Performance-First Beauty: How India's $30 Billion Market Changed in 2025 From skincare-infused makeup to 10-minute deliveries and tighter checks on SPF and ingredient claims, the beauty business entered a more demanding phase this year

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

In 2025, Indian beauty moved beyond just "clean" labels, as colour cosmetics took on skincare roles, quick-commerce reshaped discovery, and global brands expanded their footprint in the market. As the year closes, industry players suggest that only science-backed, inclusive and omnichannel brands will be equipped for the next phase of growth.

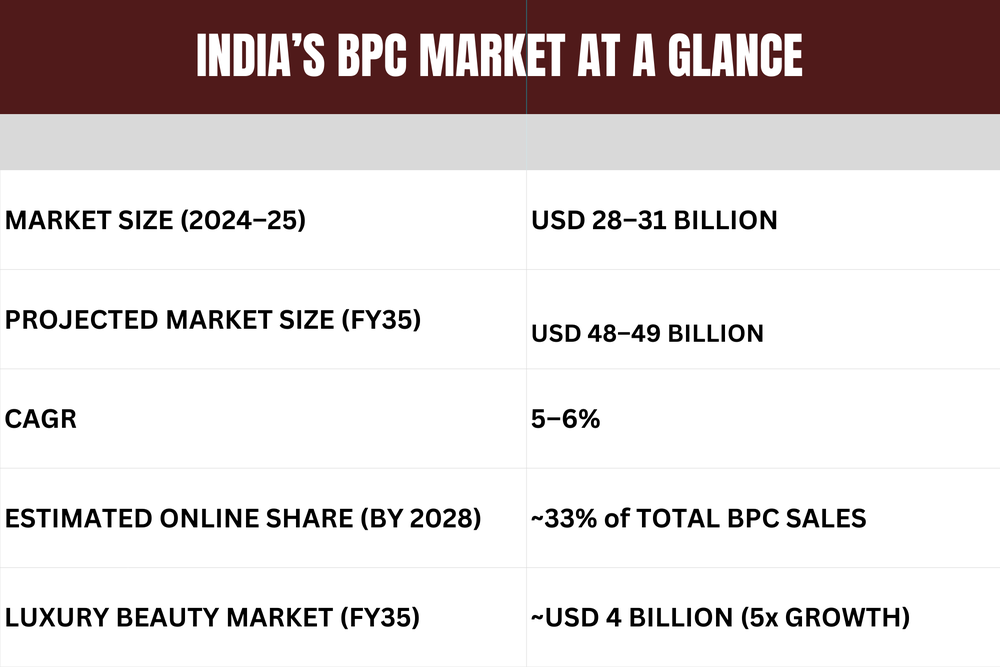

Premium and luxury beauty are outpacing the broader market, with premium set to double to about USD 3-3.2 billion by 2028 and luxury brands projected to grow fivefold to nearly USD 4 billion by 2035 as global brands like Fenty Beauty scale up in India.

Most estimates now peg India's beauty and personal care (BPC) market at around USD 28–31 billion in 2024–25, with forecasts converging on nearly USD 48–49 billion by the mid-2030s. That implies a steady 5–6 per cent annual growth rate, but this year was less about "how much" and more about "what kind" of beauty Indians were buying.

Skincare-led routines, daily sunscreen use, targeted hair and scalp care, long-wear makeup and multi-tasking products became the new normal. Consumers increasingly sought solutions for acne, pigmentation, hair fall and sensitivity, while online drove sales and clinics, content and stores built trust.

Makeup-Skincare Hybrid

One of the clearest shifts of 2025 was in colour cosmetics. Makeup was no longer just about shade, finish, or payoff; it was expected to behave like skincare.

"Consumers today are asking more and more of brands and simply colour payoff or colour intensity is no longer enough in colour cosmetics," says Karishma Kewalramani, Founder, FAE Beauty, adding, "We now push ourselves to ensure that every single one of our colour cosmetic products has a skinification angle to it."

