3 Stocks Cowen Thinks Are Going Higher Earlier this week, the folks over at Cowen released their findings from a consumer survey of millennials and Generation Z.

By Sam Quirke •

This story originally appeared on MarketBeat

Earlier this week, the folks over at Cowen released their findings from a consumer survey of millennials and Generation Z. In a published note, they said "our proprietary survey of 18-34-year-old consumers suggests the themes of sustainability, social commerce and shifts to digital will have profound effects on growth and risk across retail, e-commerce, restaurants/food, cannabis, and payments sectors. Key themes from our 2020 survey largely strengthened, suggesting that ESG and social commerce gained greater momentum in 2021 with key cohorts."

There should be no major surprises in the findings here, as these are all key trends that have been in play for sometime now. But investors will surely be keen to know which stocks have the most positive exposure to these trends, and so stand to do well as these trends strengthen. Here are three names that Cowen sees outperforming their peer group as a result of their findings.

Nike (NYSE: NKE)

Shares of the big swoosh look to be well on their way to recovering from last month's drop, and have rallied as much as 10% since the start of the month. They had come under a fair bit of pressure from the end of August and right through September as supply chain concerns rapidly accumulated. But Wall Street didn't let them fall too far, and the buyers arrived in force before shares even came close to filling in the massive gap up that they saw after June's earnings report.

With Cowen now calling them a Gen Z favorite, there's every reason to think Nike's sales machine will be back to normal levels of high output in the near future. For those of us on the sidelines, the recent drop has opened up a potential entry point. Goldman were also out earlier this week with bullish comments as they initiated coverage of Nike with a Buy rating. Their $172 price target suggests there's upside of some 10% to be had even after the recent rally, so there's no reason to think you've missed the boat if you're still considering getting in.

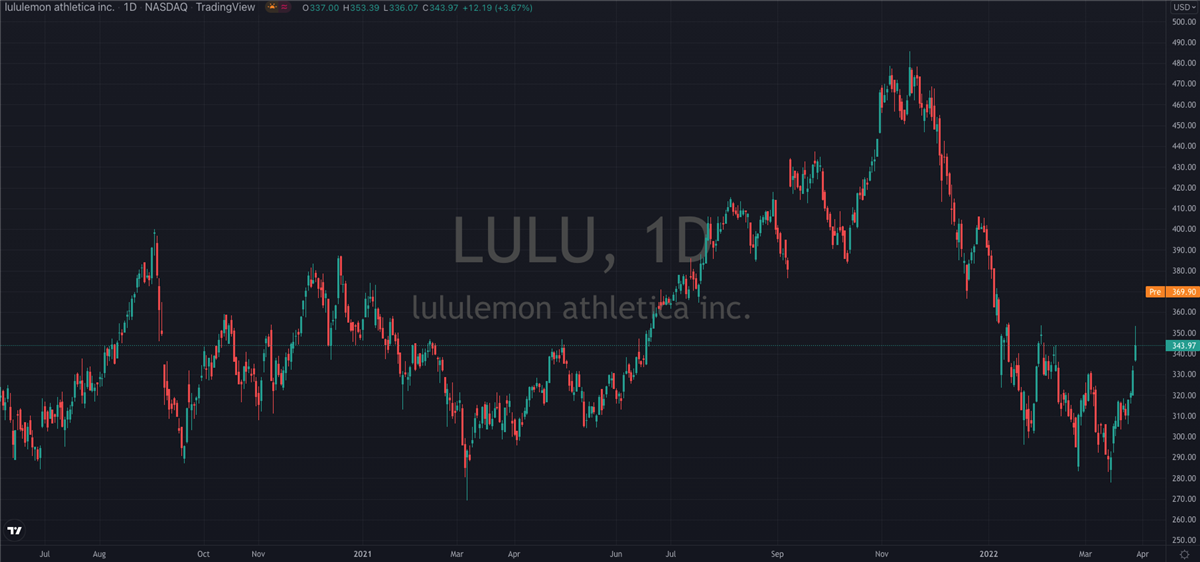

Lululemon (NASDAQ: LULU)

Lululemon shares also came under pressure in September, but like Nike, they've seen a strong bid in the past few sessions. They had been trading at all-time highs before a 12% drop late last month, but the stock never looked like it wanted to give up too much ground. One of the reasons for the consistently strong bid seen in Lululemon, compared with Nike for example which went through two months of soft trading, could be the company's strong share repurchase program, which was boosted once again by management earlier this month.

It's now just over a year since Lululemon restarted their share buyback program, and Oppenheimer's premonition on how it could act as a "sleeper" tailwind is proving true. It was also Oppenheimer who boosted their price target on Lululemon shares by 30% last month, and there's more than 20% of that potential upside yet to be realized.

Poshmark (NASDAQ: POSH)

If Nike and Lululemon are the strongest of these three as they trade close to all time highs, Poshmark is definitely the weakest as they trade only a few cents above their all-time lows. But perhaps that's what makes them a dark horse for the coming couple of months. Since IPO'ing last January, their shares have fallen more than 75%, but that didn't stop Cowen pointing out the long opportunity on the back of their consumer survey.

Analyst John Kernan wrote this week that "we are optimistic about Poshmarks' growth prospects longer-term as consumers continue to shift spend toward resale." This massive upside potential has also been spotted by the team at Berenberg, who initiated coverage of Poshmark late last month with a Buy rating. At the time they pointed out the massive discount that shares looked to be trading at, writing "the second-largest player in a structural growth market, the company has a peer-to-peer resale platform with years of robust growth ahead of it, in our view. We believe stock underperformance since its January IPO affords investors an opportunity to purchase shares of a growth business at a discount."

They're worth having on your watchlist and could well be a good long-term buy if shares can leave last week's all-time low convincingly behind them.