Asus Smartphone Exit Signals Shifting Tech Landscape Towards AI Another tech company is shelving their smartphone vertical. We dive deeper into the global smartphone landscape and changed market dynamics.

By Kul Bhushan

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur Asia Pacific, an international franchise of Entrepreneur Media.

Taiwanese technology giant Asus is halting its smartphone business.

Addressing an event in Taipei, Asus chairman Jonney Shih said that the company was not planning any new smartphone releases. The company will reportedly shift its focus towards verticals like commercial PCs and physical AI, reports GSMArena. The company will continue to provide software updates and honor warranty services for existing users.

Entrepreneur has reached out to Asus for more details. We will add their inputs as soon as we hear from them.

Having said that, Asus's move to pull the plug on smartphones, for now, is rather intriguing.

Asus was never a large player in the smartphone industry, though it did catch wide attention with its Zenfone series, which aimed at the younger generation, and the ROG series, a high-performance Android smartphone series aimed at gaming enthusiasts. It's been months since the last models from the two series were launched in the market.

Mobile phone companies come and go

In the last couple of decades or so, we've seen quite a few mobile phone companies come and go. Not long ago, Nokia and BlackBerry dominated the market.

Even as Samsung (on Android) and Apple have remained the top players, several other tech companies were in the smartphone sector.

One of the most significant exits of the decade was LG. The South Korean tech giant was known for its innovative takes on smartphones; for instance, the LG G5, a modular phone launched in 2016. The company was known for pioneering wide-angle cameras and high-fidelity audio. After facing financial losses for some time, LG in 2021 announced it was pulling the plug on the smartphone vertical—a move widely seen as an effort to stay afloat.

HTC was known for its futuristic design and feature-rich devices. Even as the company still exists, it exited the mainstream smartphone market in 2018 after selling most of its R&D team to Google for USD 1.1 billion. It still sporadically releases smartphones but never at the scale it used to.

Several other names that may ring a bell: Lumia (Microsoft), Gionee, LeEco, and Meizu. These brands either failed to do well commercially, shut down, or pivoted for one reason or another. And then, some brands like Sony strategically shrunk their market footprint.

In an interview with Entrepreneur India, Shailendra Katyal, vice president and MD, Lenovo India, had said, "At one stage, we had become number two in the country. Between Motorola and Lenovo phones, both put together, we were number two. But at some stage, we did not have the product strategy right; so, we started losing money. We felt we had to reset our business model there and focus a lot more on product innovation, rather than spreading ourselves too thin on managing two brands. We shut down the Lenovo portfolio because they were at times cannibalizing each other, and focused only on Motorola, which had better IP, better franchise."

Dropping out of the top 10 was a conscious choice for Lenovo to renovate its phone business.

"We decided that till the time our product strategy is not in place, we'll not just chase blind volumes. In the last three years, our phone business has grown three times because Motorola has finally got the product strategy right. Now, we've got true differentiators," he explained.

ALSO READ: From Innovations To Jobs: Inside Lenovo India's Gameplan

Global smartphone market & Asus

As mentioned above, Asus has never been a dominating player in the smartphone space.

However, it had its peak in 2015. According to Counterpoint Research, Asus was one of the fastest-growing smartphone brands in 2015, with its shipments growing by 500 percent compared with the year before. Its Zenfone 2 had done commercially well in certain markets, according to an Android Authority report.

