Pioneering The Next Digital Frontier: How UAE-Homegrown Platform noqodi Has Become a One-Stop-Shop For Digital Payment Services "noqodi was built on a clear vision: to create a secure, inclusive, and reliable national payments ecosystem that supports the UAE's accelerated shift toward a fully digital economy."

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur Middle East, an international franchise of Entrepreneur Media.

A September 2025 report by Mordor Intelligence noted that the UAE fintech market —expected to reach US$46.67 billion by the end of 2025— is forecast to rise to $81.55 billion by 2030 at a compound annual growth rate (CAGR) of 11.81%. The statistics reflect what many can already casually observe: fintech is growing exponentially in the UAE. But within a market that houses many different verticals and services, there is one particular sub-sector that looms large over the rest: digital payments. As per the same Mordor Intelligence report, digital payments made up for a whopping 57.56% of the total UAE fintech market share in 2024. In the midst of this ecosystem sits noqodi, a UAE-born fintech regulated by the Central Bank of the UAE and backed by emaratech, a UAE-based technology and financial services company owned by the Investment Corporation of Dubai (the principal investment arm of the Dubai Government). "noqodi was built on a clear vision: to create a secure, inclusive, and reliable national payments ecosystem that supports the UAE's accelerated shift toward a fully digital economy," declares Thaer Sulieman, General Manager at noqodi. "As digital services expanded across public and private sectors, the country encouraged fintech partners capable of ensuring trust, compliance, and seamless user experiences at scale. Our unique impact lies in our role as a national financial enabler—a platform that connects government entities, businesses, and consumers under one unified and secure payments layer. By combining regulatory alignment, advanced technology, and deep integration with national platforms, noqodi has become a trusted backbone for digital payments across the UAE."

