Luxury Cars: Need For Speed In Tier II, Tier III Cities Companies such as BMW, Mercedes-Benz, Audi, Lexus, Lamborghini and others see potential in emerging markets of Tier II and Tier III cities. Ludhiana, Udaipur, Kanpur, Mysore, among others, where there are high numbers of NRIs and HNIs have seen high penetration of luxury cars

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

Less is more. And in the case of luxury cars, small is big. Gone are the days when luxury cars were limited to urban market/metro cities. Today, luxury car makers are betting big on smaller towns: Companies such as BMW, Mercedes-Benz, Audi, Lexus, Lamborghini, and others see potential in emerging markets of Tier II and Tier III cities which are growing rapidly. "As things have started improving, we see a very good demand for luxury cars in Tier II, Tier III, however, choices of luxury cars have substantially gone down in these regions. Electric luxury cars penetrations in these areas are close to 1 per cent. Cities such as Ludhiana, Udaipur, Kanpur, Mysore, among others, where there are high numbers of NRIs and HNIs play a significant role in the penetration," said Manish Raj Singhania, president, Federation of Automobile Dealers Associations of India (FADA).

Credit: Entrepreneur India

In 2022, BMW Group delivered its best-ever year in India till date with all three brands – BMW, MINI and BMW Motorrad.

"We have seen strong contributions coming from established markets i.e. metropolitans. At the same time, emerging markets in Tier II and Tier III cities are showing remarkable growth prospects for the future. The Indian luxury market is still at a nascent stage but has immense potential with a population of over a billion. Along with the metropolitan centers, we foresee growth potential amongst the young achievers, predominantly in Tier II and Tier III cities," said Vikram Pawah, president and CEO, BMW Group India.

For BMW, Chandigarh, Kochi, Jaipur, Goa, Lucknow are among the leaders in the emerging markets. Other emerging markets with established world-class dealerships are in Ludhiana, Udaipur, Kanpur, Mangalore, Calicut, Coimbatore, Vijaywada, Madurai, Trivandrum, Vadodara, Dehradun, Bhubaneswar, Ranchi, Ahmedabad, Rajkot, Surat, Goa, Aurangabad, Indore, Nagpur and Raipur. To market aspirational brands in a country as diverse as India, it is critical to create memorable experiences and constantly stay in touch with consumers through premium brand engagements. BMW Group India will further broaden the horizons by creating more exclusive touch-points to connect with the clientele across the country especially in the emerging markets.

Over the years, Mercedes-Benz has seen an increased awareness and a significant rise in purchasing power within Tier II, Tier III markets.

"We categorize markets as metros and mini metros. Similar to the metros, the share of luxury to overall million dollar HNIs in these mini metros is also growing. Currently larger metros like Delhi and Mumbai, comprises 45 per cent of our sales volumes. However, we expect smaller markets to contribute in the mid to long-term," said Lance Bennett, VP-sales and marketing, Mercedes-Benz India.

What's Fuelling Growth?

The growth of luxury cars in smaller metros is on the back of successful enterprises, robust infrastructure, improved road connectivity and a rapid surge in economic activities.

"Rising income levels, increasing disposable incomes and the emergence of entrepreneurs from Tier II and Tier III cities have led to the overall growth of India's luxury segment, leading to pent-up demand for Audi cars. More young people, especially in the category of startup owners and young professionals, are keen on experiencing luxury at an early age. They have both the desire and means for it," said Balbir Singh Dhillon, head of Audi India.

Credit: Entrepreneur India

Audi A4, an entry-level sedan, right up to the RS e-tron GT, have seen a rise in first-generation buyers over the last two years. About 40 per cent of Audi's sales come from smaller towns and most of the buyers are below 40 years.

"We currently have 62-plus touch points across the country with a significant presence in the non-metro cities which are enough to steer the business for the next few years. If there are market and customer needs, we will look at expanding it further," added Dhillon.

The phenomenon of rewarding oneself and You Only Live Once (YOLO) is not limited to the metros.

"We have seen a definite increase in demand from non-metro cities, with almost 25 per cent of sales now coming from non-metro cities. The accumulation of wealth among millennials, the startup culture, the growth of Unicorns are the trends that we are monitoring and we are connected with these sets of prospects. Earlier the demand was largely coming from metros and the Tier I & II cities were contributing in single digits to volumes," said Sharad Agarwal, country head, Lamborghini India.

In terms of age profile, Lamborghini buyers are much younger in India. The average age of a Lamborghini owner is between 25-45 years and with Urus the age bracket goes up to 55 years.

In India, demand used to be largely from third or fourth-generation business entrepreneurs till a few years back, "Now we are witnessing increasing demand from first and second-generation entrepreneurs. From founders of successful startups to an increasing share of women buyers, the demand pool for supercar buyers has grown immensely over the past few years," said Agarwal, adding that today, Lamborghini can be seen from Ludhiana to Chandigarh, Kanpur to Lucknow, Guwahati to other north-eastern regions, and many more. "So, it is now reaching beyond metros, and you can see a Lamborghini across markets."

