General Mills Proves You Want Consumer Staples Exposure

If General Mills fiscal Q1 results are foreshadowing results within the consumer staples sector the way that we think they are, the consumer staples s…

This story originally appeared on MarketBeat

Consumer Staples Bluechip General Mills Outperforms

If General Mills (NYSE: GIS) fiscal Q1 results are foreshadowing results within the consumer staples sector the way that we think results from Federal Express (NYSE: FDX) and Lennar (NYSE: LEN) are foreshadowing results for the broader market, the consumer staples sector is one where you want to be for the Q3 earnings season and the fourth quarter in general. Not only was the company able to produce growth well above consensus but it also beat on the bottom line as well. While inflationary pressures are present, they did not cut into the bottom line as deeply as expected and led the company to raise its guidance. Both Federal Express and Lennar lowered their guidance. Speaking from the perspective of dividend growth investing, we prefer companies that are beating consensus on the top and bottom line and guiding higher versus those that aren’t.

General Mills Defies Expectations

General Mills had a great fiscal first quarter and one that proves tailwinds continue to blow throughout the consumer staples sector. While the restaurant & food services sector’s rebound may not be as strong as expected, and stay-at-home trends are subsiding, the net result is sales above consensus estimates.

General Mills reported $4.54 billion in net consolidated revenue to beat the consensus by a quarter billion dollars or 560 basis points. On an organic basis, sales are up 2% versus the -4.5% decline expected by the analysts. The company says revenue strength is driven by a combination of price, mix, and volume that we see persisting into the current quarter if not through the end of the fiscal year. On a segment basis, the company reported notable 25% and 23% increases in pet food sales and sales to convenience stores and foodservice locations.

Moving down to the profitability portion of the report, General Mills experienced a 150 basis point contraction in the gross margin. The adjusted gross margin came in at 34.7% versus 36.2% in the prior year but outpaced the consensus estimate by 50 basis points. The company says that higher input costs and higher costs related to the supply chain were offset by the same pricing, mix, and volume gains that drove top-line results. As for earnings, the GAAP EPS of $1.02 beat the consensus by $0.15 while the adjusted EPS of $0.99 beat by a dime.

Turning to the guidance, the company says it expects for revenue and earnings to come in at the high end of the previously stated range. This puts revenue growth for fiscal 2022 in the range of -1% and we think that is a cautious estimate.

High-Yield General Mills Is A Buy

Shares of General Mills yield about 3.5% with the stock trading roughly 15 times its consensus earnings estimate. That makes it one of the higher-yielding and better valued Consumer Staples stocks on the market and it comes with a positive outlook for dividend growth as well. On balance, the company has only raised its dividend and is positioned for the second consecutive increase this year. While we don’t expect a large increase, we do expect General Mills to increase its payment with the next declaration which is due out anytime.

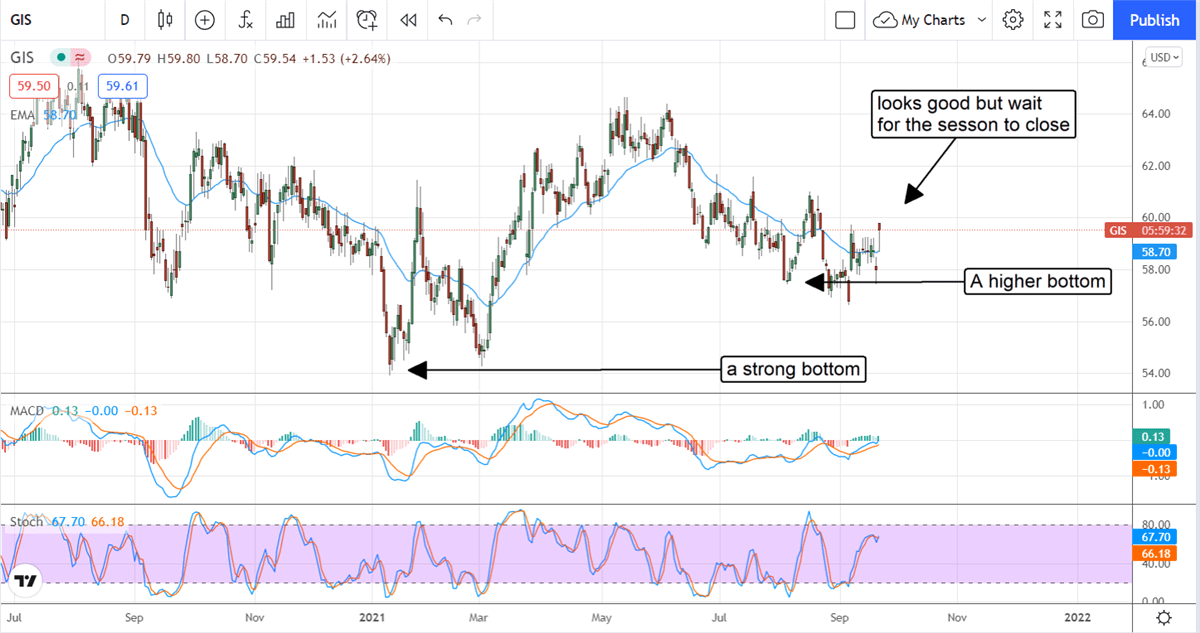

The Technical Outlook: General Mills Reverses Within A Range

Price action in General Mills has been choppy and volatile within a trading range over the last year. That said, it looks like the price action is reversing within that range and could move higher over the next few weeks and months. The Q1 report and guidance update has price action up more than 2.5% and not only confirming support but above the short-term moving average. With price action above the short-term moving average, we would expect to see it trending higher in the near to midterm. Our first target is near the $64 level which would be good for a gain near 8%. That compares to the Marketbeat.com consensus price target of $63.38 and the high price target of $73.

Consumer Staples Bluechip General Mills Outperforms

If General Mills (NYSE: GIS) fiscal Q1 results are foreshadowing results within the consumer staples sector the way that we think results from Federal Express (NYSE: FDX) and Lennar (NYSE: LEN) are foreshadowing results for the broader market, the consumer staples sector is one where you want to be for the Q3 earnings season and the fourth quarter in general. Not only was the company able to produce growth well above consensus but it also beat on the bottom line as well. While inflationary pressures are present, they did not cut into the bottom line as deeply as expected and led the company to raise its guidance. Both Federal Express and Lennar lowered their guidance. Speaking from the perspective of dividend growth investing, we prefer companies that are beating consensus on the top and bottom line and guiding higher versus those that aren’t.

General Mills Defies Expectations

General Mills had a great fiscal first quarter and one that proves tailwinds continue to blow throughout the consumer staples sector. While the restaurant & food services sector’s rebound may not be as strong as expected, and stay-at-home trends are subsiding, the net result is sales above consensus estimates.

General Mills reported $4.54 billion in net consolidated revenue to beat the consensus by a quarter billion dollars or 560 basis points. On an organic basis, sales are up 2% versus the -4.5% decline expected by the analysts. The company says revenue strength is driven by a combination of price, mix, and volume that we see persisting into the current quarter if not through the end of the fiscal year. On a segment basis, the company reported notable 25% and 23% increases in pet food sales and sales to convenience stores and foodservice locations.