How tech-driven startups are disrupting the pre-owned car market India's pre-owned car market is booming and tech-driven startups are riding the wave

By Priya Kapoor

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

When 30-year-old Vishal Gupta decided to buy an SUV, he went in for a pre-owned one instead of a new one. "I always wished to have an SUV. But when I started scouting for the one, I found it had a waiting period of 13 months. I had no issues with ownig a pre-owned one. Luckily, I got the one at a great price," says Gupta. Vishal is one of the many youngsters who don't mind preferring a pre-owned car to a new one.

Between 2016 and 2020, the sale of pre-owned cars witnessed a continuous increase before falling a bit in 2021 on account of Covid-19. In 2020, 4.2 million used cars were sold across India, compared to 4 million and 3.8 million in 2019 and 2018, respectively. This was 50 per cent higher than the new-car sales figure at 2.8 million. The forecast of future growth of sales of pre-owned cars is bright. According to Redseer management consultancy firm, by FY 26, the pre-owned car sales are expected to reach 8.3 million units, at a healthy CAGR of 11%.

There have been several factors that have fuelled the growth of pre-owned car market, including lowering of the vehicle replacement cycle from 6 years to 4 years, increasing penetration of used car financing, the semiconductor chip shortages for new cars, and an underpenetrated passenger vehicle market.

Various regulatory changes such as BS – VI emission norms (which have made new cars expensive due to additional technology costs), scrappage policies and revision of the GST rate on used cars from 28% to 12-18% have also driven the growth of pre-owned cars. Further, there has also been a shift in the mindset of consumers who now no longer associate owning a pre-owned car with the downsized social status. Instead, they think it is a smarter investment over buying a new car.

TECH-ENABLED STARTUPS RIDING THE WAVE

The boom in the pre-owned market is being encashed by many new-age tech driven startups, who have entered the space in the last few years. These include players like Spinny, droom, Cardekho, CARS24, CarTrade, CarTrade Tech and people-to-people platforms such as OLX and Quikr. "The used car market has largerly been a highly fragmented market for decades, plagued by inefficieinces and standardization gaps across the board. The entry of organized players like us has led to incrased confidence amongst consumers," says Gajendra Jangid, Co-founder & CMO, CARS24.

These startups are taking phygital approach–online services coupled with physical pan-India hubs in order to make the buying journey of used cars right from search to payment, completely transparent and hassle-free. From multiple point inspection checks to in-house refurbishing to finance and buyback options to doorstep delivery and instant payment, these startups are making sure that the buyer and seller get the best experience.

Niraj Singh, founder and CEO, Spinny who is looking to expand the presence to over 30 cities by end of 2022, says:

Our Spinny Assured® car is serviced dry-cleaned and waxed and can be home-delivered in 22 cities across the country. We offer a 5-day money back guarantee, one-year free warranty on every car. With customers getting great prices and a hassle-free selling experience for their existing car, there is also a trend of upgrading/exchanging with a better used car

On the other hand, CARS24, which has expanded its horizon in the UAE, Thailand and Australia, claims to be the first player in the pre-owned vehicle industry to procure a non-banking financial company (NBFC) licence and launch a consumer lending business with CARS24 Financial Services. "In this pursuit, we have also partnered with multiple institutions such as Kotak General Insurance , Poonawala Fincorp, and Bajaj Finance Lt. We are one-stop solution for anything and everything to do with used cars. We have also set up state-of-the-art Mega Refurbishment Labs," adds Jangid.

OPTIMISTIC POST PANDEMIC TOO

What's interesting is that, these startups are optimistic about the growth of used cars post pandemic too, "The pandemic has drastically changed the perspective of customers. In fact, we have witnessed an increase of 44% in online purchases in the second quarter of 2022. Further, customers have realized that used cars are significantly more affordable than new cars, considering higher taxes, registration, and other costs," says Singh.

Agrees Jangid, "The pandemic led to an evident behavioural shift among consumers. Today's progressive consumer realises the benefits of purchasing a used car online; affordability being the biggest driver, followed by availability of high quality cars and easy finance options, that were not present earlier.

