Quinstreet Stock is a Turnaround Play Online performance-based marketing company QuinStreet (NASDAQ: QNST) stock has been trying to turn bottom out and recover after the earnings gap.

By Jea Yu •

This story originally appeared on MarketBeat

Online performance-based marketing company QuinStreet (NASDAQ: QNST) stock has been trying to turn bottom out and recover after the earnings gap. The Company matches consumers to various brand clients in insurance, personal loans, banking, credit cards and home services through its marketing platform. The Company practically invented performance-based marketing. While changes in privacy settings have impacted social media and marketing platforms including SNAP (NASDAQ: SNAP), QuinStreet expects little impacts from the privacy changes instituted by Apple (NASDAQ: AAPL). COVID-19 vaccinations has driven the reopening as pent-up consumer demand helps to bolster spending on financial and retail products. Prudent investors seeking exposure in the performance-based marketing segment can watch for opportunistic pullbacks in shares of QuinStreet.

Q1 Fiscal 2022 Earnings Release

On Nov. 3, 2021, QuinStreet released its fiscal first-quarter 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) profits of $0.06 missing analyst estimates for $0.16 by (-$0.10). Revenues rose 14.6% year-over-year (YoY) to $159.61 million, beating analyst estimates for $152.27 million. QuinStreet CEO Doug Valenti commented, "We delivered good results again in the September quarter due to strong momentum and execution in our client verticals. Revenue in all client verticals grew at double-digit rates or better year-over-year, including in auto insurance. We also continued to invest and made excellent progress on key technology, product, and growth initiatives. Our outlook for the business remains strongly positive."

Mixed Guidance

Quinstreet lowered its guidance for fiscal Q2 2022 revenues to come in between $130 million to $135 million versus $145 million consensus analyst estimates. This is caused by seasonal and short-term effects of rising claim costs on auto insurance client budgets. The Company raises fiscal full-year 2022 revenues to come in between $650 million to $670 million versus $641.39 million consensus analyst estimates.

Conference Call Takeaways

CEO Valenti set the tone, We continue to demonstrate the power of our footprint and advantages and FY Q1 and to separate ourselves through our performance. No one else in our markets has our breadth and depth of advantages and capabilities for long-term success. We expect the trend of strong, absolute, and relative performance to continue. As we ramp for the full effects of our long-term investments in product, technology and market initiatives, our markets are growing, and we believe we are gaining share in every one of them. All of our client verticals grew at least double digit rates year-over-year in fiscal Q1 including auto insurance. We are raising our outlook for full fiscal year 2022. We now expect revenue to be between $650 million and $670 million and adjusted EBITDA to be between $65 million and $67 million. The raise is driven by one, specific indications from auto insurance clients of budget increases in the January to June period, two, stronger than expected momentum in our credit driven client verticals, and three, the acceleration of growth initiatives across the business, including QRP. Our full year outlook fully reflects the expected impact on auto insurance marketing budgets from increased claim costs, including from Hurricane Ida whose losses were significantly greater than expected. For the December quarter, our fiscal Q2, we expect revenue to be between $130 million and $135 million and adjusted EBITDA to be between $7 million and $8 million. The Q2 outlook reflects normal seasonality and the short-term effects of higher claim costs on auto insurance prime budgets in calendar year 2021. Our Q2 and full year outlook also fully reflect the expected continued effects from the pandemic on our markets and operations and on those of our clients and partners. And finally, our Q2 and full year outlook fully reflect expected effects from privacy changes to Apple iOS from which we expect little impact. We do little to no cookie or tracking driven ad targeting."

