Egypt-Based MNT-Halan's Expansion Into the UAE Marks a New Phase of Growth for the Unicorn Co-founder Mounir Nakhla says his startup has only just scratched the surface of its potential.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur Middle East, an international franchise of Entrepreneur Media.

In the plethora of entrepreneurial success stories that have come out of the MENA in the past decade, few have demonstrated the power of pivoting efficiently the way Egypt-based fintech platform MNT-Halan has. You see, when the startup was launched in 2018 -then named just 'Halan'- it was a ride-hailing platform. But a few keen market observations and one merger (with Netherlands-headquartered financial holding company MNT Investments B.V.) later, it was re-introduced to the market as MNT-Halan- a financial super app that has achieved unicorn status in 2023, and is currently the seventh-largest financial institution in Egypt.

"In 2017, I visited Indonesia and met the founder of Gojek [a super app that offers a number of services including ride-hailing, food delivery, digital payments, and financial services], which was an eye-opening moment," recalls Mounir Nakhla, co-founder and CEO of MNT-Halan. "It showed me how technology could scale operations and create financial opportunities for millions. Inspired by this, I partnered with Ahmed Mohsen, and in 2018, we launched Halan—initially as a ride-hailing platform for two- and three-wheelers, serving those excluded from traditional transport networks. As we grew, it became clear that mobility wasn't the biggest gap—financial access was. Many of our drivers and customers struggled to get credit, make digital payments, or access financial services altogether. That realization led us to pivot and evolve into what MNT-Halan is today: a full-scale financial super app, revolutionizing access to finance through technology."

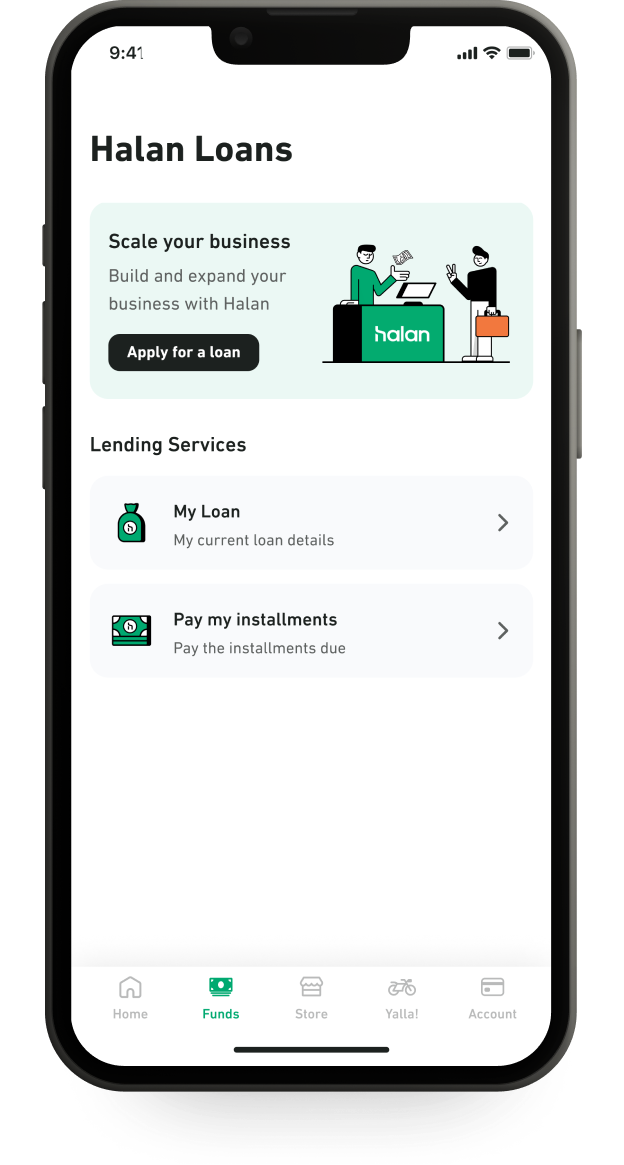

Indeed, MNT-Halan is today a financial super app that provides seamless access to lending, payments, e-commerce, and financial services—all in one ecosystem. Operational across Egypt, Pakistan, Turkey, and, now, the UAE, the startup essentially aims to serve the unbanked and underbanked populations.

