Banking Sector Shows Resilience Despite Unsecured Loan Stress: Report GNPAs surged from 3.8 per cent in FY14 to a peak of 11.2 per cent in FY18, while net NPAs more than doubled from 2.1 per cent to 5.6 per cent over the same period

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

India's banking sector has sustained a broadly benign asset quality through FY25, despite emerging stress pockets, especially in unsecured personal lending. The sector's gross non-performing asset (GNPA) ratio stood at 2.3 per cent at the end of Q4 FY25, marking a significant turnaround from the post-AQR years that saw surging defaults and a systemic clean-up in the aftermath.

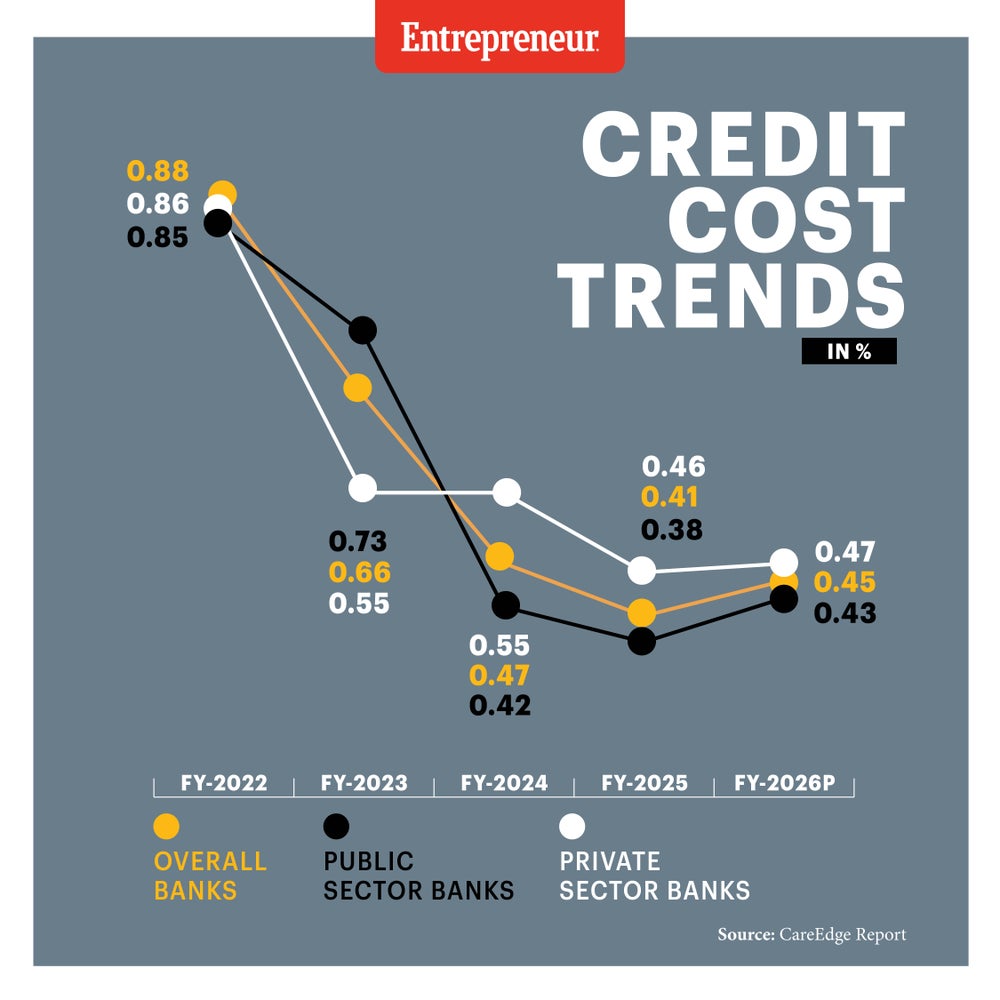

This improvement in asset quality is the culmination of a decade-long recalibration that began with the Reserve Bank of India's asset quality review (AQR) in 2015-16. Banks were then compelled to recognise bad loans and limit excessive restructuring practices, which revealed deep cracks in wholesale lending portfolios. As per a recent report by CareEdge Ratings, GNPAs surged from 3.8 per cent in FY14 to a peak of 11.2 per cent in FY18, while net NPAs more than doubled from 2.1 per cent to 5.6 per cent over the same period. In response, banks shifted focus sharply toward retail lending, expanding it from 19 per cent of advances in 2015 to 34 per cent in 2025—seeking safety in smaller, diversified exposures.

This pivot helped banks limit further slippages, aided by steady provisioning, aggressive write-offs, and recoveries. The trend continued through the pandemic years, buffered by regulatory forbearance and temporary moratoriums, and was further entrenched in FY25. Private sector banks (PVBs), however, have shown higher slippage ratios than their public sector counterparts, largely due to a heavier tilt toward unsecured retail credit. In response, scheduled commercial banks (SCBs) not only increased write-offs but also continued to sell stressed assets to asset reconstruction companies (ARCs), steadily cleaning their balance sheets.

Still, emerging risks cannot be ignored. Sanjay Agarwal, senior director at CareEdge Ratings, pointed to rising vulnerabilities in the personal loans segment. "Net additions to NPAs have remained broadly low, enabling the sector to witness a steady reduction in headline asset quality numbers. However, with the personal loans segment facing stress, the overall fresh slippages are expected to rise, and recoveries/upgrades are likely to taper gradually," Agarwal noted. He projected a marginal deterioration in GNPA ratios, estimating a shift from 2.3 per cent in FY25 to between 2.3 per cent and 2.4 per cent by FY26. "Key downside risks include deteriorating asset quality from elevated interest rates, regulatory changes, and global headwinds such as tariff increases," he warned.

Still, emerging risks cannot be ignored. Sanjay Agarwal, senior director at CareEdge Ratings, pointed to rising vulnerabilities in the personal loans segment. "Net additions to NPAs have remained broadly low, enabling the sector to witness a steady reduction in headline asset quality numbers. However, with the personal loans segment facing stress, the overall fresh slippages are expected to rise, and recoveries/upgrades are likely to taper gradually," Agarwal noted. He projected a marginal deterioration in GNPA ratios, estimating a shift from 2.3 per cent in FY25 to between 2.3 per cent and 2.4 per cent by FY26. "Key downside risks include deteriorating asset quality from elevated interest rates, regulatory changes, and global headwinds such as tariff increases," he warned.

On the policy front, the Reserve Bank of India's unexpected 50bps rate cut in FY25, along with a phased 100bps CRR reduction set to roll out from September 2025, has added fresh momentum to the banking landscape. Naveen Kulkarni, chief investment officer at Axis Securities PMS, described the move as a surprise shift from the expected gradual easing. "The regulator is in favour of front-loading rate cuts to support growth. However, the RBI has changed its stance from Accommodative to Neutral. This provides limited scope for further rate cuts," he said.

Kulkarni added that the regulator's downward revision of the FY26 inflation forecast to 3.7 per cent and its maintenance of the GDP growth estimate at 6.5 per cent signal cautious optimism. He emphasized the importance of liquidity support for banks as they aim to revive credit growth in the second half of FY26. "Asset quality concern appears to be steadily waning with unsecured segment stress showing gradual signs of stability, while the secured segment asset quality continues to hold up well," Kulkarni observed.

While the systemic GNPA numbers remain low, the coming months will test whether the stability holds as unsecured lending continues to expand and macroeconomic pressures play out.