For Lexus India, Delhi, Bombay, Bengaluru and Chennai, contribute to maximum sales, but other cities such as Coimbatore, Ahmedabad and Pune, among other relatively smaller cities, where the company is eyeing expansion, contribute significantly to its revenue. "The growth has been faster in smaller towns and almost 30 to 40 per cent of the sales come from these areas," said Naveen Soni, president, Lexus India.

Credit: Entrepreneur India

Can e-luxury make a mark?

BMW and MINI dealerships have received many enquiries and bookings for the electric range from cities like Chandigarh, Lucknow, Kochi. "At present, it is the consumers in urban markets that are driving the majority of demand but prospects from emerging markets are strengthening quickly in the medium to long-term. The rate at which the adoption is taking place in markets beyond metros will help boost customer confidence at a larger scale," said Pawah of BMW Group.

The overall sales of Mercedes-Benz's EVs in the portfolio is still nascent and is primarily driven by sales in large metro and Tier I markets. However, the customer awareness and interest levels in luxury EVs in emerging markets are at par with large metros. Mercedes-Benz clocked its highest ever sales in India, in 2022, making India the fastest growing market across Mercedes-Benz worldwide. The growth has been across segments in general, and for the top-end vehicle (TEV) in specific. The TEV sales growth has been the highest at 107 per cent in Q1 2023 and its penetration in sales has increased to 22 per cent in CY 22. "For customers in these emerging markets, it is convenient for them to have charging at home, as they own independent houses. We have seen cities like Cuttack, Karnal, Calicut and other markets warming up to luxury EVs. Even the aspirations of the customers are evolving as they are well travelled, well aware of the latest products and technology and prefers leading a premium lifestyle," Bennett added

Audi's electric vehicles - the RS e-tron GT and etron have seen some young buyers – in the age bracket 35-40 years old. "While the large share is male; there are also women e-tron customers. Our share of women buyers has gone up from 4 per cent to 11 per cent in the last three years (including ICE)." The Audi e-tron range is witnessing good traction from markets such as Coimbatore, Indore, Ahmedabad.

Lexus is planning to go electric globally and is testing a few sample UX battery electric vehicles: There are two deterrents – heat and dust, which are both extremes in India. Thus, EVs have to undertake a lot of adaptation and trials. "Of course, there are challenges – operational issues, availability of charging infra, etc. Consumers will not be willing to adapt their lifestyle based on the products they buy, the products have to adapt to their lifestyles," said the India head of Lexus.

Used-car market

Audi India's pre-owned cars business witnessed the strongest-ever sales with a quarterly growth of 50 per cent. "We currently have more than 300 cars available on the Audi Approved: plus portal across the country. In the past two to three years, the market for pre-owned cars has increased, especially in Tier-II and Tier-III cities. Our Audi Approved: plus (pre-owned) car business has grown from 7 facilities in 2021 to 23 facilities at the moment in order to meet this rise in demand," said Dhillon, head of Audi India.

BMW Premium Selection plays an important role in the success of the company. It is the first structured pre-owned premium car business in India and is distinguished by its exclusive approach. BMW Premium Selection has provided a vital impetus to BMW operations in India and has introduced many new customers to the BMW brand, especially from the non-metros. Buying a pre-owned vehicle allows customers to experience the product substance, customer service, sales and aftersales process. This is an important decision-making factor for customers who are looking at new car purchase in the future. BMW Premium Selection acts as a steppingstone into the world of luxury for many near-premium customers who consider upgrading to become first-time luxury buyers. "BMW Premium Selection has provided a vital impetus to BMW operations in India and has introduced many new customers to the BMW brand, especially from the non-metros," said the India head.

Sharing a similar opinion, Bennett said, "Mercedes-Benz Certified, Mercedes-Benz Marketplace and the newly launched pre-owned cars online store enable customers to select a car of their choice from the available range of pre-owned Mercedes-Benz cars. The flexibility and trust of these programs have resulted in significant growth in sales in mini metros."

Almost 40 per cent of Lexus's sales in the pre-owned luxury car sector is contributed by the Tier II and Tier III cities.

"Customers want to own and experience the luxury life by owning these cars that come quite easy-- thanks to the luxury used cars sector-- this upward trend is taking place parallel to customers getting interested in the opening price ranges of luxury car brands. It helps increase competitiveness as when a car of a particular brand makes rounds in the market and then resold, it increases the lifespan of the said car, eventually helping the brand name to survive longer," Naveen Soni, explained.

What sells the most?

Each vehicle type has had a journey and timeline of its own. When luxury cars had just started to come into the market, hatchbacks were a raze. Then came a time when people went out to buy sedans only as they looked classier and a change of style took place. "In the present times with all the styles and types mixed in, we are noticing a shift in preference, the population bending more towards owning a SUV. A sizable number of people who are coming into the market are starting to prefer SUVs over sedans. Even as the average age of owning luxury cars is reducing, first-time buyers are also opting for SUVs," said Naveen Soni adding that we have noticed that ES 300h, a self-charging electric motor has led the market for Lexus cars.