Source: MNT-Halan

Source: MNT-Halan

The platform offers a three-pronged suite of services across lending, digital payments, and e-commerce. Within its business and consumer lending vertical, a key highlight is its microfinancing options wherein loans of up to 200,000 EGP (approximately US$3,950) can be applied for and received in three working days. Its endeavors in this space have earned it a 25+% share of Egypt's microfinance market. MNT-Halan's other lending options include buy-now-pay-later (BNPL), payroll lending and small and medium enterprise (SME) lending, among others. Within digital payments, it offers services such as disbursement and collection via the Halan cash wallet and peer-to-peer transfers, whereas its e-commerce platform caters to home appliances and fast moving consumer goods (FMCGs) serving both merchants and consumers.

"Businesses can access credit to grow, while individuals can borrow, pay, and invest with ease," explains Nakhla. "Built on our proprietary core banking technology, MNT-Halan scales financial inclusion at speed, unlocking economic potential across emerging markets. We operate across multiple markets offering tailored financial solutions. In August 2024, we acquired Tam Finans in Turkey, a leading factoring company disbursing over US$150 million monthly to more than 50,000 businesses. In Pakistan, we're focused on microfinance for small business owners, salaried individuals, and women entrepreneurs. To date, we've disbursed over $11 billion, with an outstanding loan book of $1.2 billion, which we're targeting to grow by 50% annually in US Dollars over the next three years. We serve more than 2.3 million people quarterly, with 1.1 million active borrowers. While we've achieved unicorn status and scaled rapidly, our mission remains the same: to improve livelihoods, empower individuals, and create real economic impact through innovation."

Related: How Naser Taher Transformed MultiBank Group into a Global Financial Powerhouse

The magnitude of the results MNT-Halan has achieved is not lost on Nakhla. "The scale of what we've built is significant- but we're just getting started!" he adds.

Indeed, with the impressive wealth of experience -and, well, success- Nakhla and his co-founder Mohsen have amassed over the years, the duo decided to launch in the UAE in December 2024 as Halan UAE. Its key offering in this new market is Halan Advance, a salary financing solution that provides employees with early access to their salaries. "We've already issued over 100,000 earned wage access loans, and thus addressed a critical gap, in just under six months since moving into the market, with plans to expand our offerings further!" reveals Nakhla. "You see, across Egypt, Turkey, Pakistan, and the UAE, financial challenges for the unbanked have been shaped by high inflation, economic volatility, cash dependency, and limited access to credit. But in the UAE in particular, a large underbanked expat workforce faces barriers to accessing traditional financial services. Of course, there is no doubt that the UAE has a well-developed fintech sector. But a large segment of blue- and pink-collars remains underbanked, struggling to access affordable, flexible credit solutions."

Munir Nakhla, and Ahmed Mohsen, co-founders of MNT-Halan. Source: MNT-Halan

Munir Nakhla, and Ahmed Mohsen, co-founders of MNT-Halan. Source: MNT-Halan

Now, Nakhla's observations about the UAE come as a response to being asked how the fintech startup assesses a given market's needs and shortcomings. To explain how MNT-Halan addresses each of the four markets it operates in, Nakhla offers a brief overview of the unique challenges faced by them. "In, Turkey, while most people are banked, businesses struggle with long lead times and extremely high interest rates for credit- here, we leveraged our proprietary technology and advanced risk assessment models to make financing more efficient and accessible," he explains. "On the other hand, in Egypt, the challenge is that most people are unbanked. We addressed this with a digital-first model, using mobile-based lending, microfinance, and digital wallets to bridge the financial access gap at scale. Whereas in Pakistan, with one of the lowest household debt-to-GDP ratios globally, many lack access to structured credit. We entered that market post-COVID-19 and post-floods, when financial providers were struggling, confident that our core banking technology and market expertise could unlock this opportunity."

