Data Snapshot: India Venture Capital 2025 India's VC market in 2025 was defined by selective capital, larger cheque sizes, and a clear shift toward profitability, execution depth, and exit visibility.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

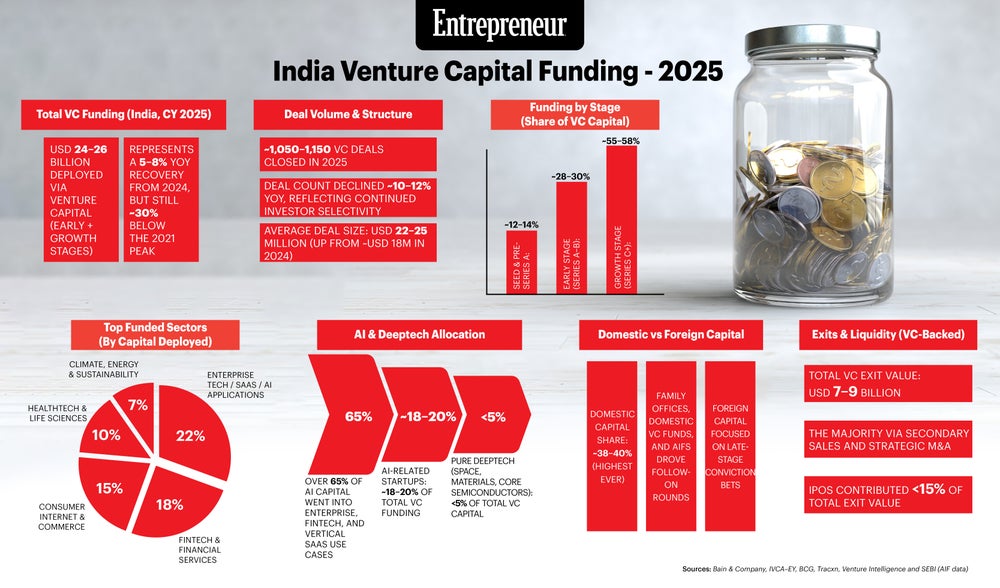

Venture capital in India deployed USD 24-26 billion across early and growth-stage ventures in calendar year 2025, marking a modest 5-8 per cent year-on-year recovery, still below the 2021 peak.

Close to 1,150 venture deals were closed during the year, reflecting continued investor discipline. Average deal sizes ranged from USD 22 to 25 million, indicating capital concentration in fewer and higher-conviction companies.

Coming to stage-wise capital allocation, seed and pre-series A bagged close to 12-14 per cent of the capital, with series A through B allocated 28-30 per cent. Series C and beyond attracted the rest of the capital, with late-stage and scale-up rounds dominating overall capital deployment.

In sectoral distribution (by capital deployed), Enterprise Tech, SaaS, and AI applications led the race with ~22 per cent, fintech and financial services took ~18 per cent, Consumer Internet and Commerce: ~15 per cent, Healthtech - Life Sciences: ~10 per cent, and Climate, Energy and Sustainability: ~7 per cent.

AI-linked startups accounted for 18-20 per cent of total VC funding, with over 65 per cent of this capital directed toward application-layer and enterprise use cases. Core deeptech investments (space, materials, advanced hardware) remained below 5 per cent of overall VC funding.

Domestic investors accounted for 38-40 per cent of total VC capital deployed, the highest share on record, driven by Indian AIFs, family offices, and local fund managers. Foreign capital remained selective, focusing primarily on late-stage opportunities.

VC-backed exits generated an estimated USD 7-9 billion in value, largely through secondary transactions and strategic M&A. IPOs contributed less than 15 per cent of total exit value.

"Structural tailwinds, a maturing exit environment, and supportive government policies strongly affirm our optimism for the years ahead. While maintaining vigilance against global and local uncertainties, our guiding philosophy is clear: invest with discipline, stay close to founders, and build for long-term impact and generational value," said Waterbridge Ventures, an early-stage, India-focused venture capital firm that invests in tech-driven startups.

India's VC market in 2025 was defined by selective capital, larger cheque sizes, and a clear shift toward profitability, execution depth, and exit visibility.