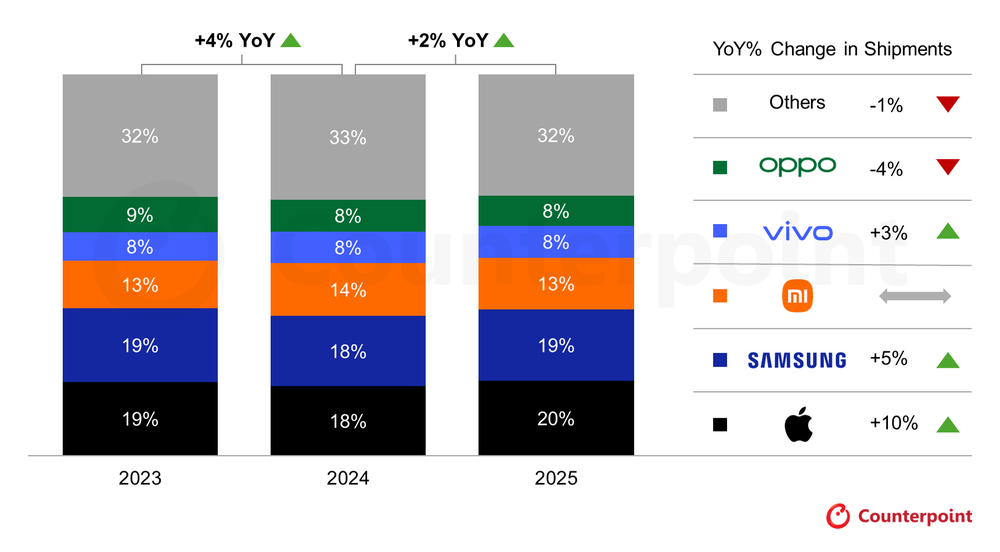

Counterpoint's latest data shows that Apple led the global smartphone market in 2025 with a 20% share and 10% YoY shipment growth—the highest among the top five brands. Samsung, Xiaomi, vivo, and Oppo featured in the top five list.

Chips shortage & strategic shift

In the case of Asus, the smartphone vertical was not driving a lot of revenue, and the current pause is unlikely to hit its total revenue either. Furthermore, current market dynamics make things more complicated for companies in the sector.

Asus chairman Jonney Shih disclosed that the company's revenue grew to TWD 738.91 billion (USD 23.4 billion approximately) in 2025, which is a 26% growth over the previous year.

The highlight, however, is that the AI server business saw 100% growth, which is double Asus's own target, reports GSMArena.

Counterpoint Research's senior analyst Varun Mishra tells Entrepreneur that Asus's smartphone business has been struggling for a few years, with its global market share remaining below 1% since 2017.

"The situation is becoming even more precarious due to rising memory prices, which will increase pressure more on the long-tail brands which have smaller scale and margins," he said.

Moreover, niche devices like ROG may have been losing appeal in the market.

"The gaming phone as a segment has remained niche. Flagship and even mid-segment phones have become so powerful that they are able to handle most games, so consumers have it all – a gaming phone with no trade-offs in terms of other specs like camera quality," Mishra said.

It's worth noting that the global electronics companies are reeling under a chip shortage. This is primarily due to the fast-paced expansion of the AI infrastructure that is powered by high-end chips like high-bandwidth memories (HBMs).

With chipmakers shifting their focus on this new demand, conventional electronics companies are facing a restricted supply of general-purpose memory modules. And it's expected that there will be fewer new model launches as well as likely the company may pass the inflating chip costs onto the consumers.

As evident by Shih's statement, Asus is better off making money from the AI division.

IDC in a blog post explains: "For decades, the production of DRAM and NAND Flash for smartphones and PCs was the primary driver for production. Today, that dynamic has inverted. The voracious demand for HBM by hyperscalers, such as Microsoft, Google, Meta and Amazon, has forced the three biggest memory manufacturers (Samsung Electronics, SK Hynix, and Micron Technology) to pivot their limited cleanroom space and capital expenditure towards higher margin enterprise-grade components. This is a zero-sum game: every wafer allocated to an HBM stack for an Nvidia GPU is a wafer denied to the LPDDR5X module of a mid-range smartphone or the SSD of a consumer laptop."

IDC predicts DRAM and NAND supply growth in 2026 to be below historical norms at 16% year-on-year and 17% year-on-year, respectively.

"The exit of ASUS from smartphones is not just an outcome of decline in market share and revenue opportunities but a strategic decision considering the memory crisis that has now become a reality for technology vendors in consumer hardware. The nature of the industry has shifted fundamentally because of the increasing demand in servers and enterprise business which is reducing the priorities for component suppliers towards consumer tech hardware like smartphones and PCs," Rishi Padhi, Principal Analyst at Gartner told Entrepreneur.

