Why this Canadian-Israeli Stock Grew 121% This Year Innocan Pharma operates three primary and distinct segments: research and development (R&D) of CBD-loaded exosomes, R&D of the use of CBD-loaded liposomes, and commercialization and sale of branded CBD-integrated pharmaceutical and topical treatment products

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur Asia Pacific, an international franchise of Entrepreneur Media.

Innocan Pharma Corporation (OTCQB: INNPF) is an Israeli pharmaceutical technology company that develops several drug delivery platforms that combine cannabidiol (CBD) with other pharmaceutical ingredients. The company also develops and markets CBD-integrated pharmaceuticals. Innocan Pharma stock trades on the Canadian Stock Exchange as a Canadian Corporation and also transacts in Germany (Frankfurt Stock Exchange) and the US (OTC Markets).

The company operates three primary and distinct segments: research and development (R&D) of CBD-loaded exosomes, R&D of the use of CBD-loaded liposomes, and commercialization and sale of branded CBD-integrated pharmaceutical and topical treatment products.

The company is led by a multi-disciplinary management team with decades of R&D and pharmaceutical commercialization experience. The former CEO of Teva Israel (NYSE: IEX), Ron Mayron, serves along the likes of Iris Bincovich and Yoram Drucker--two executives with a wide breadth of healthcare and publicly-traded company experience--in an effort to commercialize the fruit of R&D carried out.

Prof. ChezyBarenholz, Head of the Laboratory of Membrane and Liposome Research of the Hebrew University and Prof. Daniel Offen, a leading research specializing in Neuroscience and Exosome Technology and Head of the Department of Human Molecular Genetics and Biochemistry Department at Tel Aviv University, conduct primary R&D on Innocan's behalf in an effort to monetize nascent pharmaceutical technologies. Prof. Barenholz develops liposomes-based nano-drugs leveraging lipid biophysics. He tailors these nano-drugs for the therapeutic treatment of cancer, diseases that involves inflammation and auto-immune diseases, bacterial infection, osteoarthritis and toxicology of nano-particles (mainly liposomes).

Over the recent two years, in the midst of a ravaging Covid-19 pandemic, Prof. Barehnolz considered how liposomes- based nano-drugs could treat acute and chronicmaladies resulting from the all-encompassing auto-immune component of respiratory illnesses.

Prof. Offen studied molecular biology, specializing in RNA processing, at the Weizmann Institute of Science, Israel. As a Post Doctoral Fellow at the Albert Einstein College of Medicine, NY, US, he developed transgenic models of autoimmunity. His research concentrates on the processes of cell death in neurodegenerative diseases, specifically in Parkinson's and ALS. Professor Offen and the teams he works with conduct pioneering work in the role of stem cells in health and disease. Prof. Offen participated in the publication of more >200 original articles, review papers and book chapters.

Prof. Offen is a co-founder of several biotechnology companies developing gene and cell therapies for neurological disorders. One of them, Brainstorm Cell Therapeutics, showed efficacy in ALS patients in a Phase III clinical trial.

Sources: Innocan Pharma, Offen's Lab Recent Stock Performance

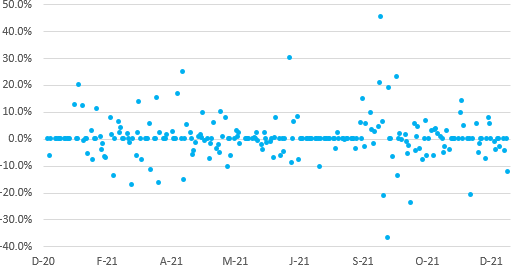

The chart above illustrates daily stock price movements for Innocan during the last twelve months. The price rose significantly between August and September 2021 pursuant to announcements made related to product development and technological/pharmaceutical breakthroughs.

While the stock fell thereafter, it remains elevated relative to pre-August 2021 levels: investors seemingly valued the stock at a premium relative to the first half of the year. Promising developments anchored by signing of exclusive and non-exclusive licensing agreements, presently and yet-discovered, underpin future growth prospects in the coming twelve months.