She points to lip glosses infused with peptides for long-term smoothing, and foundations built with niacinamide and hydrating factors to actively improve texture and pigmentation with consistent use, she says.

That performance-first expectation showed up across both mass and mid-priced beauty brands as well. At Mars Cosmetics, Vice President of Marketing Anmol Sahai Mathur says 2025 was defined by demand for "long-wear products, makeup hybrids with small skincare benefits, and complexion boosters that deliver oily skin control, smoother texture and a real skin finish." Breathable and climate-adapted formulas drove repeat buying as Indian consumers increasingly prioritised comfort alongside coverage.

Meanwhile, Mihir Jain, Sales and Marketing Director at Insight Cosmetics, describes 2025 as the year "toxic-free, high-performance makeup became the default expectation." According to him, consumers leaned towards vegan and dermatologically tested formulas, and complexion products that addressed acne, pigmentation and humidity stress. "The shift is clearly towards results-driven, inclusive beauty built on trust, safety and everyday wearability," he says.

Industry data mirrors these observations. Skincare, haircare and sun care remain the fastest-growing segments, while men's grooming has emerged as a major growth engine, with the market projected to reach nearly USD 4.9 billion by 2030, growing at 7–9 per cent annually.

Increased Scrutiny

If earlier growth leaned on "clean" labels, 2025 brought tougher consumer scrutiny. Awareness around ingredients grew rapidly, while sunscreen and performance claims came under the scanner after lab tests raised questions on popular products. At the same time, tighter advertising rules for influencers pushed brands towards clearer, more transparent communication.

"The year 2025 was under heavy scrutiny for ingredient safety, SPF correctness and 'clinical' claims," says Mathur. "We strengthened validation across SPF, long-wear and active-infused formats, ensuring that every claim is test-supported and aligned with changing regulations." Mars also recalibrated its packaging strategy to prioritise ingredient clarity, application guidance and simplified benefit communication.

Jain echoes this shift towards a more disciplined operational culture. "Scrutiny around SPF integrity, active percentages and safety claims completely altered the environment," he says. Insight doubled down on documentation, efficacy studies and stability testing while reinforcing its vegan, toxin-free and PETA-certified positioning. "With the influx of global brands, what separates Indian players is performance adapted to our skin tones, climate and value expectations," he adds.

Rise of Q-Commerce

Like in most categories, this year also rewired how beauty is discovered and bought. With India becoming an increasingly digitally-led consumer market, creator-led reels, live demos, and short tutorials replaced traditional counter selling as the first point of product interaction.

"By 2025, our communication mix had become a multi-touch ecosystem," says Mathur. Influencers and short-form videos enabled rapid discovery, while q-commerce strengthened impulse buying for everyday essentials. At the same time, offline trials in beauty stores emerged as the final confidence trigger for complexion categories.

Quick commerce played an outsized role this year. Beauty and personal care is now one of the top categories on 10–20 minute delivery platforms, with online BPC sales growing dramatically faster than offline.

Yet, as Jain points out, beauty retail did not disappear. "Offline remained critical for shade matching and tactile trust-building. The journey became a blend of digital influence, instant access and in-person validation," he says. While digital CAC increased due to crowded ad markets, retention improved as performance-based products delivered visible results with regular use.

What is Coming Now?

As the industry looks ahead, 2026 is expected to be shaped by tighter regulations, deeper science, broader shade inclusivity and sharper profitability discipline.

"The upcoming year will be driven by science-based formulations, hybrid beauty, inclusive shade systems and ethical ingredient standards," says Jain. He expects stricter SPF and active regulations to redefine industry benchmarks even as consumers continue to demand vegan, toxin-free and dermatologically tested products. Offline expansion, particularly for complexion categories, will remain central to consumer trust-building.

Mathur believes AI will increasingly reduce shade-matching fatigue and product trial errors, especially across lips, cheeks and base makeup. "Inclusive undertone systems and climate-adapted comfort will drive the next phase of growth," he says.

While D2C beauty continues to expand, tighter funding and rising competition are forcing brands to focus on sustainable, trust-led growth across digital and physical retail.