Coty Stock Providing Opportunities Entries Here

Beauty products and fragrance maker Coty, Inc. (NYSE: COTY) stock was having a strong 2021 until its fiscal Q3 2021 earnings reaction collapsed shares move than (-20%) off its $10.49 yearly highs.

This story originally appeared on MarketBeat

Beauty products and fragrance maker Coty, Inc. (NYSE: COTY) stock was having a strong 2021 until its fiscal Q3 2021 earnings reaction collapsed shares move than (-20%) off its $10.49 yearly highs. The world’s leading fragrance maker with high-end prestigious brands including Gucci, Hugo Boss, Burberry and Marc Jacobs and iconic make-up brand Cover Girl was decimated by the pandemic. The COVID-19 vaccinations and subsequent re-openings added momentum to the recovery as shares got closer towards reboundingto pre-COVID levels. Logically, a return to normal equates to live interactions which should boost fragrance and cosmetics sales as workers shed the sweatpants and dress up for the return to the office. Unfortunately, the recovery back near pre-COVID levels was not good enough for the markets as shares were punished as a result. The Company continues to trim its debt and set the bar low in its guidance. Prudent investors seeking a re-opening play at a discount, can patiently monitor opportunistic pullback levels to consider scaling in exposure.

Q3 Fiscal 2021 Earnings Release

On May 10, 2021, Coty released its fiscal third-quarter 2021 results for the quarter ending March 2021. The Company reported an adjusted earnings-per-share (EPS) of breakeven excluding non-recurring items versus consensus analyst estimates for a profit of $0.01, missing estimates by $0.01. Revenues fell (-3.3%) year-over-year (YOY) to $1.03 billion, falling short of analyst estimates for $1.04 billion. The Company provide flat fiscal Q4 2021 revenues of $4.5 billion to $4.6 billion versus analyst estimates for $4.57 billion. Coty reaffirmed its target adjusted EBITDA if $750 million for F21. The Company continues to lower its leverage ration towards 5X by the end of current-year 2021 as net debt stood at $5.1 billion at the end of Q3. The Company also raised $900 million in secured notes in April 2021.

Conference Call Takeaways

Coty CEO, Sue Nabi, set the tone, “Sales trends in the quarter were led by Asia-Pacific region, which increased 20% like-for-like. This was primarily driven by the very strong performance in China. Even when compared to our fiscal ’19, the pre-COVID baseline sales in China rose double-digits. We are very encouraged by the momentum we are seeing in China, which, as you know, is a key pillar in our strategy.” She went on to review various regions including the Americas (-3%) from weaker cosmetic sales and EMEA (-13%) impacted by strict lockdowns and restrictions.

Silver Linings

While the results and guide was ho hum at best, the underlying silver lining is the focus not on growth but optimization and debt reduction. Gross margins expanded to 62.2% as the Company stated that 60% will be the new baseline moving forward. China is hands down the growth driver. Cover Girl experienced market share gains after four-years of stagnancy and declines. The e-commerce segment still had growth of 30% YoY and 56% YoY in consumer beauty. The Company continued to trim costs and decreased fixed costs (-15%) YoY or $110 million in cost savings on track towards its $300 cost savings for the year. The acceleration of COVID-19 vaccinations in the EMEA should help revenue rebound while the Company continues to bolster internal metrics. Prudent investors can watch for opportunistic pullback levels during the drawdowns as the bar is set low moving forward.