Recurring revenue will accrete in 2022 as licensing agreements signed likely bear fruit. Present investors executing warrants and financing future growth will likely continue to play a role in expansion. Stock price increases depend directly on continue execution of agreements with readily identifiable and favorable economic terms. Significant downside potential present should intellectual property portfolio not perform and dollars invested in sales and marketing efforts not deliver outsized returns relatively quickly (8-14 month span).

The chart above illustrates daily log stock price returns for Innocan during the last twelve months. The company's stock generated a daily mean return of 0.30 per cent with a standard deviation of 7.49 per cent. Return volatility heightened between September and October of 2021 and recently quieted as investors permanently incorporated Innocan developments through a higher stock price. Note two distinct outliers: an around 50 per cent increase in mid-September and an around 40 per cent decrease thereafter.

Potential and current investors should take care of investing for the long-run and avoid making a play on short-term volatility. Higher volatility, all else equal, should produce greater returns. The level of daily return given the risk is expected, though one should anticipate a trend reversal as the company matures: lower volatility and higher average returns.

Recent Developments/Milestones

Research and licensing agreements: On December 6, 2021, Innocan's wholly-owned subsidiary, InnoCan Pharma Ltd (InnoCan Israel), signed a Research and License Agreement with Ramot, the Technology Transfer Company of Tel Aviv University(TAU), to extend and replace a previously-announced agreement signed April 17, 2020, for the development of a CBD-loaded exosome delivery platform. Ramot funded around $500,000 paid over a period of 13 months per the original agreement.

The renewed agreement calls for Ramot to finance an aggregate amount of around $1,200,000 funded over 21 months, payable over four separate installments to Innocan. Innocan benefits from an added clause related to distribution: InnoCan Israel now retains exclusive, worldwide royalty-bearing licensing rights for commercialization of any research results related to technology developed. The new funds from this agreement will increase turnover by around $700,000 per annum over the next two years, reducing the amount of external financing needed to finance operations and elongating the run-rate of operations. In the long-run, the exclusivity option tied to this agreement's potential technology could add significant revenues if Innocan develops the technology without going over budget.

Pharmaceutical discoveries and product development: Innocan seeks a leading position as a premier global developer and licensor of CBD-based pharmacological solutions. On September 3, 2021, the company announced a recent experimental study of its CBD- loaded liposome technology (LPT) on large animals. Study findings showed similar pharmacokinetic profiles in animals to a previous small animal study, bringing the company much closer to clinical trials in humans.

Pharmacokinetics (PK) functions as a determining key performance indicator in relation to drug concentrations in the blood as a function of time, indicating better drug efficacy. Results show Innocan's LPT platform could suitably engender numerous therapeutic applications. Relative to oral administration, continuous exposure to CBD via less frequent subcutaneous injections allow the company to overcome the low (10-20 per cent) oral bioavailability of CBD. Superior PK of CBD in LPT facilitates controlled concentrations of CBD in the blood, significantly improving clinical outcomes across different delivery methods. The significance of advancing from small animal to large animal studies and the subsequent confirmation of results across both stages implies presently Innocan builds long-term intangible assets via R&D licensing agreements with significant know-how behind the scenes. The windfall from these potential arrangements with a first-mover advantage could be significant for Innocan's growth prospects.

Concurrent with scientific and technological breakthroughs, Innocan must also innovate ways of delivering a viable suite of products as it commercializes research and development efforts across verticals and international markets.

On June 16, 2021, the company announced statistically significant results for two clinical studies: one related to the effectiveness of the anti- puffiness delivered by the company's SHIR CBD EyeSerum and the other related to the level of anti- inflammatory protection provided by the company's SHIR CBD+ Anti-Aging Sleeping Mask. UPTEC, Science and Technology Park of the University of Porto, an independent lab, conducted both clinical studies, consistent with principles of ICH GCP, the Helsinki declaration and domestic legal requirements. Innocan resultantly signed an agreement with Brandzon Co. Ltd. to establish a joint venture for marketing and sales online of skincare and bodycare products, including the two just cited in the resultant clinical studies.

