These 8 D2C Brands Dominated VC Funding in 2025 As venture capital turned selective in 2025, only a handful of D2C brands with clear category leadership and repeat consumption managed to raise large institutional rounds. These eight names stood out in a cautious funding year

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

After the post-pandemic funding boom, 2025 remained a cautious year for consumer startups, especially in D2C. The funding playbook for consumer startups changed significantly in 2025. As investors moved away from growth-at-all-costs, venture capital increasingly favoured brands with clear category leadership, repeat consumption, and paths to profitability. Despite this tighter environment, a handful of consumer-facing companies across quick commerce, food, beauty, fashion, pet care, and lifestyle still managed to raise meaningful institutional capital.

Here are 10 consumer brands that stood out for their VC-backed fundraises in 2025.

1. Zepto

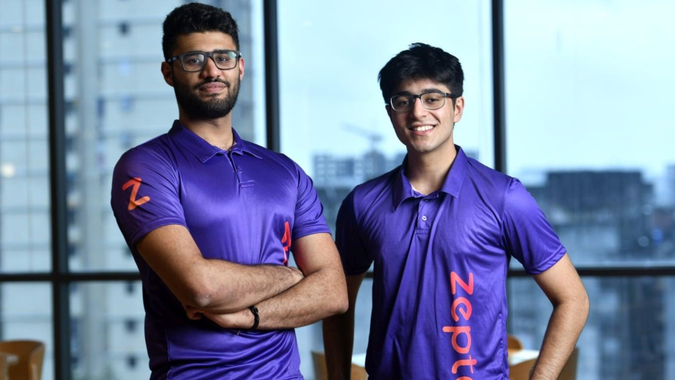

Zepto Co-founders Aadit Palicha and Kaivalya Vohra

India's quick-commerce race continued to draw significant capital in 2025, with Zepto emerging as the year's biggest consumer-facing fundraising story. The company raised USD 450 million in a VC-backed pre-IPO growth round at a valuation of around USD 7 billion, backed by investors including General Catalyst, Goodwater Capital, and Lightspeed. The round reaffirmed investor confidence in high-frequency consumption models, even as funding slowed across the broader consumer startup ecosystem.

Commenting on the raise, Aadit Palicha, CEO and co-founder of Zepto, said in an October statement that the financing reflected the team's execution in scaling the business while building operating leverage. "We now have approximately $900M of net cash in the bank and more than well-capitalised for the future," he shared.

Founded in 2021 by Aadit Palicha and Kaivalya Vohra, Zepto has quickly grown into one of India's fastest-scaling quick-commerce platforms.

2. Snitch

Siddharth Dungarwal, Founder & CEO, Snitch

Men's fashion brand Snitch continued to be one of the standout D2C fashion fundraisers of 2025, closing a Series B round of up to USD 40 million (around INR 340 crore) in June 2025. The funding was led by 360 ONE Asset Management, with continued participation from existing backers IvyCap Ventures and SWC Global, alongside the Ravi Modi Family Office and other strategic and angel investors.

Founded in 2020 by Siddharth Dungarwal in Bengaluru, Snitch has built a fast-fashion, trend-driven menswear portfolio distributed through its website, mobile app and an expanding network of physical stores. The brand's earlier financing includes a Series A of about USD 13 million in December 2023, and the strong 2025 round lifted its valuation to around INR 2,500 crore (approximately USD 300 million)

Commenting on the funding, Siddharth Dungarwal, founder and CEO of Snitch, said in a statement, "This fundraise is a backing to our belief that Indian fashion can move with speed, scale and confidence, and truly compete at a global stage."

3. GIVA

GIVA Founder & CEO Ishendra Agarwal

Jewellery brand GIVA closed one of the largest pure D2C funding rounds of 2025, raising INR 530 crore (around USD 61.5 million) in a Series C round announced in June. The round was led by Creaegis, with participation from existing institutional backers including Premji Invest, Epiq Capital and Edelweiss Discovery Fund. The capital is being deployed to accelerate offline store expansion, deepen omnichannel capabilities, and strengthen supply chain and technology infrastructure, including its push into lab-grown diamond jewellery.

