Abu Dhabi Investment Authority Commits INR 4,966.8 Cr Investment in Reliance Retail This comes less than a month after KKR infused INR 2,070 crore into the company

By S Shanthi

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

Reliance Retail Ventures Limited (RRVL) has announced that a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA) will invest INR 4,966.80 crore into the company.

According to a statement shared by the company, the investment values Reliance Retail Ventures at a pre-money equity value of INR 8.381 lakh crore, which makes it among the top four companies by equity value in the country.

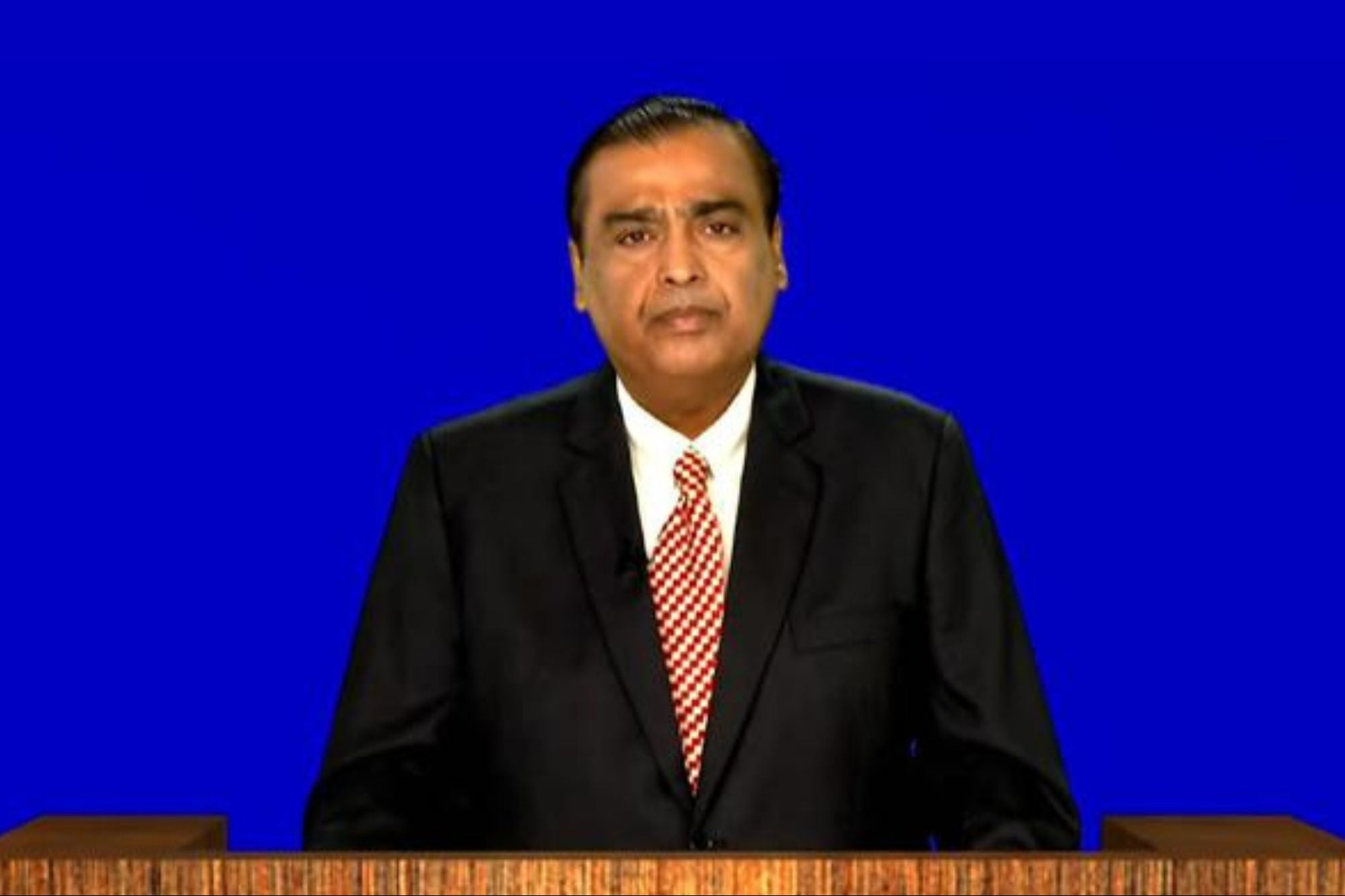

"We are pleased to further deepen our relationship with ADIA with their continued support as an investor in RRVL. Their long-standing experience of over decades of value creation globally will further benefit us in implementing our vision and driving the transformation of the Indian retail sector," said Isha Mukesh Ambani, executive director, RRVL in a statement.

"Reliance Retail has demonstrated strong growth and adaptability in a market that is evolving at an unprecedented pace," said Hamad Shahwan Aldhaheri, executive director of the Private Equities Department, ADIA.

"This investment aligns with our strategy of supporting our portfolio companies that are transforming their respective end-markets. We are pleased to partner with the Reliance Group, and increase our exposure to India's dynamic and fast-growing consumer sector," he added.

Funding spree for RRVL

Last month, the retail arm announced that it had received INR 8,278 crore from Qatar Investment Authority (QIA) for around 1 per cent stake in RRVL. As per the deal, it has allotted 6.86 crore equity shares to QIA of RRVL, which is the leading retailer in the country, said a regulatory filing from Reliance Industries Ltd (RIL).

On September 11th, RRVL also announced that global investment firm KKR, through an affiliate, will invest INR 2,069.50 crore into RRVL. This investment values RRVL at a pre-money equity value of INR 8.361 lakh crore, which makes it among the top four companies by equity value in the country, according to the media statement shared by the company.

"We are pleased to extend our relationship with Reliance Retail Ventures Limited. Throughout our investment period in Reliance Retail, we have been impressed by the company's vision and extensive work to empower retailers across India

through digitalization, as well as by its resilience and performance in spite of the pandemic and other disruptions. We look forward to continuing to work alongside the Reliance Retail team to support the company's mission to build a more inclusive Indian retail economy," Joe Bae, co-CEO, KKR, had said.

Since August alone, Qatar Investment AuthorityKKR and now ADIA have cumulatively infused over INR 15,000 crore into Mukesh Ambani-led Reliance's retail unit.

In the AGM of Reliance Industries, its Chairman Mukesh Ambani said many marquee global strategic and financial investors have shown strong interest in Reliance Retail. "In less than three years, the valuation of Reliance Retail has doubled and the pace of this value creation is unmatched globally," he said.