COTY Opportunistic Pullback Levels

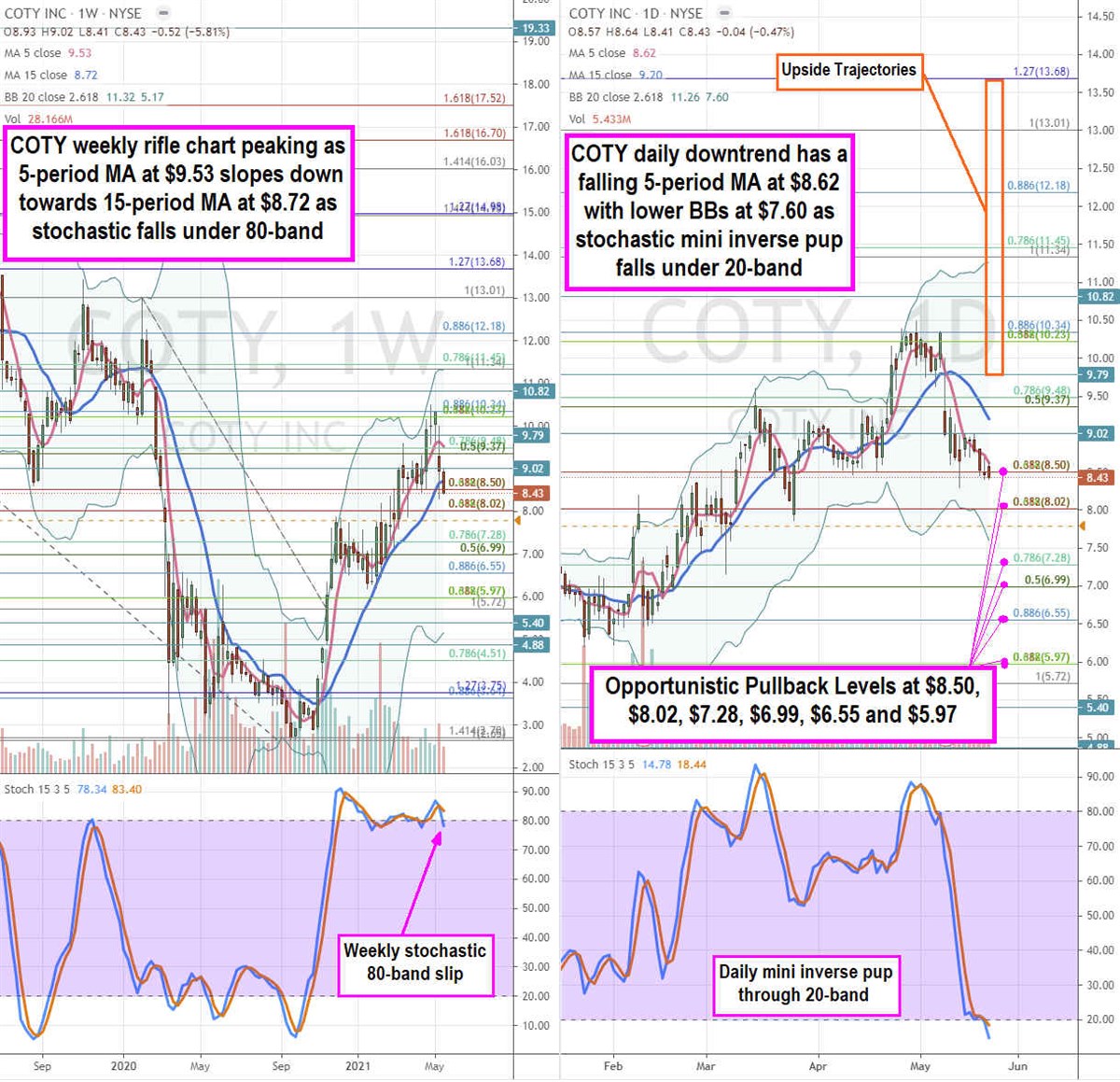

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for COTY stock. The weekly rifle chart peaked out near the $10.34 Fibonacci (fib) level. COTY took a hard tumble on its earnings report as shares fell through the weekly 5-period moving average (MA) at $9.53 and 15-period MA at $8.72. The weekly stochastic abruptly crossed down through the 80-band stochastic. The daily rifle chart is down trending with falling 5-period MA at $8.52 driven by the stochastic mini inverse pup that leaned through the 20-band. The mini inverse pup targets the daily lower Bollinger Bands (BBs) at $7.60. The daily market structure low (MSL) buy triggers above $8.94. Prudent investors can monitor for opportunistic pullback levels at the $8.50 fib, $8.02 fib, $7.28 fib, $6.99 fib, $6.55 fib, and the $5.97 fib. The upside trajectories range from $9.79 level up to the $13.68 fib level.

Featured Article: Options Trading – UnderstandingStrike Price

Beauty products and fragrance maker Coty, Inc. (NYSE: COTY) stock was having a strong 2021 until its fiscal Q3 2021 earnings reaction collapsed shares move than (-20%) off its $10.49 yearly highs. The world’s leading fragrance maker with high-end prestigious brands including Gucci, Hugo Boss, Burberry and Marc Jacobs and iconic make-up brand Cover Girl was decimated by the pandemic. The COVID-19 vaccinations and subsequent re-openings added momentum to the recovery as shares got closer towards reboundingto pre-COVID levels. Logically, a return to normal equates to live interactions which should boost fragrance and cosmetics sales as workers shed the sweatpants and dress up for the return to the office. Unfortunately, the recovery back near pre-COVID levels was not good enough for the markets as shares were punished as a result. The Company continues to trim its debt and set the bar low in its guidance. Prudent investors seeking a re-opening play at a discount, can patiently monitor opportunistic pullback levels to consider scaling in exposure.

Q3 Fiscal 2021 Earnings Release

On May 10, 2021, Coty released its fiscal third-quarter 2021 results for the quarter ending March 2021. The Company reported an adjusted earnings-per-share (EPS) of breakeven excluding non-recurring items versus consensus analyst estimates for a profit of $0.01, missing estimates by $0.01. Revenues fell (-3.3%) year-over-year (YOY) to $1.03 billion, falling short of analyst estimates for $1.04 billion. The Company provide flat fiscal Q4 2021 revenues of $4.5 billion to $4.6 billion versus analyst estimates for $4.57 billion. Coty reaffirmed its target adjusted EBITDA if $750 million for F21. The Company continues to lower its leverage ration towards 5X by the end of current-year 2021 as net debt stood at $5.1 billion at the end of Q3. The Company also raised $900 million in secured notes in April 2021.