Tata Communications' Fast & Furious Journey To Be a Tech Titan A.S. Lakshminarayanan, CEO, Tata Communications is repositioning the company from a telecom major to a technology powerhouse. He tells Entrepreneur India how the heavy weight is gearing up.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

In business, there is no such thing as a free lunch.

…Yet sometimes, despite working hard, you may find your lunch being eaten away by others.

That's precisely what Tata Communications realized and this marked a new beginning for the company.

The script flipped when A.S. Lakshminarayanan, CEO, Tata Communications for six years, chartered a new growth strategy by turning around the balance sheet.

He repositioned the company from a telecom major to a technology powerhouse.

"Across the world, telcos were running hard yet showing little progress… their lunch being eaten by others. Realizing this truth marked the beginning of a bold transformation for us," the CEO tells me.

Lakshminarayanan is redefining the narrative – how the world sees a company – that quietly powers one-third of the world's internet. The CEO says the company is speeding toward its goals.

When Vision Meets Reality

So, what exactly is Tata Communications doing? The company enables the digital transformation of enterprises globally. It is investing heavily in AI projects, expanding cloud services, and building integrated platforms to offer end-to-end digital transformation, moving beyond traditional networking.

It is well on its journey of transforming into a technology company and does not want to be identified as being a networking and communications infrastructure solutions provider only.

When asked about the genesis of this transformation, the CEO says, "Earlier, when we looked at our products, we used to say, although we have a product, the solutions were powered by other companies. Where is the TataCom-powered solution? We were debating; moments like those really prompted us to shift."

"If you look at the financial results of most of the global telcos, especially in the B2B (business to business) market, you would see most of the B2B telcos are either de-growing or showing a small percent growth. Their ROCE (return on capital employed) were sub 10 per cent to 8 per cent, still heavy on CAPEX. That was the nature of the business," he explains further, why transformation is the need of the hour.

In business, ROCE is a key profitability ratio showing how effectively a company generates profit from all the capital invested.

The behemoth's transformation is on the back of "Digital Fabric" strategy – integrating connectivity, cloud, security, and AI into unified solutions like Vayu, its cloud service, partnering with NVIDIA for AI infrastructure, and shifting from infrastructure to data-driven services – aiming to become a core digital ecosystem enabler for enterprises.

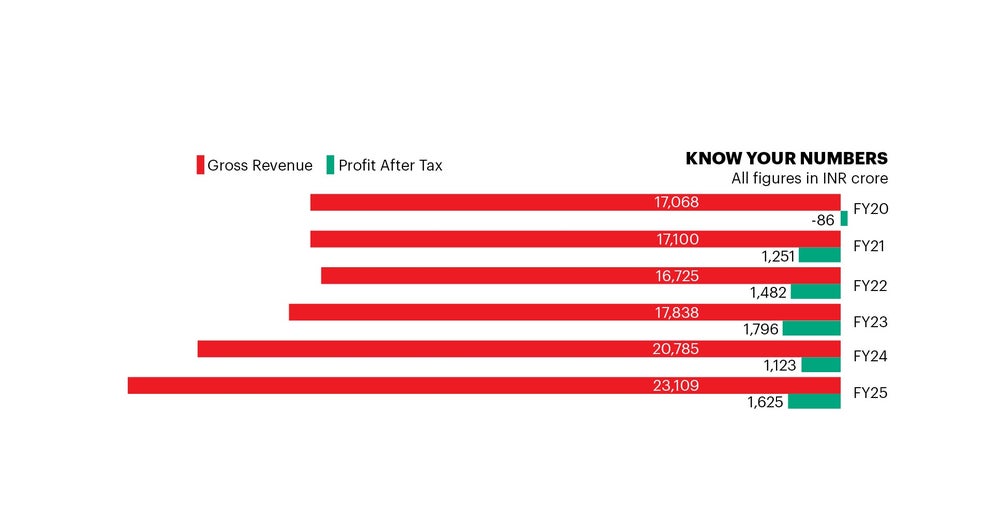

All these metrics have helped the company grow financially. At the end of financial year (FY2024-2025), with continued investments across the full stack of its Digital Fabric, the company recorded high double-digit growth of digital revenues, bringing this vision to life.

Further to FY25, Tata Communications' recent result of Q2 FY2026, shows stable performance with consolidated revenue around INR 6,100 crore, up 6.5 percent year-over-year (YoY), despite some macroeconomic headwinds, driven by data revenue growth and strategic deals.