The company continues to test liposome-based platforms on several potential indications, including psoriasis and diabetes-related dermal conditions. On July 9, 2021, Innocan announced the filing of an international patent application for topical composition for the treatment of diabetic symptoms. The application discloses and makes claims for several compositions for topical administration comprising of cannabinoids for the treatment of diabetic related conditions. On July 28, 2021, the company further announced it filed a patent application for its topical composition for hair loss treatment. The proposed therapeutic platforms seek to enhance blood flow to peripheral areas in patients suffering from diabetic symptoms and foster hair follicle cell growth by stimulating the endocannabinoid system via topical routes, respectively. On June 14, 2021, the company further announced it filed an international patent application for a novel cannabis-based vaginal moisturizer and lubricant treatment. The platform aims to alleviate vaginal dryness and atrophy by incorporating cannabinoids and additional agents of phytoestrogen and hyaluronic acid.

By targeting a variety of verticals, the company expands its economic prospects via a unique focalization strategy: utilizing novel technologies and pharmaceutical breakthroughs to target niche markets with significant first-mover advantage.

If Innocan secures formal patent protection for current and forthcoming technologies, investors could comfortably extract significant value from the current pipeline of technological and pharmaceutical products and solutions. The company, for example, announced on July 1, 2021 the signing of an exclusive distribution agreement with Health Investments Group S.A. to distribute SHIR and Relief & Go brands in Poland to the domestic cosmetic market. The commercialization of technologies advanced significantly in 2021 for Innocan in the form of exclusive and non-exclusive licensing agreements, most of which are derived from breakthroughs produced by the company.

Forthcoming economic results will soon indicate the economic viability and risk return profiles of these go-to- market efforts.

Financial position and performance: Investors exercised warrants and further financed the company's present research and development phase in 2021. During the first three fiscal quarters of this year, Innocan required around $4.2 million in operating funds.

Through a private placement equity infusion and the exercising of previously issued warrants, the company simultaneously syndicated around $7.9 million in funds.

Between the end of the last fiscal year (2020) and now, the company concurrently increased its net cash position by roughly $3.5 million while retained deficit grew from around $14.5 million in the fourth quarter of 2020 to approximately $24 million in the third quarter of 2021. As of the third quarter of 2021, investors retain nearly $2.7 million in remaining warrants, giving the company a maximum potential contributed capital basis of around $30.7 million as is.

Cumulatively, the company only turned over roughly $110,000 during the first nine months of this year. Absent additional sources of revenue derived from announced licensing deals, the company must rapidly produce significant returns on marketing and sales dollars it recently and currently deploys. Either current inventory levels rise or receivables related to the commercialization of Innocan intellectual property rapidly increase. Otherwise, potential investors risk further dilution relative to the present capital stack. Innocan must grow its base of exclusive licensing agreements such as the one signed with Ramot earlier in 2021. Absent further dilution and debt financing backed by bona fide intellectual property and/or related trade finance facilities, the company might only maintain operations until the second or third quarter of 2022 (considering cash reserve levels and quarterly operational cash requirements).

Disclaimer: The author of the Article, does not own any securities of the companies set forth in this Article, either directly or indirectly. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. The Article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. This Article is not a solicitation for investment. The author does not render general or specific investment advice and the information provided herein above should not be considered a recommendation to buy or sell any security. The author does not endorse or recommend the business, products, services or securities of any company mentioned. This document contains forward-looking information and forward- looking statements, within the meaning of applicable securities legislation, (collectively,

"forward-looking statements"), which reflect possible expectations for future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as "predicts", "projects",

"targets", "plans", "expects", "does not expect", "budget", "scheduled", "estimates",

"forecasts", "anticipate" or "does not anticipate", "believe", "intend" and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential; (b) market opportunity; (c) business plans and strategies; (d) services intended to offer; (e) milestone projections and targets; (f) expectations regarding receipt of approval for regulatory applications; (g) intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) expectations with regarding ability to deliver shareholder value. Forward- looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions in light of experience and perception of trends, current conditions and expected developments, as well as other factors, that may or may not be relevant, and reasonable in the circumstances, as of the date of this document. The author makes provides no representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. The author shall have no liability whatsoever, under contract, tort, trust or otherwise, to any person resulting from the use of the information provided in this document or for alleged omissions from the information in this document, and the Author was compensated to provide his independent analysis in cash. Any images, photos, graphs, tables or other information contained in this document are intended only for illustration purposes and are not necessarily indicative of past, present or future performance of entities ad persons mentioned in this document.