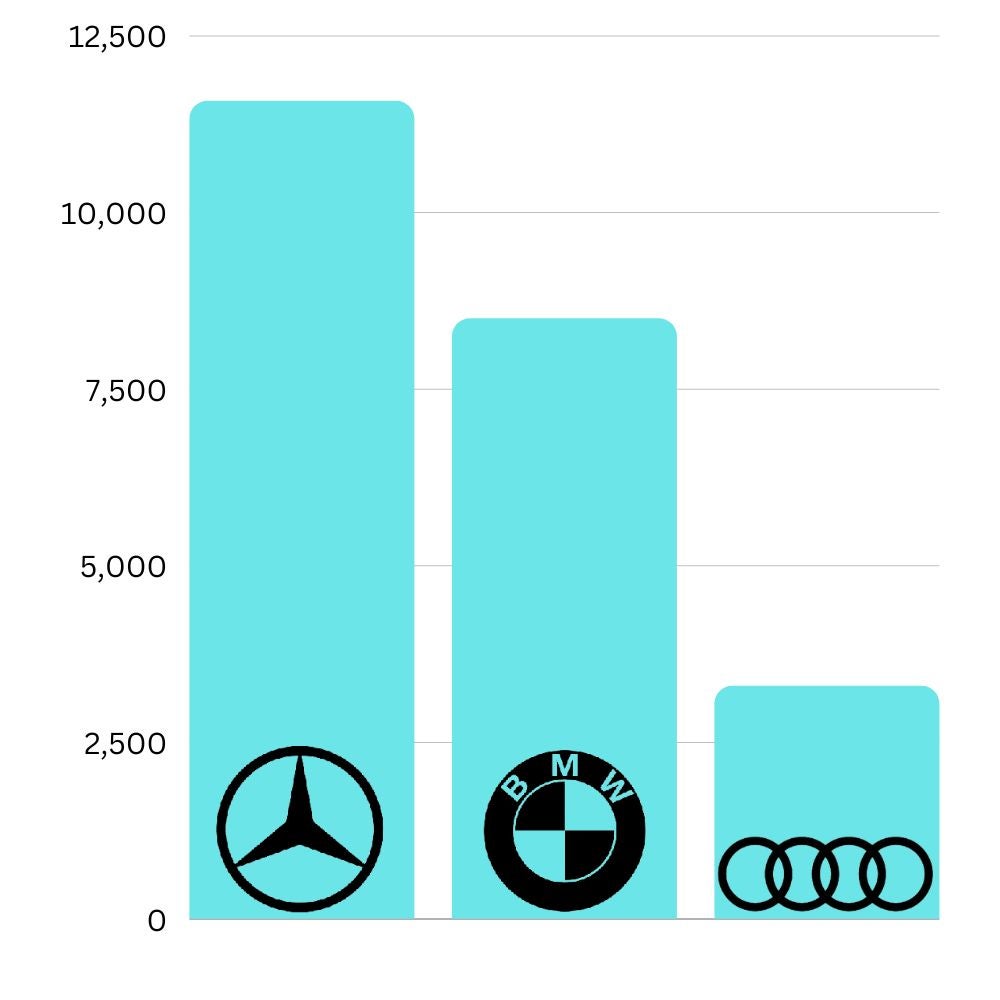

Sales volume of vehicles in the luxury car segment across India in financial year 2022, by brand | Source: Statista

For BMW, the maximum demand volume wise comes from the price range between INR 40 – 70 lakhs where traditionally popular models such as the BMW X1, BMW 2 Series Gran Coupe, BMW 3 Series, BMW 3 Series Gran Limousine and BMW 5 Series lie. "In 2022, our locally produced Sports Activity Vehicle (SAV) range including the BMW X1, the BMW X3 and the BMW X5 contributed over 50 per cent to sales.In MINI, the locally produced MINI Countryman had a share of 41 per cent in sales while the MINI Hatch contributed 38 per cent and MINI Convertible 21 per cent. In BMW Motorrad, the BMW G 310 R, BMW G 310 RR and BMW G 310 GS command a share of 90 per cent," Pawah explained.

The Mercedes-Benz customers in India are getting younger. S-Class customer's average age is now 38 years and the C-Class age stands at 35 years and the average age was above 50-years even 10 years back.

Audi India retailed 1950 cars in Q1 2023 witnessing a growth of 126 per cent compared to the previous year. "SUVs have contributed 60 per cent of our sales in Q1 2023. Furthermore, all our five electric cars - the Audi e-tron 50, Audi e-tron 55, Audi e-tron, Sportback 55, Audi e-tron GT and Audi RS e-tron GT - have received good demand and continue to have a strong order bank," the Audi India head explained.