How To Lower Your Risk With A Conservative Covered Call Approach On 3 Strong Buy Dividend-Paying ETFs

Selling covered calls on conservative dividend paying ETFs can lower your risk but still provide real returns for astute investors and traders.

This story originally appeared on StockNews

Selling covered calls on conservative dividend paying ETFs can lower your risk but still provide real returns for astute investors and traders.

The recent drop in 10-year Treasury yields back well below the 4% level has made dividend paying stocks comparatively more attractive once again. The fact the Fed is nearer the end than the beginning of the recent rate hikes makes higher yield stocks a solid choice over the coming months.

Rather than trying to pick individual stocks, buying a higher yielding ETF can be a safer and saner approach. Here are three A rated – Strong Buy- Dividend funds to consider purchasing along with a covered call to consider selling.

- Vanguard High Dividend Yield ETF (VYM)

- SPDR Dividend ETF (SDY)

- iShares Select Dividend ETF (DVY)

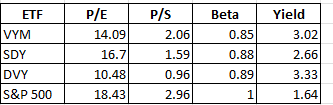

These three ETFs all have below market risk (lower than 1.00 beta) and below market valuations on both Price to Earnings (P/E) and Price to Sales (P/S) basis. They each carry a bigger dividend yield than the S&P 500 as well. So generally, a safer choice than the overall market. A quick comparison of the three dividend ETFs versus the S&P 500 is shown below.

Plus selling a covered call against the dividend ETF can further reduce the risk and generate potentially higher returns.

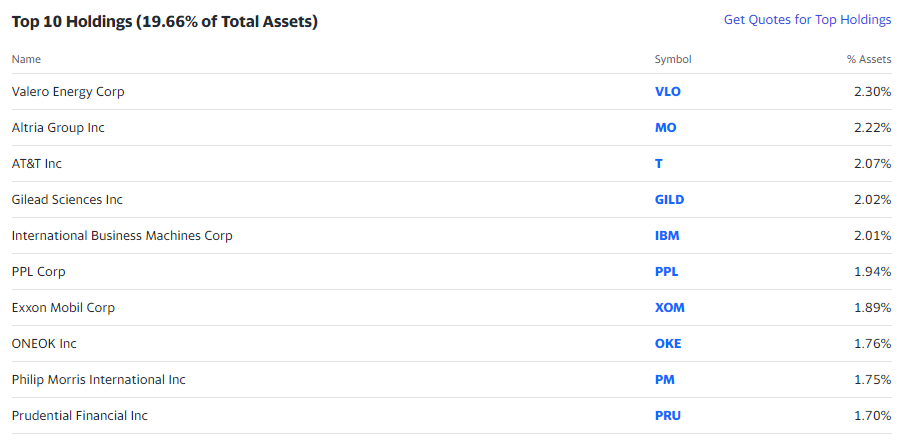

Each of the three higher yielding ETFs has different components that comprise the overall basket of stocks. Notice how oil giant Exxon Mobil (XOM) is a big part of all three ETFS but has a slightly different weighting and ranking within each fund.

Let’s take a quick walk through the three.

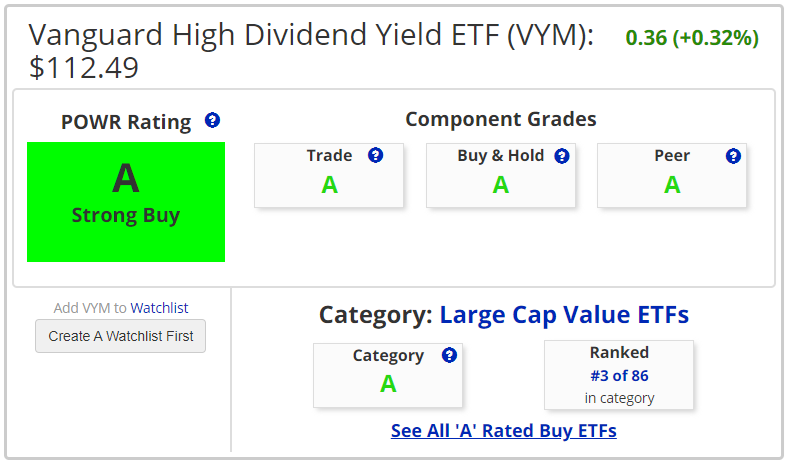

VYM (Vanguard High Dividend Yield ETF)

VYM has a Price to Earnings (P/E) ratio of just over 14 (14.09) and Price to Sales (P/S) ratio just north of 2 (2.06). Both are at a discount to the similar metrics for the S&P 500 of 18.43 for P/E and 2.96 (P/S). The beta for the VYM is 0.85 so a lower risk than the overall market. It sports a yield of 3.02%, well above the S&P 500 yield of just 1.64%. It ranks number 3 in the Large Cap Value ETF category.

The top 10 holdings in VYM account for over 23% of the total assets. J.P. Morgan (JPM) and Johnson and Johnson (JNJ) hold the two top spots.

Selling the July $116 call against the underlying purchase of VYM can reduce the net cost by about $5.00 (over 4%) while still leaving an upside appreciation of roughly 3% open to the short strike of $116. Plus you still get over 3% dividend as long as VYM stays below $116.