Founded in 2019 by Ishendra Agarwal and Nikita Prasad, GIVA began as a digital-first silver jewellery brand and has since expanded into gold and lab-grown diamond categories. With over 240 physical stores across India and aggressive expansion plans targeting Tier II and Tier III cities, the Series C positions GIVA as one of the most well-capitalised consumer lifestyle brands in the country.

4. Purple Style Labs

Abhishek Agarwal, Founder of Purple Style Labs

Luxury fashion platform Purple Style Labs raised USD 40 million in institutional funding in 2025, standing out as one of the larger capital infusions in India's premium and designer-led fashion segment.

Founded in 2015 by Shantanu Dalmia, Purple Style Labs operates a portfolio-led model spanning luxury retail, brand incubation and omnichannel distribution. The company works closely with leading Indian designers and labels, helping scale their presence across physical stores, digital platforms and international markets.

The fresh capital is being deployed to expand its luxury retail footprint, strengthen technology and supply-chain capabilities, and deepen partnerships with designers as demand for premium fashion grows across metros and emerging affluent markets. The funding positions Purple Style Labs as one of the more well-capitalised players in India's evolving luxury fashion ecosystem, where organised platforms are increasingly playing a central role in brand-building and distribution.

5. Foxtale

Romita Mazumdar, Founder, Foxtale

Skincare brand Foxtale raised USD 30 million (INR 250 crore) in a Series B round in April 2025, marking one of the largest beauty-focused D2C fundraises of the year. The round was led by Panthera Growth Partners, with participation from Matrix Partners India and existing investor Stellaris Venture Partners.

Founded in 2021 by Romita Mazumdar, Foxtale has built a ingredient-focused skincare portfolio targeted at Indian skin types and climates. The fresh capital is being used to accelerate product development, strengthen brand marketing, and expand offline retail presence, reinforcing sustained investor appetite for digital-first beauty brands with strong repeat consumption and unit economics, even amid a tighter funding environment.

6. Country Delight

Chakradhar Gade and Nitin Kaushal, Co-founders, Country Delight

D2C food brand Country Delight continued to attract institutional capital in 2025, raising around USD 25 million in fresh funding as part of its ongoing growth rounds. The funding saw participation from existing investors, including Temasek, Elevation Capital and Orios Venture Partners, reinforcing long-term investor confidence in the company's fundamentals.

Founded in 2015 by Chakradhar Gade and Nitin Kaushal, Country Delight operates a vertically integrated model spanning sourcing, quality control, logistics, and last-mile delivery. The capital is being deployed to deepen supply-chain infrastructure, expand into new cities and product categories, and strengthen customer retention across its daily-consumption portfolio, positioning the company among India's most consistently funded consumer food brands.

7. Heads Up For Tails

Rashi Narang, Founder, Heads Up For Tails

Premium pet-care brand Heads Up For Tails moved closer to a INR 25 million Series B round in 2025, as institutional investors deepened their exposure to India's fast-growing pet care market. The round was anchored by a strategic investor linked to Apparel Group, which had earlier acquired a majority stake in the company, alongside participation from existing financial backers.

Founded in 2008 by Rashi Narang, Heads Up For Tails operates across pet food, grooming, accessories and services, with a strong omnichannel presence spanning D2C, offline stores and partnerships with vets and pet professionals.

The fresh capital is being channelled towards expanding its retail footprint, strengthening private-label offerings, and scaling supply-chain and sourcing capabilities. The funding reflects rising investor confidence in pet care as a high-engagement, repeat-consumption lifestyle category, driven by increasing urban pet ownership and premiumisation trends among Indian consumers.

8. Farmley

Farmley co-founders Akash Sharma and Abhishek Agarwal

D2C snacks and dry fruits brand Farmley emerged as one of the largest food-focused D2C fundraises of 2025, raising around USD 40 million in institutional funding during the year. The round was led by L Catterton, with participation from existing investors including Fireside Ventures and other growth-stage backers, underscoring strong investor appetite for branded, packaged nutrition plays.

In a joint statement, Farmley co-founders Akash Sharma and Abhishek Agarwal said, "We are committed to reimagining snacking for the modern Indian consumer, transforming what was once considered mere convenience food into a wholesome, delightful experience.

The fresh capital is being deployed to expand product categories, strengthen supply-chain and processing infrastructure, and scale distribution across online platforms and modern trade. With its emphasis on repeat consumption and everyday snacking, the funding positions Farmley among the top-funded consumer food brands of 2025.