Auto Industry Faced a Turbulent May 2025: SIAM Despite some declines, the overall data underscores resilience in India's automotive industry.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

India's automobile sector continued its forward march in May 2025, registering consistent output and sales across most vehicle categories, according to the latest data released by the Society of Indian Automobile Manufacturers (SIAM). The report reflects a mixed bag of performance amid the auto industry.

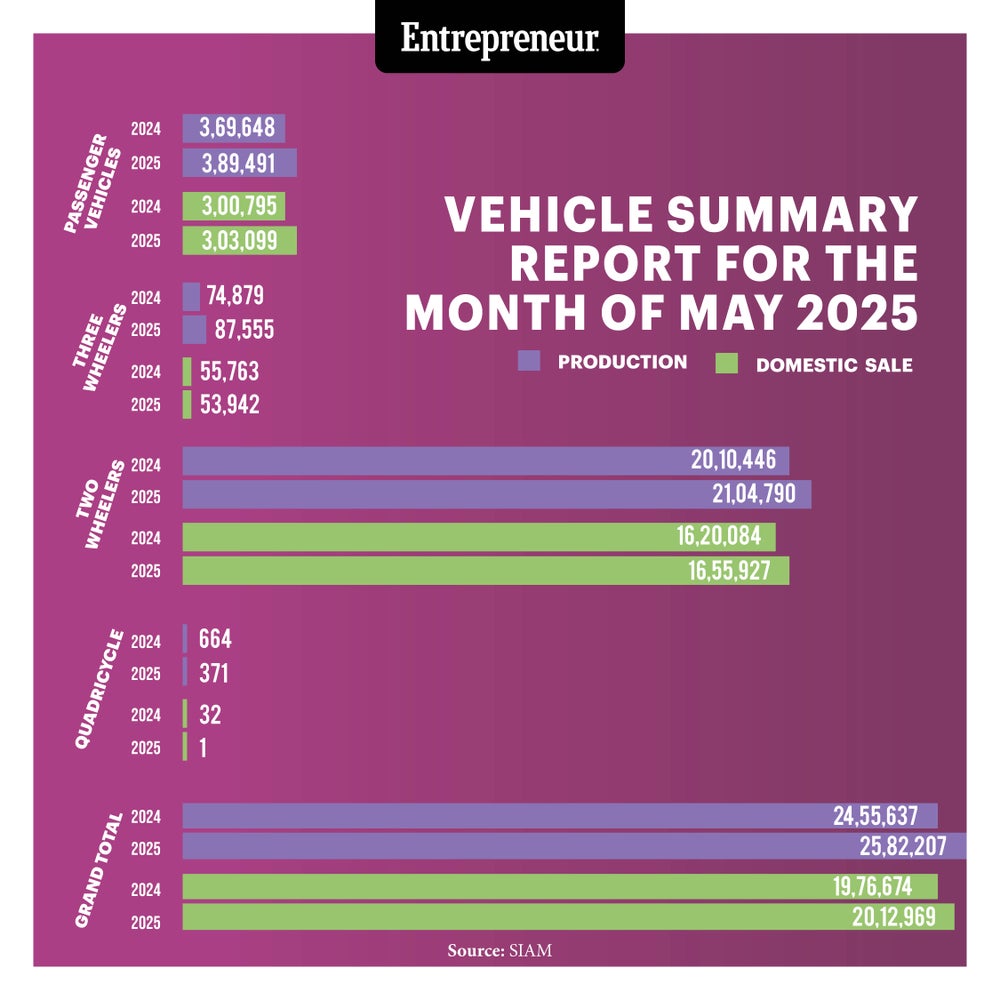

The industry produced a total of 25,82,207 vehicles in May 2025, a modest increase from 24,55,637 units during the same period last year. Domestic sales also saw an uptick, reaching 20,12,969 units compared to 19,76,674 in May 2024.

However, the growth wasn't uniform across all categories. The passenger vehicles segment, which includes cars, utility vehicles, and vans, recorded a production increase to 3,89,491 units in May 2025 from 3,69,648 units in May 2024. Yet, domestic sales told a different story, edging up only slightly to 3,03,099 units from 3,00,795. While these figures represent the second-highest May sales on record for the PV segment, it still marked a marginal year-on-year decline of 0.8 per cent.

"All vehicle segments posted stable performance in May 2025," noted Rajesh Menon, director general of SIAM. "Passenger Vehicles segment posted sales of 3.45 lakh units, though 2nd highest ever of May, the segment de-grew marginally by (-) 0.8 per cent compared to May 2024."

"All vehicle segments posted stable performance in May 2025," noted Rajesh Menon, director general of SIAM. "Passenger Vehicles segment posted sales of 3.45 lakh units, though 2nd highest ever of May, the segment de-grew marginally by (-) 0.8 per cent compared to May 2024."

The two-wheeler segment, which forms the backbone of India's mobility landscape, fared better. It saw a growth of 2.2 per cent in domestic sales, reaching 16,55,927 units, up from 16,20,084 units in May 2024. Production also rose, from 20,10,446 units in 2024 to 21,04,790 units this year, maintaining its position as the largest contributor to overall vehicle numbers.

Conversely, the three-wheeler segment experienced a dip. Domestic sales dropped to 53,942 units in May 2025 from 55,763 units the year before, marking a decline of 3.3 per cent. Production, however, rose from 74,879 to 87,555 units, suggesting manufacturers may be anticipating a rebound or focusing on export markets.

"Three-Wheelers de-grew by (-) 3.3 per cent compared to May of previous year, with sales of 0.54 lakh units," Menon stated. On the brighter side, he emphasized the potential of macroeconomic levers in improving the sector's future outlook. "Going forward, the RBI's three repo rate cuts totalling 100 basis points in less than six months, along with a forecast of above-normal monsoons are some of the indicators which should positively impact the Auto sector by improving affordability and boosting consumer sentiment in the coming months."

The quadricycle segment, while still nascent, remained negligible in its contribution, with production falling from 664 units in May 2024 to 371 units this year. Only one unit was sold domestically, a steep drop from 32 last year, underscoring its limited market traction.