Banking Rebuilt for the Internet Era Moving money internationally often means delays, high costs, and complex account structures. In recent years, however, internet-native financial platforms—sometimes described as neobanks—have started to experiment with models that attempt to overcome these limitations.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

For decades, traditional banking has been defined by legacy systems, fragmented cross-border processes, and a reliance on intermediaries. Moving money internationally often means delays, high costs, and complex account structures. In recent years, however, internet-native financial platforms—sometimes described as neobanks—have started to experiment with models that attempt to overcome these limitations.

Reimagining Banking Infrastructure

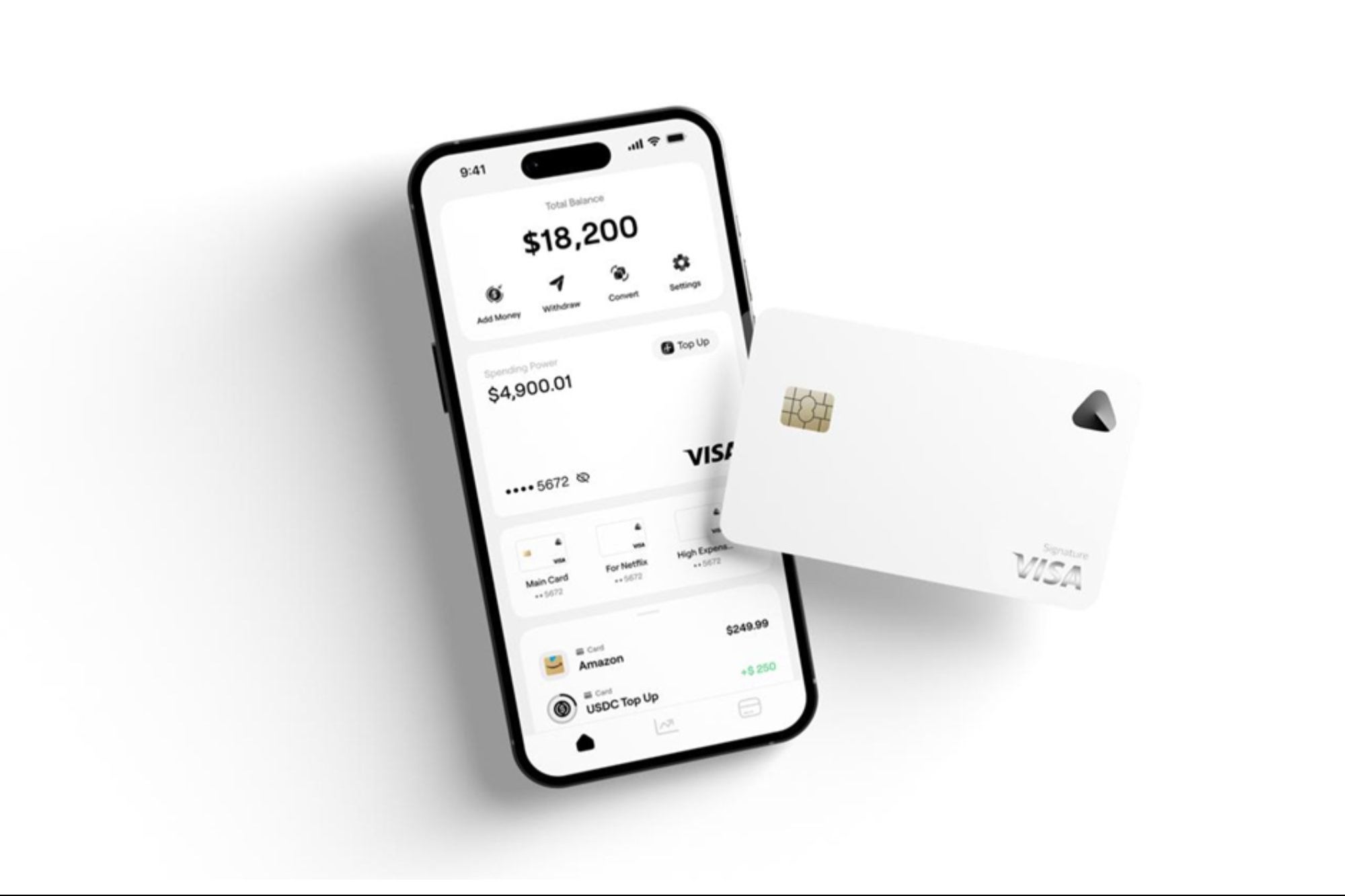

One development in this space is the ability to link digital asset balances directly with payment networks such as Visa. By doing so, these platforms aim to reduce some of the reconciliation and funding challenges faced by conventional fintech systems while offering users the flexibility to spend digital currencies in everyday transactions.

In addition to payments, digital accounts denominated in major currencies are being integrated with financial providers worldwide. This enables entrepreneurs and businesses in places like Dubai, Brazil, India, and Singapore to accept cross-border payments without needing to establish a presence in the United States. Such systems can convert incoming funds into digital currencies or local fiat almost instantly, offering speed and efficiency that traditional banking infrastructure often struggles to match.

Avici: One of the Emerging Experiments

Among the companies exploring this space is Avici, an internet-focused neobank. It uses a self-custodial smart contract wallet, allowing users to retain control over their assets while accessing programmable features. Some of the tools under development include automated payroll for remote teams, real-time settlement for merchants, on-chain lending mechanisms, and yield integration within accounts.

Avici was founded in January 2024 by Sitaram Kakarlamudi, Abhishek Tiwari, and Varun Lohade. The team draws on experience in fintech and crypto, with an aim to simplify user experiences that have traditionally been complex. From its launch, the platform has been accessible in over 100 countries, offering features such as low conversion spreads and no top-up fees, while operating with a lean structure rather than large-scale corporate backing.

Broader Implications

What stands out is not just the payment utility but also the potential for new forms of financial interaction. Freelancers can receive payments across borders without relying on legacy systems; businesses can transact in different currencies more seamlessly; and individuals can maintain direct custody of their assets instead of depending solely on traditional banks.

This model introduces questions about ownership, transparency, and the role of intermediaries in global finance. Rather than positioning banks or platforms as the sole custodians, these systems place more responsibility—and control—in the hands of users themselves.

Looking Ahead

As digital money and programmable wallets continue to evolve, their applications could extend well beyond payments. Cross-border settlements, payroll automation, decentralized credit, and integrated yield opportunities are just a few of the areas being tested. While these experiments are still at an early stage, they highlight how smaller, internet-native ventures might influence the future of financial infrastructure.

The direction is not yet fixed, but the trend suggests that the next phase of global banking may not be driven solely by established institutions. Instead, agile platforms with internet-first models could play a significant role in reshaping how individuals and businesses engage with money in a more connected world.