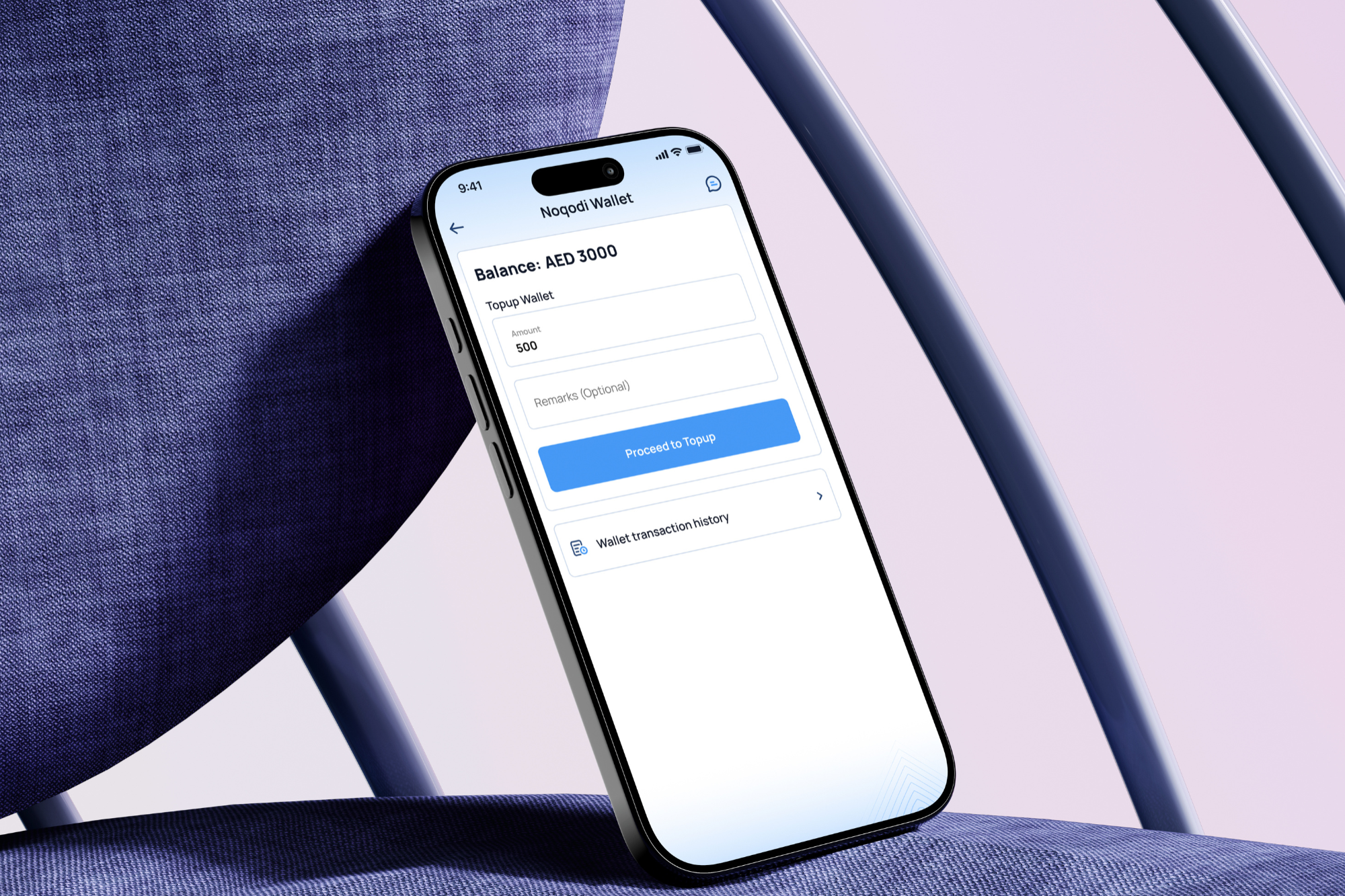

By thus serving as a bridge between government and private sectors, noqodi's impact extends beyond that of a regular digital payments platform. That is perhaps best reflected in the range of tools it offers: from digital wallets for individuals and businesses; online and in-store payment acceptance through processing and aggregation models; and merchant and payee acceptance for both wallet and credit card payments to government payment processing and reconciliation; QR payments; local fund transfers, and even escrow services (a financial arrangement in which a neutral third party holds and manages funds or assets on behalf of two parties involved in a transaction). "What differentiates noqodi is our deep public-sector integration, compliance-first architecture, and end-to-end financial infrastructure," Sulieman says. "Few fintechs in the region combine government-level scale with flexible, modular services that also support everyday consumers."

For Suleiman, his tenure at noqodi isn't his first rodeo in the fintech space. Prior to his current role, in a career that has spanned over two decades, he had notably launched the region's first digital wallet, CashU, and one of the UAE's earliest payment gateways, PayFort. As such, having deeply familiarized himself with the pulse of the industry, Suleiman notes that there are a few distinct traits that demarcate the digital payment needs of the public sector from the private. "Government entities require uncompromising reliability, regulatory compliance, and strong security controls, especially given the sensitivity and scale of the transactions they handle. Private-sector clients, on the other hand, focus more on speed, cost efficiency, and seamless integration into their business operations," he says. "In both sectors, our mission remains consistent: to deliver secure, compliant, and frictionless digital payments that enhance transparency, reduce operational complexity, and support the UAE's wider digital transformation. We aim to enable a unified national payment experience—one that is trusted by institutions and convenient for users across all segments."

To further expand its presence across the nation in becoming a full-service financial ecosystem –rather than simply remaining a digital payment provider– noqodi is in the process of launching two features for businesses: credit card acquiring and customized card-issuing. "It is a move that positions us as a full financial enabler, allowing faster and seamless onboarding for all types of merchants—especially small and medium enterprises (SMEs)—and helping businesses accept payments more efficiently," Suleiman explains. "It also equips end-users with a wider range of payout instruments through tailor-made cards suited to each segment, in addition to the existing payment tools. For the UAE fintech landscape, this means increased innovation, greater competition, and more localized payment options. For customers, it means better pricing, faster settlement, enhanced reporting, and new use cases such as tourist cards, virtual cards, SME and corporate expense cards, and integrated acquiring solutions—all supported by a platform allowing both credit card acquiring, aggregation and wallet management."

