Small Building Supply Companies Notch Big Gains Amid Construction Boom

TopBuild Corp (NYSE: BLD) is among leaders in the building supply industry, as demand from new construction and remodeling projects remains strong. It…

This story originally appeared on MarketBeat

is among the leaders in the building supply industry, as demand from new construction and remodeling projects remains strong.

TopBuild broke out of a cup-with-handle base on September 9, clearing a buy point above $229.89 in volume 156% heavier than normal. Trading volume last week came in 38% above average, while the stock advanced 2.46%.

The Florida-based company, with a market capitalization of $7.26 billion, is hardly a recognizable business name, at least to the general public.

But it’s just one of many stocks in the building and construction supply industry showing outstanding price gains this year.

Depending on where you live, you may be seeing evidence of the building boom driving earnings and revenue. Here in Santa Fe, New Mexico, there’s more new construction than I’ve seen in the entire 13 years I’ve been here.

While Santa Fe is well-positioned as an “escape from the cities” destination, even big cities like New York are seeing new construction. While the building phenomenon is not something that was widely forecast in March and April 2020 as pandemic lockdowns began, here we are.

TopBuild reported second-quarter results on August 3. Earnings grew 64% to $2.76 per share, while revenue was up 29% to $834.3 million.

It marked the fourth quarter in a row of earnings growth acceleration and the third for revenue acceleration.

The stock is up fractionally since the earnings report.

After clearing its cup-with-handle base last week, TopBuild pulled back and is now trading slightly below its 10-day and 21-day moving averages. The stock is teetering at a level where the breakout may fail, as it’s currently 5.1% below its buy point.

Even if the breakout fizzles out, analysts still have high expectations for the stock. Wall Street is eyeing earnings growth of 49% for the full year, to $10.83 per share. Next year that’s seen rising 19% to $12.94 per share.

Analysts’ consensus rating on the stock is a “buy,” with a price target of $240.75, representing a 10.28% upside. Since TopBuild reported earnings, four analysts boosted their price target or upgraded their rating.

The company has been growing through acquisition. On August 23, the company said it acquired California-based Valley Gutter Supply, which fabricates and distributes gutter products and specialty metals.

On September 9, the day the stock cleared its buy point, the company announced the acquisition of Distribution International for $1 billion. DI is a specialty distributor of mechanical insulation products for industrial and commercial markets.

TopBuild is hardly alone in being an industry component notching strong price gains in recent months.

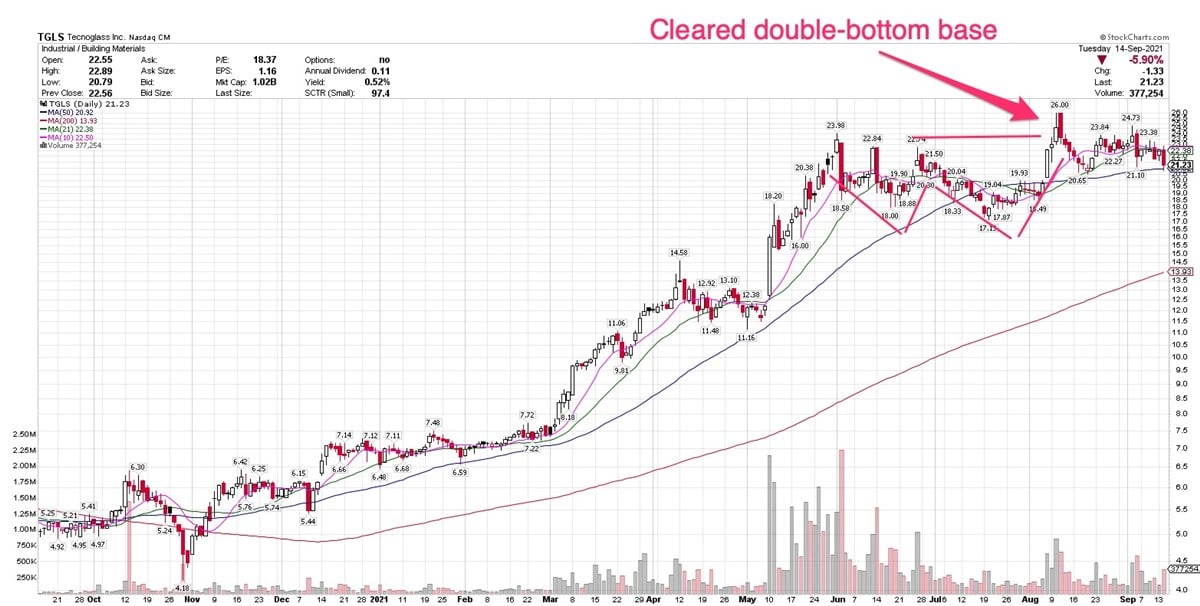

For example, Tecnoglass (NASDAQ: TGLS), a manufacturer of architectural glass and other aluminum products for the global commercial and residential construction industries, is up 227.28% year-to-date.

It’s trading near $21 after clearing a double-bottom buy point above $22.77 on August 9, the day after the company’s earnings report.

The company is based in Colombia, and serves customers throughout the U.S. and in Latin American markets.

In addition to a strong chart, the company’s earnings and revenue growth are also worth watching. Revenue was $121.7 million in the most recent quarter, up 49% from the year-ago quarter. Earnings per share were

This is a small company, with a market cap of just $1 billion. Smaller stocks like this get scant attention from Wall Street analysts. That’s because large caps are more liquid and easier for large institutions to buy and sell. Also, investment banks and research analysts can command higher fees for reporting on large-cap companies.

However, small caps have historically outperformed larger stocks, in a phenomenon dubbed the “small-cap premium.” That doesn’t mean you should jump into a portfolio of mid-and small-caps. Large caps growth stocks, particularly techs, have performed extremely well in recent years, and it would have been a mistake to avoid those.

However, the success of smaller companies from the building supplies industry is a great illustration of how little known, smaller names can add alpha to an investor’s portfolio.

is among the leaders in the building supply industry, as demand from new construction and remodeling projects remains strong.

TopBuild broke out of a cup-with-handle base on September 9, clearing a buy point above $229.89 in volume 156% heavier than normal. Trading volume last week came in 38% above average, while the stock advanced 2.46%.

The Florida-based company, with a market capitalization of $7.26 billion, is hardly a recognizable business name, at least to the general public.