India's GDP Grows 7.4% in Q4 FY25; FY26 Forecasts Headwinds: Report The final quarter surge was powered by a 10.8 per cent rise in construction activity, improved manufacturing momentum, and solid performance in services, particularly financial, real estate, and professional sectors

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

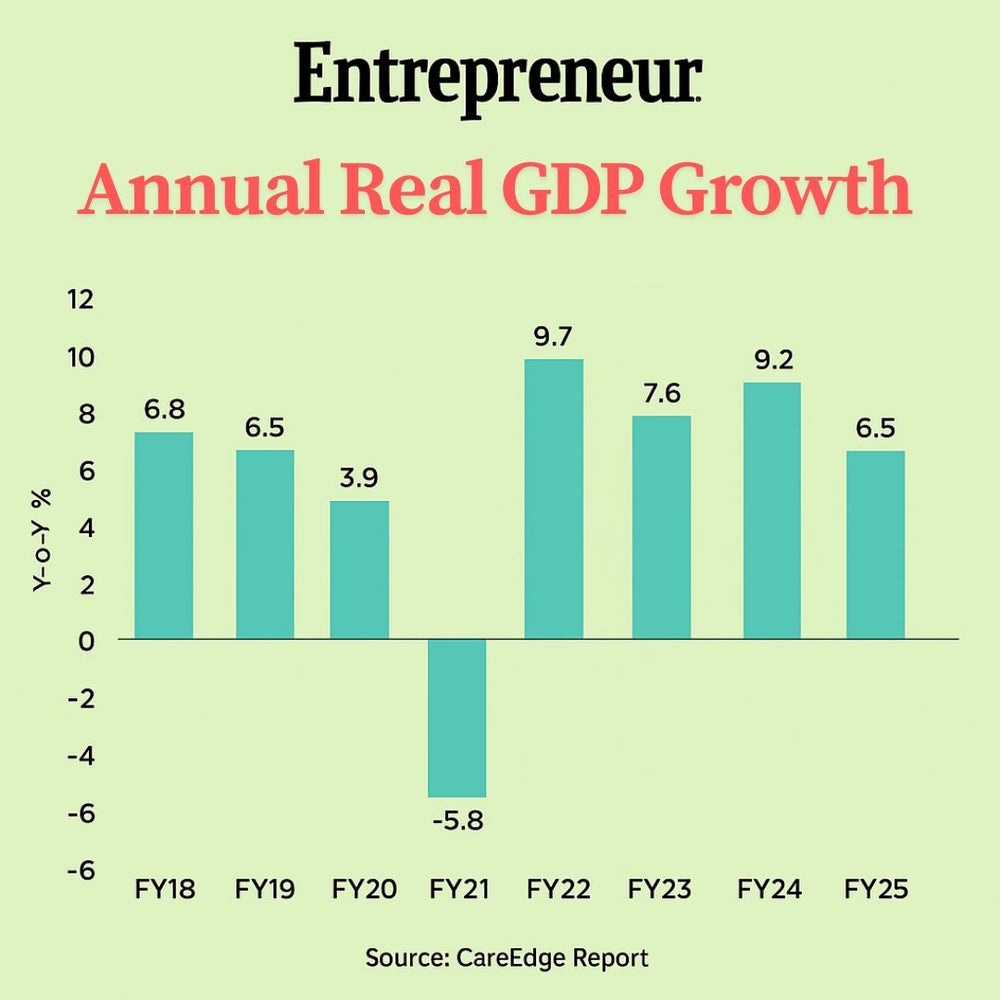

India's economy posted a stronger-than-expected performance in the final quarter of FY25, with GDP growth clocking in at 7.4 per cent, according to a report by CareEdge Ratings. This brought the full-year growth to 6.5 per cent, a downshift from the 8.4 per cent average over the preceding two years but still resilient amid global headwinds.

The final quarter surge was powered by a 10.8 per cent rise in construction activity, improved manufacturing momentum, and solid performance in services, particularly financial, real estate, and professional sectors. Gross fixed capital formation (GFCF), a key indicator of investment activity, rebounded to 9.4 per cent growth in Q4, offsetting some of the drag from a contraction in government final consumption expenditure.

Private sector sentiment also showed signs of revival, with report data reflecting an uptick in investment announcements and completions in Q4. Electricity led the way, accounting for 37 per cent of FY25 investment announcements, while completed projects in manufacturing and power nearly doubled from the previous year.

Manoranjan Pattanayak, executive director – Economic Advisory, PwC India, contextualized the picture stating, "Indian economy has shown enough resilience, given the global context and the growth witnessed in different parts of the world. Private sector demand has bounced back with private final consumption expenditure growing at 7.2 per cent in FY25 and investment also registering a good growth rate of 7.9 per cent on an average over the last eight quarters. As per IMF estimates, India is expected to grow at 6.2 per cent in FY26, retaining its position as the fastest growing major economy in the world."

The report projects GDP growth to moderate further to 6.2 per cent in FY26, a trend influenced by mixed consumption signals and softening external demand. Still, future sentiment remains upbeat across both demographics, bolstered by rising rural wages, up 6.1 per cent year-on-year in February, and easing inflation.

Consumer price index (CPI) inflation dropped to 3.2 per cent in April 2025, the lowest reading since August 2019. This moderation was driven by favorable agricultural conditions, including a promising Rabi harvest and adequate reservoir levels. Yet, food inflation remains sticky due to steep prices in edible oils and fruits. It is expected that CPI inflation will average 4 per cent in FY26, down from 4.6 per cent in FY25.

Despite the headline growth, there are deeper structural concerns. Gross domestic savings declined to 30.7 per cent of GDP in FY24 from 32.2 per cent in FY15. Notably, household savings continued to fall for the third consecutive year, now down to 18.1 per cent of GDP, while household financial liabilities surged to 6.2 per cent, nearly double the level seen a decade ago.

On the fiscal side, the Centre's FY25 deficit came in at INR 15.8 trillion or 4.8 per cent of GDP, slightly above revised estimates. While corporate tax collections outperformed expectations, shortfalls in income tax and GST collections dragged down total revenues. Lower revenue expenditure helped cushion the gap.

Pattanayak is still optimistic about the future stating, "Even as global uncertainty, trade woes and geopolitical risks pose headwinds, domestic fundamentals remain strong amid a supportive monetary-fiscal policy environment. In the coming quarters, economic momentum is expected to benefit from a benign inflation trajectory, contained international oil prices, robust consumer spending, government's strong capex push and transmission of RBI's 100 basis points of rate cut delivered in this calendar year."