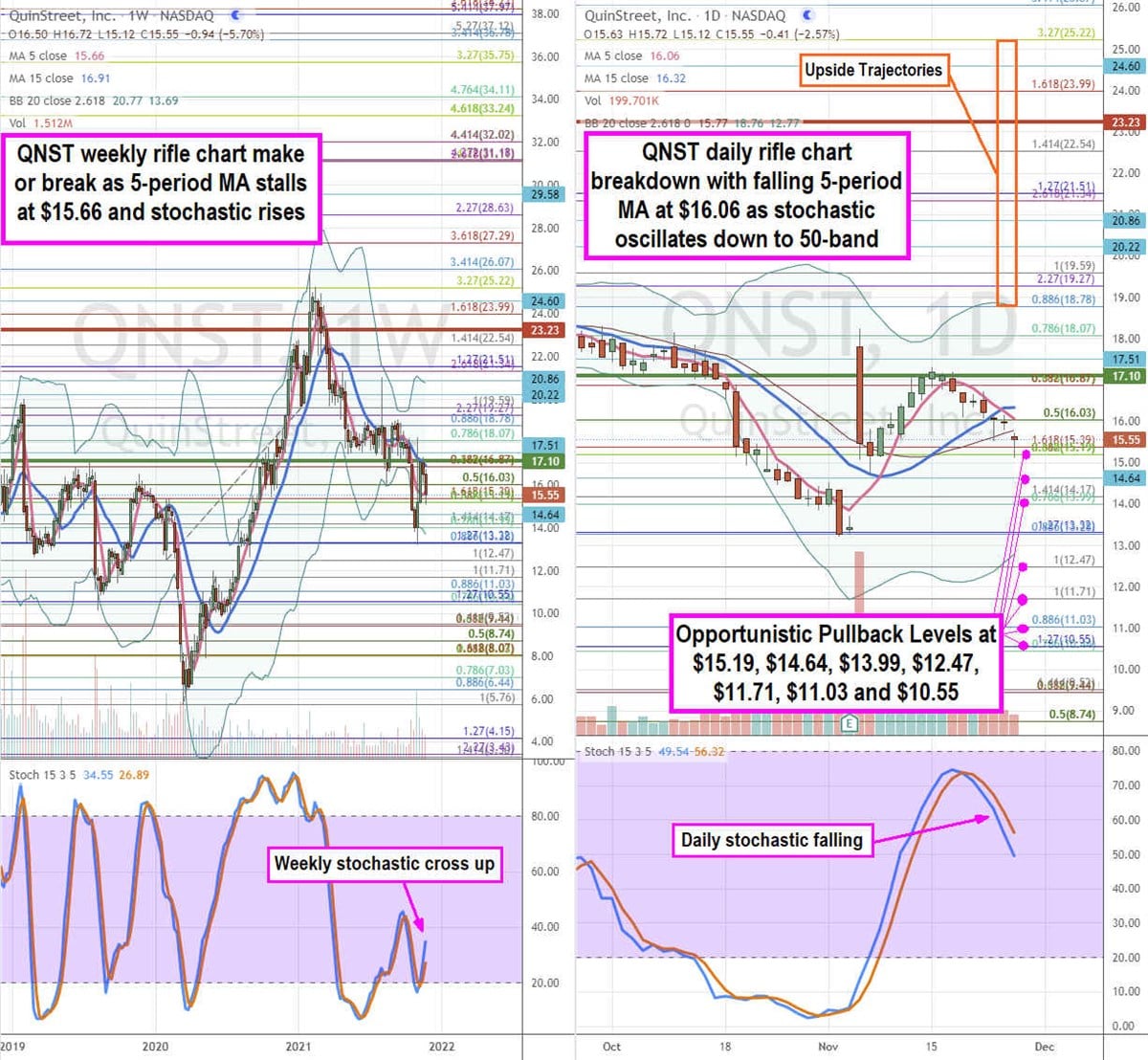

QNST Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the playing field for QNST shares. The weekly rifle chart stalled its downtrend as the weekly 5-period moving average (MA) flattens near the $15.39 Fibonacci (fib) level as stochastic crossed back up towards the 40-band. The weekly market structure high (MSH) sell triggered on the breakdown under $23.23. The weekly market structure low (MSL) buy triggers on a breakout above $17.10. The daily rifle chart is forming a breakdown as the stochastic falls towards the 50-band on the daily 5-period MA at $16.06 crossover through the daily 15-period MA at $16.32. The downtrend is shallow with a potential gap fill under the $13.99 fib. Prudent investors can watch for opportunistic pullback levels at the $15.19 fib, $14.64 fib, $13.99 fib, $12.47 fib, $11.71 fib, $11.03 fib, and the $10.55 fib. The upside trajectories range from the $18.78 fib up towards the $25.22 fib level.