial services ecosystem, thanks to advancements like UID. Moreover, it's clear to us that this revolution will be mobile first – from mPOS to mobile wallets, and Ezetap is the only company, which can seamlessly and agnostically supports this fast changing landscape." Palihapitiya will step on Ezetap's board as Chairman. The former Facebook executive has first time taken on this role with a portfolio company outside the US.

The Beginning

Ezetap, a pioneer in mobile payments and payments processing solutions for emerging markets, was co-founded in 2011 by Abhijit Bose, Bhaktha Kesavachar, and mobile payments pioneer Sanjay Swamy, who guides the team on product thought leadership. The company which became operational in 2013 has grown much faster than the rest of the industry, deploying over 60,000 new points of sale across India within 30 months.

"Our vision is to be the most preferred, lowest cost and universal platform through which businesses transact and engage with their customers. This funding, along with Chamath's active guidance from scaling Facebook, will give us the fuel to help Ezetap realize its vision and massive potential," said Abhijit Bose, Co-Founder and CEO, Ezetap.

How it Works?

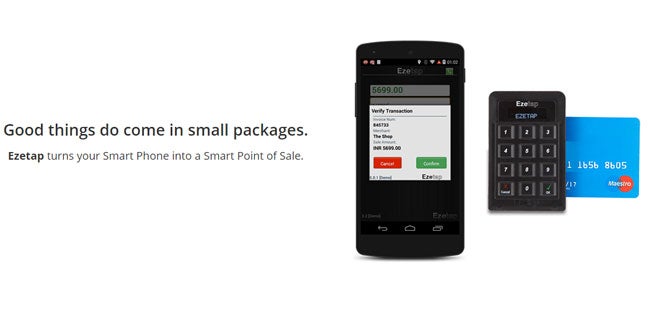

Ezetap's solution turns any merchant's mobile device into an intelligent point of sale that is able to read any type of card and complete any type of financial transaction from a credit card sale to a real-time bill payment, to an ATM cash withdrawal or deposit.

The solution comprises of a configurable mobile application, a secure and lightweight card reader, and a flexible platform that allows Ezetap to provide customised value-added services and integrate to a merchant's existing system. Ezetap's technology has been developed and built in India, and is compliant with global security guidelines.

The firm has already activated mPOS over 500 new small retail merchants, and plans to use some of its funds to increase that by 5 times in the next few months. Speaking on the same lines, Sanjay Swamy, Co-Founder and Vice-Chairman, Ezetap, said, "Ezetap has moved beyond a start-up into a market-defining leader, and is now in its growth phase". Swamy is also the Managing Partner at Prime Venture Partners, formerly known as AngelPrime, where Ezetap was incubated and seeded.

Market Opportunity

Ezetap processes transactions worth over $1 million per day and has a customer base ranging from the most well known enterprises to tens of thousands of small retail businesses. While many enterprises, including some of the leading e-commerce, Insurance and mobile companies, have standardised their offerings using Ezetap's platform and have deployed its integrated solution, the company also sees huge potential in the small and medium business sector.

"What makes mPOS unique is that every Ezetap mobile application being used by a merchant is configurable and smart. This is a fundamental change from the way payments have worked for decades and why it never scaled in India. Not only we can easily enable a storekeeper anywhere in the country to accept all forms of payments and increase their sales, we can actually turn his or her small shop into a bill payment centre, eGovernment service point, full service bank branch, and much more with only a few keystrokes in Bangalore," said Bose.

Ezetap had earlier raised around $3.5 million in its Series A round led by Social+Capital Partnership; Peter Thiel, Co-founder of Paypal; and others in November 2013, and $8 million in Series B led by Helion in February last year.

Most recently, the State Bank of India chose Ezetap to be its mPOS partner in order to help scale electronic payments and banking services to every corner of the country and launch "Chota ATM' for just Rs 499. Ezetap has partnerships with leading banks, including Citibank, HDFC Bank, and American Express, who is also an investor in the company.