Mark J. Kohler

Entrepreneur Leadership Network® VIP

Author, Attorney and CPA

Want to write for Entrepreneur too? Apply to join Entrepreneur Leadership network.

Latest

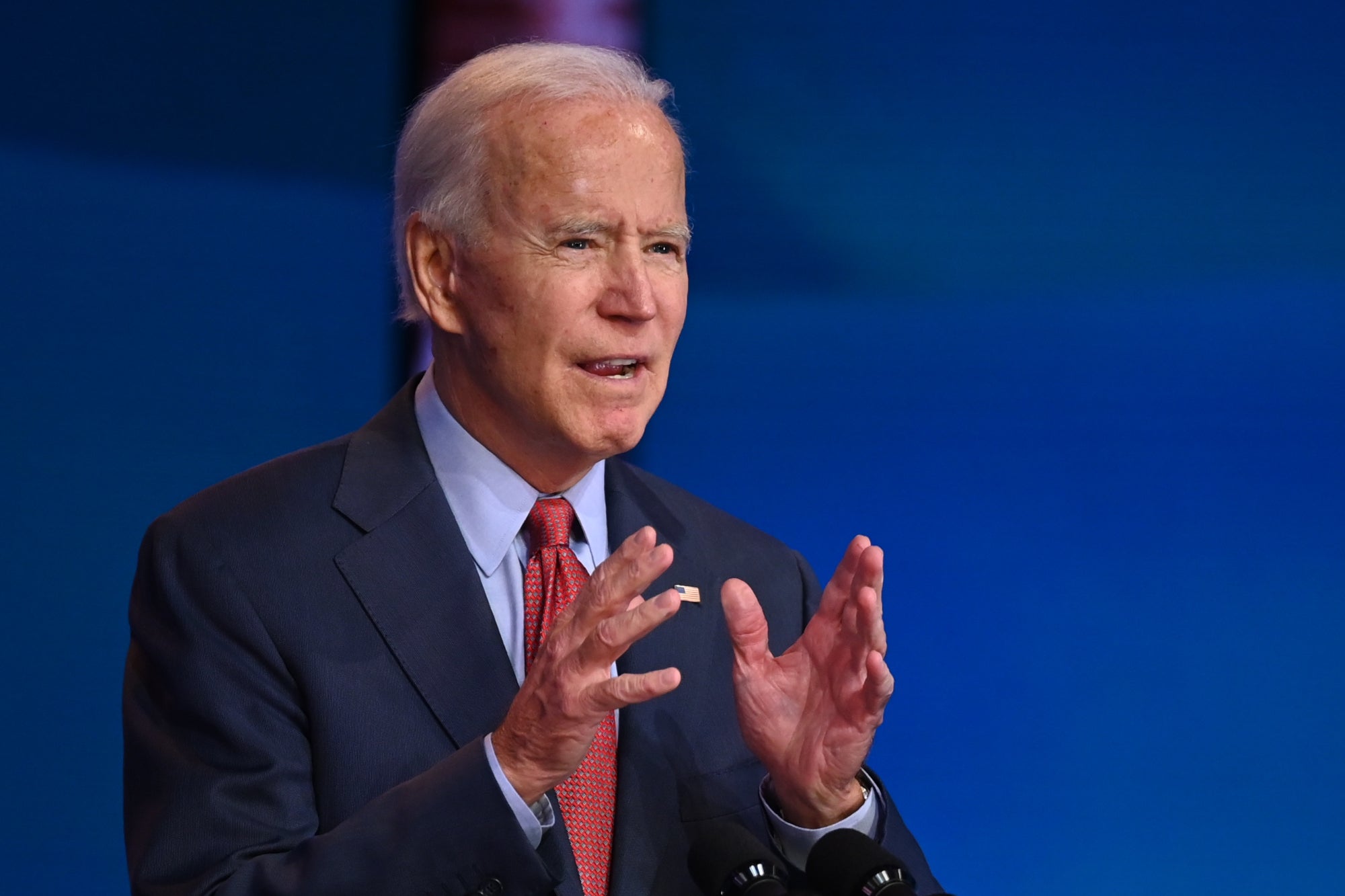

What You Need to Know About Joe Biden's Federal Tax Plan Before November 3

CPA and attorney Mark Kohler explains how Biden's plan will affect small businesses.

How Joe Biden's Tax Plan Could Affect Small-Business Owners

This attorney and certified public accountant breaks down the Democratic nominee's small-business policies.

SBA Releases New EZ PPP Loan-Forgiveness Application

And it appears many business owners may qualify for it.

How to Build a Personal 10-Year Plan

For a business owner, it could be the difference between making a profit and elusive success.

Self-Employed With No Employees? You Can Still Get a PPP Loan

Here is some clarity for frustrated sole proprietors across America.

¿Trabajador por cuenta propia sin empleados? Aún puede obtener un préstamo PPP

Aquí hay algo de claridad para los propietarios únicos frustrados en todo Estados Unidos.

More Authors You Might Like

-

Dr. Dave Bolman

Provost and Chief Academic Officer, University of Advancing Technology

-

Amanda Breen

Senior Features Writer

-

Emily Rella

Senior News Writer

-

Jaxon Parrott

CEO @ Presspool.ai

-

Praveen Krishnamurthy

Product Marketer at Adobe

-

Sherin Shibu

News Reporter