India's Family Offices Reach 300 in 2024: Report While a quarter of these offices still prioritize capital preservation, a broader trend is clear: diversification, global exposure, and intergenerational continuity are now front and centre.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

India's ultra-wealthy are no longer content to quietly preserve their fortunes. According to a new EY–Julius Baer report, The Indian Family Office Playbook, they're embracing risk, going global, and rethinking the way wealth is managed. The country now hosts over 300 family offices, up sharply from just 45 in 2018, and many are stepping beyond traditional investing models.

The shift is more than cosmetic. While a quarter of these offices still prioritize capital preservation, a broader trend is clear: diversification, global exposure, and intergenerational continuity are now front and centre. Surabhi Marwah, co-leader of Private Tax and partner at EY India, said: "The Indian family office ecosystem is at an inflection point where wealth preservation alone is no longer enough."

Today's family offices, typically formed by high-net-worth and ultra-high-net-worth individuals, are evolving into sophisticated wealth management engines. Their remit stretches beyond financial returns, covering everything from philanthropy and governance to succession planning and international compliance. The result: a model that is more institutional, nimble, and global in ambition.

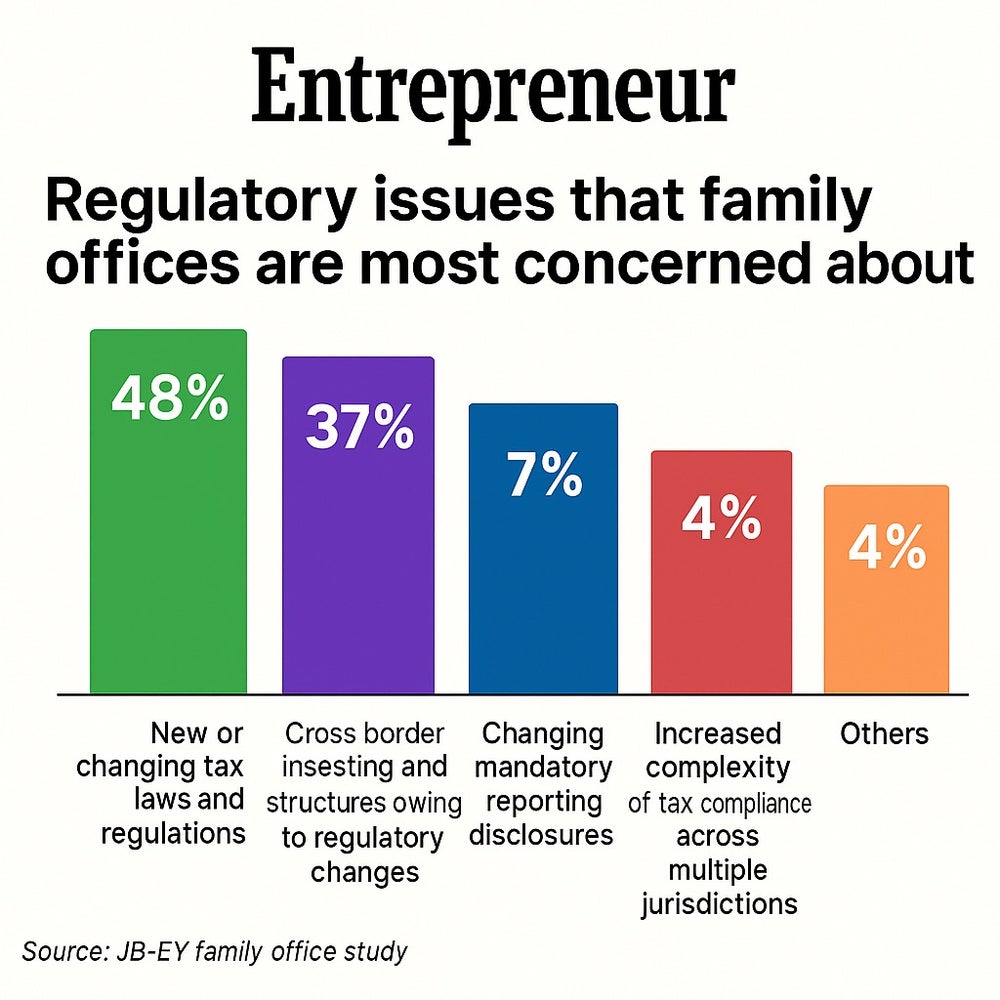

But with opportunity comes complexity. Nearly half of the family offices surveyed cited concerns over shifting tax laws, while 37 per cent flagged challenges around cross-border regulations. These anxieties aren't sidelining global ambitions but are now baked into how portfolios and structures are designed.

"Family offices are increasingly catering to first-generation entrepreneurs who are more risk-tolerant and open to emerging sectors," said Umang Papneja, CEO of Julius Baer India. "As the scale and complexity of wealth grow, there's a stronger focus on strengthening governance, growing asset value and planning for legacy succession."

Even so, the road to alternatives is being walked carefully. Despite growing interest, 57 per cent of family offices still allocate less than 10 per cent of their holdings to private equity or venture capital. The reasons range from limited access to cautious investment postures, underscoring that while ambition is high, risk appetite remains measured.

Another critical area of evolution is governance and succession. The report shows that while 59 per cent of family offices have wills or constitutions in place, only 19 per cent have moved to adopt formal legal structures like private trusts or LLPs. This gap between intent and execution could prove costly as wealth transitions to younger generations.

"Preserving and enhancing generational wealth lies at the heart of every family office," said KT Chandy, Partner and Co-leader of Private Tax at EY India. "In the process, they enable seamless succession through structures like private trusts, aligned shareholder agreements, and defined governance roles."

Looking forward, several trends are expected to define the next phase of India's family office journey. GIFT City is emerging as a key hub for cross-border structuring and tax efficiency, while ESG investing is aligning portfolios with the values of the next generation. Technology and data are also playing a growing role, especially in risk monitoring and strategic rebalancing.