Image courtesy noqodi

Image courtesy noqodi

In a country that aims to have one million operational SMEs by 2030, noqodi opens up opportunities for small business owners to overcome some widely persistent financial obstacles– ones that Suleiman himself is keen on weeding out. "Many SMEs continue to face challenges such as high payment acceptance costs, delayed settlement cycles, complicated onboarding processes, and limited access to financial tools, and noqodi helps address these by offering competitive acquiring models that reduce cost burden, efficient settlement and transparent reporting, digital tools that simplify spend management and reconciliation, and a foundation for future embedded finance services that combine card acceptance, merchant wallets, and additional financial services such as card issuance, remittance, and QR code payments," he explains.

Image courtesy noqodi

Image courtesy noqodi

Suleiman adds that one of noqodi's main objectives is to help SMEs operate more efficiently and "grow with greater financial confidence." "SMEs need financial tools that are simple, reliable, and cost-efficient, and noqodi addresses this through fast and compliant merchant onboarding, affordable online and in-store payment acceptance, automated reconciliation and reporting, wallet-based business solutions for micro-merchants, and, soon, prepaid virtual and physical cards for controlled business spending," he reiterates. "Our focus is thus on reducing manual effort, improving cash-flow visibility, and giving SMEs the same level of financial control typically available only to larger enterprises."

While much of what has been discussed so far covers ease of online payments for businesses, there is of course the end-user market as well. With multiple studies showing financial inclusivity and a lack of interoperability within the digital economy, noqodi has channeled its efforts into creating a customer-first digital wallet that brings together relevant financial services that are designed for inclusion across multiple user segments. "Today's consumers expect payments to be fast, intuitive, and secure—and the noqodi wallet is evolving to meet these expectations," Suleiman says. "We are enhancing the user journey with biometric login, adaptive authentication, device intelligence, and integrated payment options across government and private platforms. From an inclusivity perspective, noqodi is actively working to support groups that are traditionally underserved—such as youth, tourists, low-income workers, and individuals without full access to traditional banking or with temporary needs for financial services. Through secure wallet accounts and accessible digital services, we enable these groups to safely participate in the digital economy."

Suleiman's approach is well aligned with how the overall market is poised at the moment– an October 2025 study by US-based market research firm Research And Markets shows that the UAE mobile wallet market was valued at $4.18 billion in 2024, and is expected to reach $8.28 Billion by 2030 at a CAGR of 12.12%. Defining this growth are already established factors such as a strong government push toward a cashless economy and the country's increasing digitalization. According to Suleiman, the surety of such trends continuing will fuel noqodi's expansion plans as well. "The GCC and surrounding region present strong opportunities driven by digital adoption, proactive government agendas, and a growing need for unified payment orchestration," he notes. "Countries like Saudi Arabia, Kuwait, and Oman share the UAE's ambition of building cashless ecosystems supported by strong regulatory frameworks. noqodi, as a Dubai-based eWallet and fintech leader, aims to act as a connector across regional countries and beyond—through partnerships with other licensed financial institutions—to ensure a seamless, cashless experience for visitors traveling to and from Dubai. Our regional expansion strategy is partnership-led, compliance-driven, and tailored to the priorities of each market."

As Suleiman and his team move into 2026, the business leader is confident that his firm can continue to cement itself as an integral part of the region's fintech ambitions. "The trends that excite us most include instant payments and real-time settlement rails, digital identity as a primary enabler of financial authentication, tokenization and new digital asset frameworks, and embedded finance integrated directly into consumer and business journeys," Suleiman says. "To support these shifts, regulatory frameworks will need to continue advancing in areas such as interoperability, open finance, cross-border digital services, and national wallet frameworks. These changes will accelerate innovation while ensuring consumer protection remains at the core. noqodi is deeply aligned with this future, and we are committed to playing a leading role in shaping the next chapter of digital payments in the region."