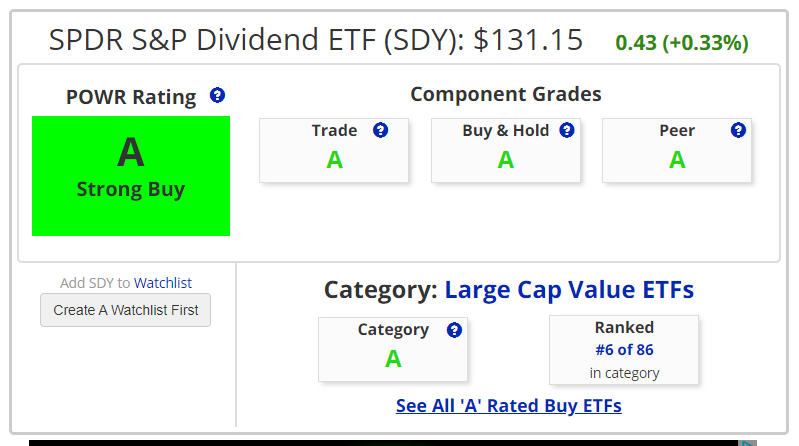

SDY (SPDR S&P Dividend ETF)

It checks in at number 6 in the Large Cap Value ETFs.

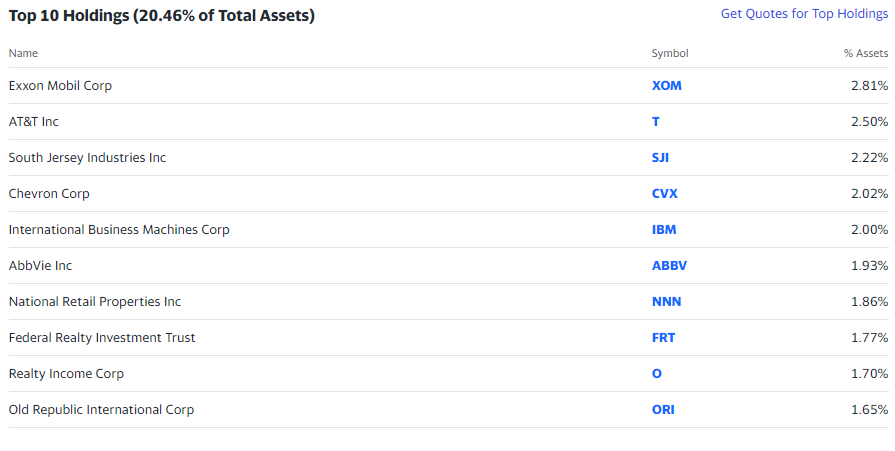

The biggest 10 holdings in SDY make-up just over 20% of the overall ETF. ExxonMobil (XOM) and AT&T (T) are the top two.

Selling the July $137 call against the underlying purchase of SDY can reduce the net cost by about $5.00 (just under 4%) while still leaving an upside appreciation of over 4% open to the short strike of $137. Plus you still get over 2.5% dividend as long as SDY stays below $137.

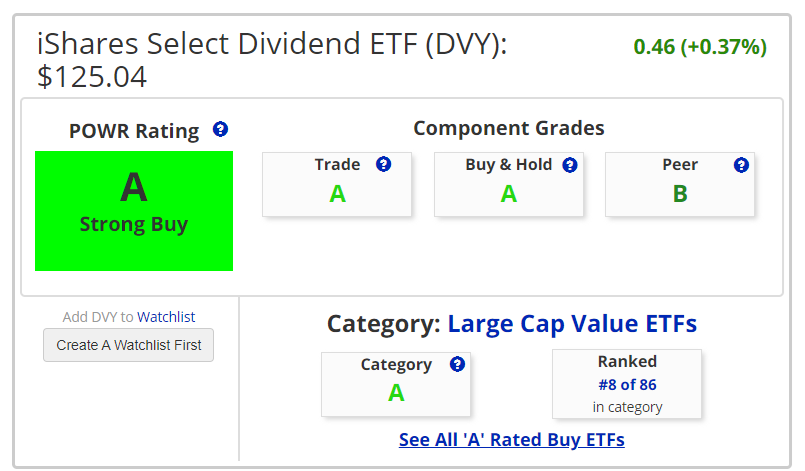

DVY (iShares Select Dividend ETF)

DVY holds the number 8 spot in the Large Cap Value ETF category.

The Top 10 holdings for DVY are shown below. They are just less than 20% of the overall assets. Valero (VLO) and Altria (MO) grab the highest weightings.

Selling the June $130 call against the underlying purchase of DVY can reduce the net cost by about $4.20 (well over 3%) while still leaving an upside appreciation of about 4% open to the short strike of $130. Plus you still get over 3.3% dividend as long as DVY stays below $130.

After the recent red-hot run up in stocks, many traders and investors are looking to lower risk and still retain return. Taking a more conservative covered call approach on quality higher-yielding, lower beta ETFs is certainly a solid way to play in a saner way.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

SPY shares closed at $402.33 on Friday, down $-0.09 (-0.02%). Year-to-date, SPY has declined -14.31%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post How To Lower Your Risk With A Conservative Covered Call Approach On 3 Strong Buy Dividend-Paying ETFs appeared first on StockNews.com

Selling covered calls on conservative dividend paying ETFs can lower your risk but still provide real returns for astute investors and traders.

The recent drop in 10-year Treasury yields back well below the 4% level has made dividend paying stocks comparatively more attractive once again. The fact the Fed is nearer the end than the beginning of the recent rate hikes makes higher yield stocks a solid choice over the coming months.

Rather than trying to pick individual stocks, buying a higher yielding ETF can be a safer and saner approach. Here are three A rated – Strong Buy- Dividend funds to consider purchasing along with a covered call to consider selling.