Amongst overall revenue, data revenue reached approximately INR 5,179 crore, showing 7.3 per cent YoY growth, driven by strong digital portfolio expansion despite challenges like Red Sea cable cuts, reinstating the company is on the right trajectory.

Recently it acquired a 51 per cent majority stake in Commotion Inc., a US-based AI-native enterprise software company, in a strategic move to boost its own AI capabilities for customer experience (CX) and digital transformation.

"We have shifted the company from debt to an organization full of future possibilities with a digital fabric that resonates with the customers. There have been some good deals. We just announced the acquisition of Commotion; with this, not only will our product portfolio improve, but we are hoping to rub off some of those capabilities inside the company to transform ourselves," he continues.

Breaking the Perception

A.S. Lakshminarayanan believes it's the right time for the market to know Tata Communications' story.

However, the first and primary goal is to serve the large enterprise customers: Once the visibility for large enterprise customers is created, the company will be better known.

"Today, when we go and meet with the CIO, or even the CEO, do workshops, they don't realize TataCom can do all of this. Their perception is still that we have large networks and connect them. But they didn't realize that we are progressively a technology powerhouse," he says.

In the last five years, the company has doubled its $10 million customers. The number of customers has grown 30 per cent to 40 per cent. "It's growing because we are becoming more and more relevant to the enterprise."

By its nature of work, the brand is still far away from being known by the Aam Aadmi.

"When the company size becomes larger, we would definitely like to take this message out to a broader number of people who would understand and realize what we do," he quips.

MM Factor: Money & Moat

Tata Communications launched Vayu Cloud on March 20, 2025 aimed at cutting costs by up to 30 per cent compared to major providers. Targets enterprises in finance, retail, and government with no data egress fees.

Two quarters into the launch, and the reception has been exceptional.

"We have a lot of deals in the pipeline and have closed a few as well. It's just not a CPU cloud, we offer GPU as a service and Edge cloud as well. We are continuing to invest both on infrastructure and GPUs, and are talking to very large organizations and governments, who are showing interest," he tells, highlighting growth and investments in the area.

Tata Communications is building a major AI-focused GPU infrastructure in India through partnerships with NVIDIA.

Talking about the GPU vision, the CEO says, "Our aim is to provide an infrastructure and a platform that will enable enterprises to build the best AI products and solutions needed at the right price point."

With AI, especially with inferencing which is going to take-off, cost challenges are going to crop up.

"Nobody has modeled what the cost is going to be in the future. It's easy to get into the public cloud, but as one scales, there are a lot of egress costs and the price just goes up exponentially," he continues.

What's the moat? "With our solution, starting from our AI engine with commotion to running on Vayu Cloud, we will give a predictable pricing. This will be coupled with sovereignty in data and intelligence."

Next Frontier: What Lies Ahead?

Despite some macro economic headwinds, the company is aiming to hit the target of doubling data revenue to INR 28,000 crore by FY28. Internally for 2030, it has set a bigger goal.

"We can double hit all the financial metrics, we are setting ourselves up with ambitious goals," he says.

One of its core lies in the data center business. It has major strengths in the data centre to data centre connectivity and is a market leader in the segment. To expand it further, the company will soon be launching its new product: on demand connections.

The company is bullish about inorganic growth. "If there are opportunities from a capability perspective, we would be looking to acquire. The second category of acquisitions would be to expand geographically," Lakshminarayanan explains.

Network is the largest revenue generator for the company. The core network and the next generation connectivity put together is more than 50 per cent of the business. The interaction fabric is one of the largest contributors to its digital portfolio.

"All the portfolios are growing fast. The interaction fabric contributes 40 per cent of the digital portfolio. We are placing bets on all the four fabrics," he adds.

The company's capital allocation strategy is to invest up to $300 million per annum. It has spent close to $1.4 billion in the last few years, cumulatively. "We are earmarking similar, if not more investments in the coming days. Fiber and cable is a long-term investment sector and data center connectivity will be another area of investment. We have also earmarked $60 million per year for organically building software and platform capabilities."

Its top priorities for the rest of FY26 are to hit the numbers, grow the million dollar customer base, and generate positive LOB margins through acquired businesses.

As the company is upping its ante to be a tech powerhouse — competition is impossible to ignore – Lakshminarayanan is buoyant and ready. He insists Tata Communications' uniqueness will define its next chapter — a tech titan in the making, built on digital fabric and ambition.