India's Passenger Vehicle Market Slows in June 2025 Amid Mixed OEM Performances While some manufacturers have managed to tap niche growth opportunities, especially in the SUV and EV categories, the broader market remains under stress.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

India's passenger vehicle market showed visible signs of strain in June 2025, with major automakers reporting a year-on-year dip in domestic wholesale numbers. The overall trend underscores growing pressure in the mass-market segment and a shift in consumer preferences as the auto industry navigates through a volatile demand landscape.

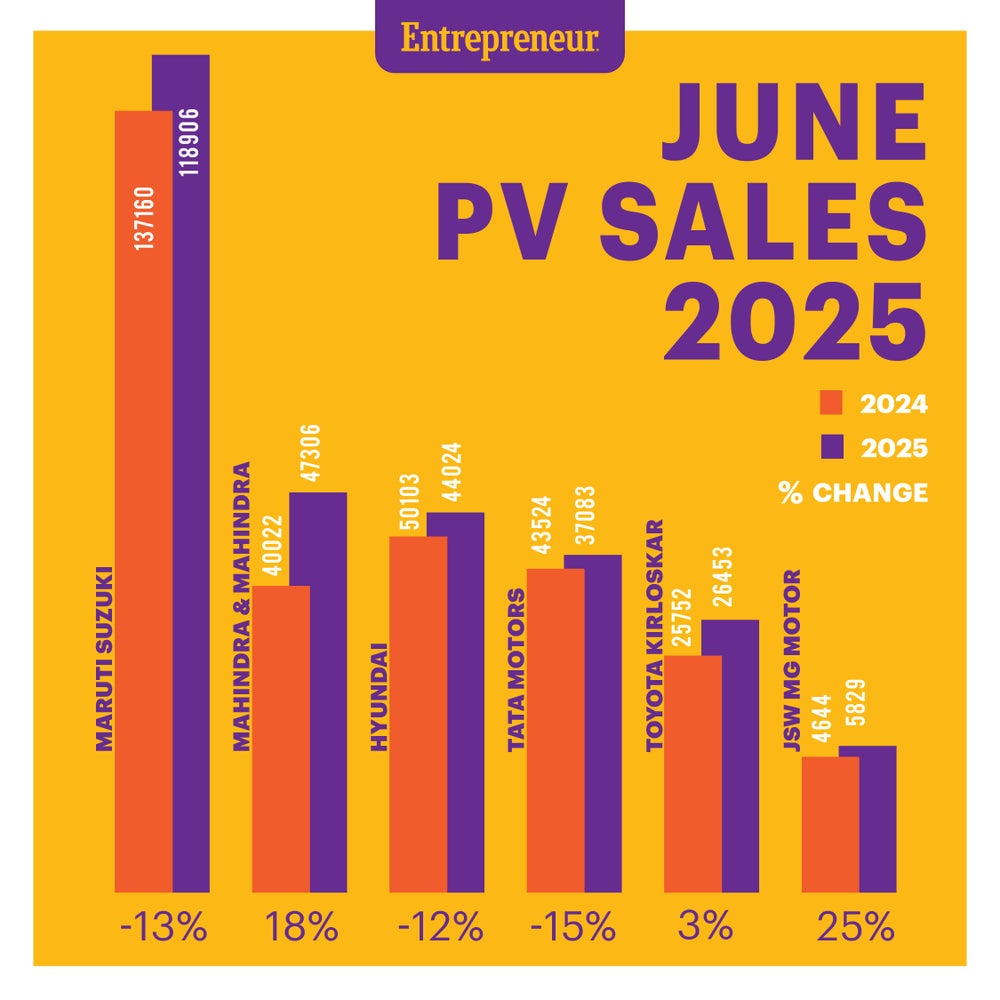

Leading the downturn, Maruti Suzuki, the country's largest carmaker, saw domestic wholesales fall by 13 per cent, dropping to 1,18,906 units from 1,37,160 units in June 2024. The decline highlights a larger malaise in the entry-level car market. "The slowdown in passenger vehicle sales is largely due to a sharp decline in the smaller segment cars," said Rahul Bharti, senior executive officer, Maruti Suzuki India to PTI. "Historically, passenger vehicle sales used to grow at 1.5 times the GDP growth. But now, even after 6.5 per cent GDP growth, the car market is nearly flat."

Tata Motors, another top player, reported an even steeper drop of 15 per cent, with sales falling to 37,083 units from 43,524 units a year ago. The company, however, remains optimistic on the back of its electric vehicle (EV) portfolio. "In Q1 FY26, the passenger vehicle industry experienced volume pressures, particularly in May and June, with flat growth reflecting continued softness in demand," said Shailesh Chandra, managing director of Tata Motors Passenger Vehicles Ltd. and Tata Passenger Electric Mobility Ltd. "The Electric Vehicle segment emerged a bright spot, driven by robust growth and the launch of new EV models across OEMs, enhancing customer interest and consideration."

Chandra noted that Tata Motors recorded Q1 FY26 wholesales of 124,809 units, including 16,231 EVs. "EV sales gained strong momentum towards the end of the quarter with a healthy growth trajectory," he added, pointing to a 16 per cent year-on-year growth in Tiago volumes and a promising response to the Altroz and Harrier.ev.

Hyundai Motor India also reported a 12 per cent decline in domestic wholesales, down to 44,024 units from 50,103 in June 2024. Despite the slump, the company found a silver lining in the strong performance of its flagship SUV. "The Creta becoming the best-selling model in June 2025, exactly as it completes 10 years in the country, is a testament to the love and trust that Indian customers have placed in the brand," said Tarun Garg, whole-time director and COO, Hyundai Motor India.

Among the few manufacturers that bucked the downward trend, Mahindra & Mahindra (M&M) posted an 18 per cent jump in wholesales, rising from 40,022 units in June 2024 to 47,306 units in June 2025. Similarly, JSW MG Motor surged by 25 per cent, albeit on a smaller base, increasing from 4,644 to 5,829 units.

Toyota Kirloskar Motor also managed to inch forward, registering a 3 per cent gain to reach 26,453 units. "TKM sales in the month of June 2025 were 5 per cent higher than that of June 2024," clarified Varinder Wadhwa, vice president of sales-service-used car business at Toyota Kirloskar Motor. "We continue to strongly engage with our customers through after sales service support offerings and value-added offerings that are aimed at enriching their ownership experience."

Honda Cars, however, joined the laggards with a 4 per cent drop in sales, recording 4,618 units compared to 4,804 units in June 2024.