Security Hacks are leaving a Lasting Impact on Retailers Here's how the era of security breaches is changing shopper behavior

By Rustam Singh

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

Since the past decade security hacks and data breaches have become far too common. From over a million private temporary pictures on Snapchat getting hacked, to the infamous cheating website Ashley Madison's private user account details and chats being leaked to scores of Facebook hacks, data breaches are frighteningly real. Nearly every industry has been targeted, from retail and insurance to entertainment and government—no one is immune and there seems to be no end in sight.

Unfortunately, even though logically as technology and security gets better every day and we are improving our systems everyday, only breaches may it across as first page news. This negative publicity has scared plenty of customers to stay away from the digital e-commerce from it's varios forms.

Retail Perceptions published a detailed survey which revealed suer behavior patterns. Some of them are as following:

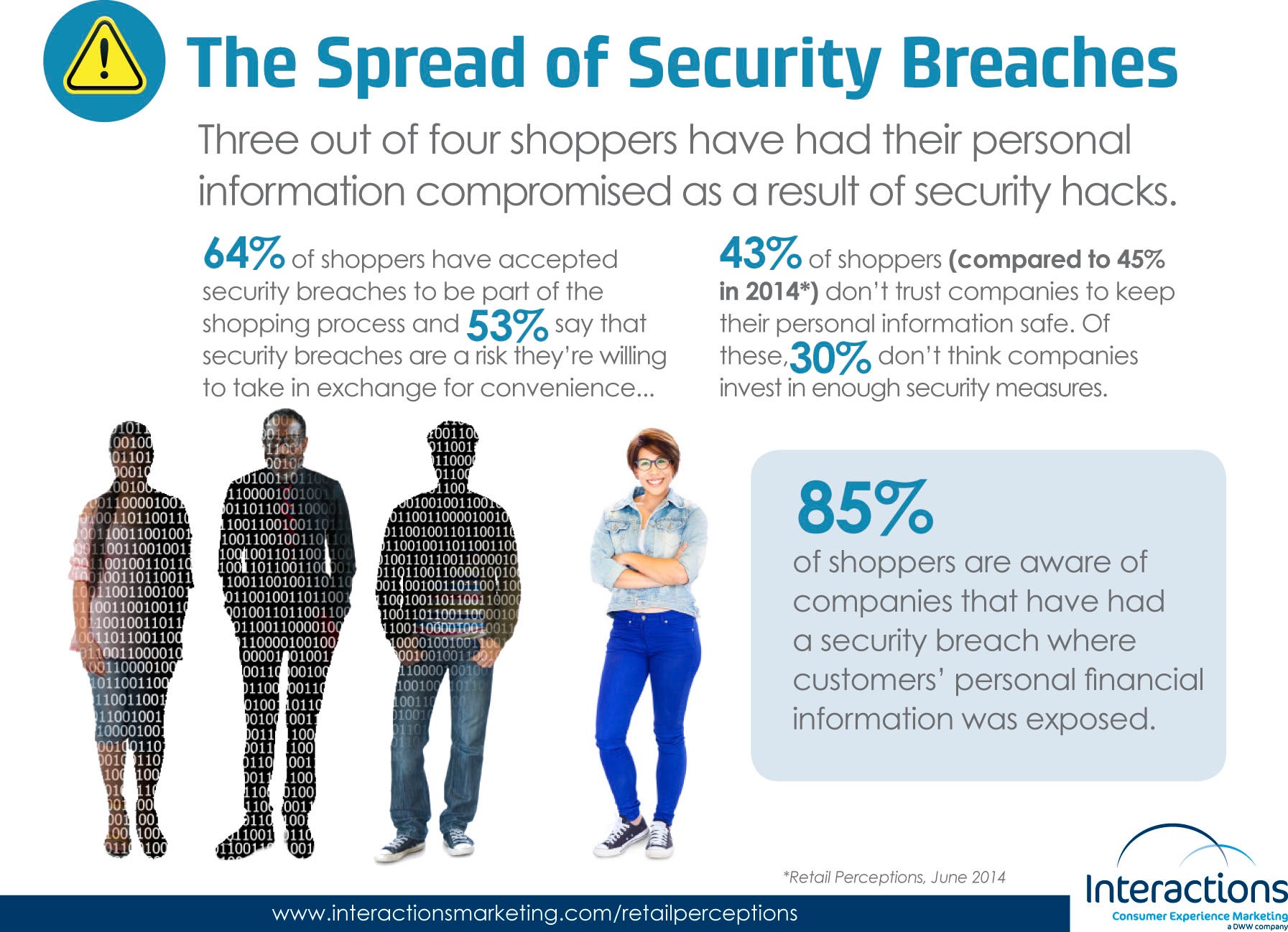

Spread of Security Breaches

- 64% of shoppers have accepted security breaches to be part of the shopping process and 53% say that security breaches are a risk they're willing to take in exchange for convenience...

- 43% of shoppers (compared to 45% in 2014*) don't trust companies to keep their personal information safe. Of these, 30% don't think companies invest in enough security measures.

- 85% of shoppers are aware of companies that have had a security breach where customers' personal financial information was exposed.

Change in spending habits due to security breaches

- 39% spend less per shopping trip than before (Compared to 26% in 2014*)

- 69% try to use cash instead of credit/debit cards (Compared to 79% in 2014*)

- 60% shop online with one specific card designated to online purchases so that they can monitor its activity

Chip Card Technology

- 62% of shoppers have used credit and/or debit cards with chip technology to make purchases. Of these…

- 71% say that using credit card with chip technology makes them feel more secure when shopping.

- 60% prefer to use a card enabled with chip technology over any other method of payment.

- 26% say that they do not like using a credit card with chip technology because it takes too long

Shoppers say that retailers could rebuild trust by…

- 80% Being honest about the incident

- 73% Communicating with shoppers and responding to questions

- 72% Taking financial accountability for their mistake

- 69% Investing in additional preventative security measures

- 6% Firing their CEO

- 6% Firing the head of the IT department

Nearly half of shoppers think that a retailer could avoid a security breach by investing in better technology.

How do hacks and security breaches affect your business? Let us know in the comments on our official Facebook page Entrepreneur India