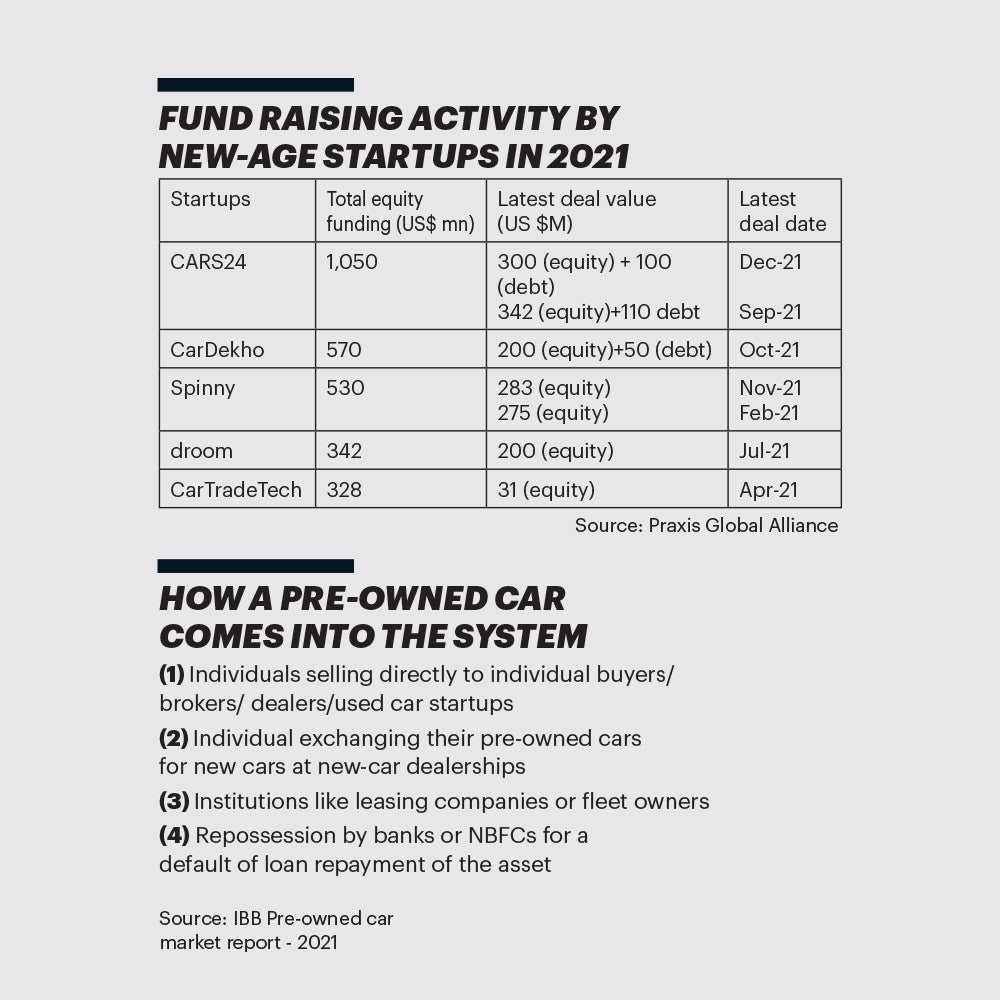

INVESTORS BULLISH

Investors are super bullish about the pre-owned car market and have been pouring in millions in these startups. In fact, as many as three startups-Droom, CarDekho and Spinny entered into the Unicorn club in 2021 on the back of huge funding made by the investors. After raising funds in 2021, the valuation of CARS24 reached $3.3 billion from $1.84 billion.

Says Aprit Agarwal, Director, Investment, Blume Ventures, who has invested in Spinny:

We realized that the trust and transparency which is there in buying a new car was missing in case of used cars. This led us to believe that the scope of the used car business is huge if a used car too comes with the same trust and transparency. However, back then, it was difficult for venture capitalists to believe in the business model of marketplaces like Spinny, but glad we did. The improvement in road conditions and changing consumer preferences from owning a car for 6 to 7 years to just 2-3 years makes us bullish about the used car market in the country."

CORPORATES GEARING UP

Maruti, which has been in the pre-owned market space since 2001, is ready to up its game. According to it, the new-age digital aggregators have a disproportionately high mindshare (brand recall) in the pre-owned car market compared to their marketshare.

This is a crucial area of concern. And, to gain mindshare in a segment where digital plays a big role, we have to leverage and promote our own state-of-the-art digital tools such as the all-new pricing engine and the revamped evaluator app," says Shashank Srivastava, Senior ED, Marketing and Sales.

"We retailed 83,255 pre-owned cars in Q1 2022-23, a growth of 76%. The True Value Certified car sales grew even higher at 155% (at 20,433 units), adds Srivastava.