"We have already seen this in examples like Micron, one of the three memory vendors, exiting their consumer business (Crucial) in favor of high demand and high margin business for datacenters. ASUS themselves have taken the decision given the announcement of results in their annual event where they mentioned that their smartphone business was losing traction, their own server business achieved 100% growth," Padhi added.

Padhi is referring to Micron's recent announcement that it was exiting the Crucial consumer business, including the sale of Crucial consumer-branded products at key retailers, e-tailers and distributors worldwide. Crucial was essentially its vertical that sold memory (DRAM) and storage (SSDs) to PC builders, upgraders, gamers, and creators.

"The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments," said Sumit Sadana, EVP and Chief Business Officer at Micron Technology, in a post.

"Thanks to a passionate community of consumers, the Crucial brand has become synonymous with technical leadership, quality and reliability of leading-edge memory and storage products. We would like to thank our millions of customers, hundreds of partners and all of the Micron team members who have supported the Crucial journey for the last 29 years."

The Gartner analyst also explained that technology vendors are looking to cut down their costs and focus on high-margin driven business in AI and datacenters which is where all the AI inferencing is happening right now. While there exist examples of AI hardware at edge in the form of AI-PCs and GenAI smartphones which rely on Neural Processing chipsets (NPUs), the core AI services offered here as well rely on servers and cloud where the inferencing and investments are happening at scale.

"Thus, the whole of consumer hardware is at a juncture where memory pricing and component availability is at a critical undersupply for the year 2026, forcing vendors to renegotiate pricing and available supply with memory suppliers. And right now, only the large vendors have the market share to justify large orders and long-term agreements to gain some favorable terms in pricing even if it is much higher than what it was in 2025," the analyst added.

Summing it up,

If you look at the global smartphone market share, it's increasingly being dominated by Chinese brands—specifically the independent entities that emerged from BBK Electronics, such as Oppo (including OnePlus and Realme) and Vivo (including iQOO). These brands have gone on to launch their own sub-brands, and there are Xiaomi and Huawei (in select markets) as well. Other than those, there are the more permanent names: Apple (US) and Samsung (South Korea).

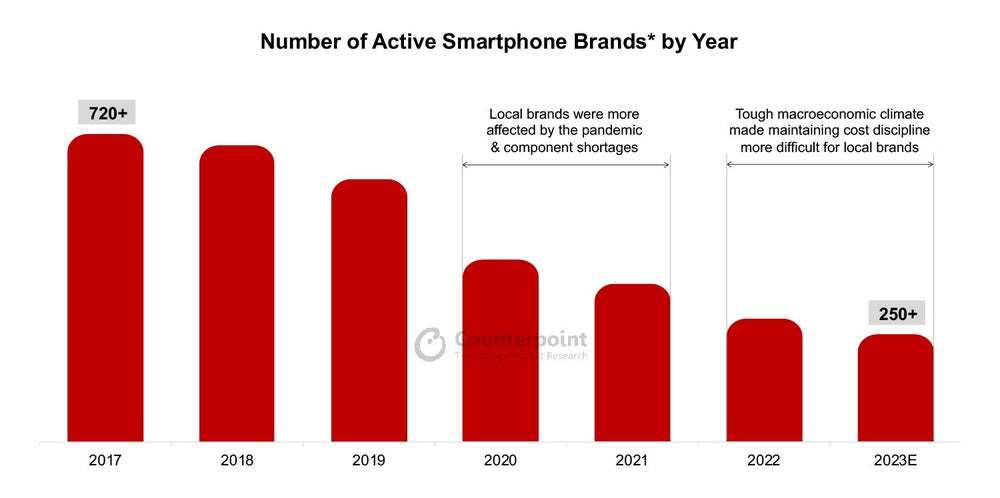

Given the departures of several Android players over the years, the overall market looks much less fragmented and diverse than a decade or so ago. Counterpoint's Mishra notes that it's difficult competing with Chinese OEMs as a whole; however, it's not game over for non-Chinese Android players.

"2026 is going to be tough for everyone – regardless of country of origin – because of the negative impact from memory prices. OEMs with the most robust supply chains and ability to change up portfolios quickly will be the winners," he cautioned.