It is with this approach that Nakhla and his team have moved into the UAE as well. "At MNT-Halan, adaptability is about focus—we don't launch every service in every market," he adds. "Instead, we align our solutions with market demand, ensuring strong unit economics, operational efficiency, and sustainable growth. By combining scalable technology with local expertise, we elevate businesses and individuals while building a resilient and profitable model. Since launching in the UAE, Halan UAE has rapidly expanded through strategic partnerships with leading employers, payroll solutions, and exchange houses. We have already acquired over 100,000 customers and are on track to reach 250,000 customers and disburse more than AED350 million in loans by the end of 2025. As we expand, we'll continue to leverage our tech-driven infrastructure to introduce more customized credit and financial services that fit the real needs of this workforce segment. By bringing scalable, AI-driven credit solutions to an underserved yet essential workforce, MNT-Halan enhances financial inclusion, boosts economic participation, and strengthens overall economic resilience in the UAE. As such, our goal is clear: to redefine financial access for millions in the UAE, delivering innovative, technology-driven solutions that empower individuals and businesses alike."

To achieve this end-target, Halan UAE has set three objectives in place: scaling salary financing and micro-loans for the underbanked; expanding innovative financial products; and achieving scale through partnerships. "In the first objective, with millions of blue- and pink-collar expats in the UAE lacking access to affordable credit, our salary financing solutions and robust credit engine for microloans provide instant liquidity with flexible repayment options, addressing a critical financial gap," reiterates Nakhla. "To achieve our second objective, we are soon launching a relatively novel service- Send Now, Pay Later, a remittance service that allows users to send money home instantly and repay in installments, easing financial strain. Additional services from our financial ecosystem will follow, ensuring greater access to credit, payments, and financial tools for underserved populations. Finally, we aim to fulfil our third objective by integrating with leading payroll providers and exchange houses, through which we can reach over 20% of the UAE's population.This strategic distribution model enables us to scale rapidly while maintaining strong unit economics."

Mounir Nakhla is the co-founder and CEO of MNT-Halan. Source: MNT-Halan

Mounir Nakhla is the co-founder and CEO of MNT-Halan. Source: MNT-Halan

As the Halan UAE team sets its sights on carving a competitive niche for itself within the country's fintech market, Nakhla notes that while the end-goal will always be to aid the financially underserved people, the startup will also not shy away from setting bigger business milestones for itself. "Our most important milestone was developing the ability to provide credit at low risk—a result of building our digital infrastructure, our core banking software (Neuron), credit model, and Halan, our consumer-facing super app," he declares. "Expanding beyond Egypt into Turkey, Pakistan, and the UAE marked another key milestone, proving the scalability of our technology and business model across diverse markets. Look, unicorn status was never the goal—it was simply a byproduct of being laser-focused on sustainable growth. But now that we've made it here, it only feels right to go after a decacorn. After all, 10 is a much nicer number than one."

Mounir Nakhla, Founder and CEO of MNT-Halan, shares tips on how to pivot and innovate successfully

Don't chase short-term wins—build a real business. "Growth is important, but if you're only focused on valuation milestones, you're thinking too small. Solve a fundamental problem profitably, and scale will follow."

Think global, but act hyper-local, and execute with hyper personalization. "Fintech can scale across borders, but consumer behavior, regulations, and financial habits are deeply local. A great tech stack means nothing if it's not solving a real, market-specific problem."

Your team is your greatest leverage. "A strong business needs people who think, challenge, and solve—not just execute. The right team will push boundaries, adapt fast, and turn strategy into results."

Don't adapt—create. "Having attended the World Economic Forum in Davos, one thing is clear to me: the world is changing at breakneck speed. Artificial intelligence (AI), quantum computing, digital contracts, and crypto are reshaping industries. What works today may be obsolete tomorrow. The winners aren't reacting; they're setting the trend. Leverage new tools, disrupt the status quo, and build something that transcends time and space."

Related: Innovator's Edge: How Silicon Valley-Based Sakuu Created The World's First Platform That Prints Battery Electrodes