Weekly Wrap: Major Deals, Strategic Acquisitions, and IPO Movements Weekly Highlights: February 7–13, 2026

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

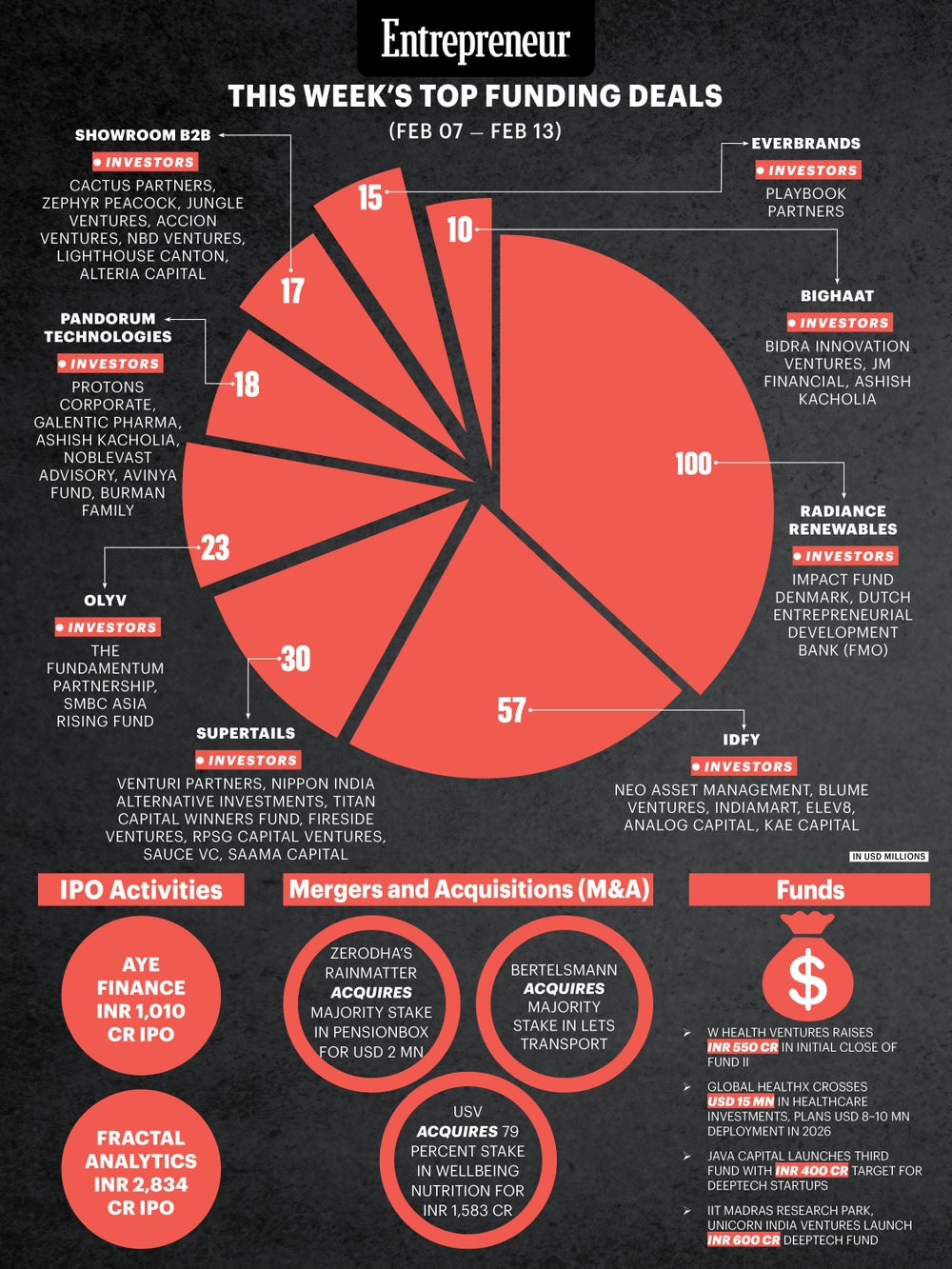

India's startup funding landscape recorded a notable rebound this week, with total investments rising nearly 26 percent compared to the previous week (Jan 30–Feb 05, 2026), according to Tracxn. The funding momentum was led by climate tech, fintech, agritech, and digital commerce ventures, reflecting continued investor confidence in scalable, tech-enabled solutions targeting sustainability, financial inclusion, and supply chain efficiency.

Top Funding Deals

Radiance Renewables (Climate & Energy)

Radiance Renewables delivers customized renewable energy solutions including solar, wind, hybrid, and storage systems for corporate clients. The company manages the entire project lifecycle and specialises in open-access and behind-the-meter projects, enabling businesses to cut energy costs by up to 40% while advancing decarbonisation and net-zero sustainability goals.

• Inception: 2018

• Headquartered: Mumbai

• Founders: Kuldip Kaura, Prasanna Desai

• Funding Amount: USD 100 Million

• Investors: Impact Fund Denmark, Dutch Entrepreneurial Development Bank (FMO)

IDfy (RegTech & Identity)

IDfy provides AI-powered identity verification and fraud prevention solutions, enabling secure digital onboarding, KYC, KYB, and background verification. Its platform uses facial recognition and document authentication technologies to deliver real-time risk assessment and compliance support for enterprises across financial services, e-commerce, and gig economy sectors.

• Inception: 2011

• Headquartered: Mumbai

• Founders: Ashok Hariharan, V Balakrishnan

• Funding Amount: USD 57 Million

• Investors: Neo Asset Management, Blume Ventures, IndiaMART, Elev8, Analog Capital, Kae Capital

Supertails (Pet Care & E-commerce)

Supertails is a digital pet care ecosystem offering premium pet food, accessories, online veterinary consultations, pharmacy services, and behavioural training. The platform combines expert-led care with fast delivery and expanding offline clinics to support modern pet parents seeking integrated healthcare and lifestyle solutions for companion animals.

• Inception: 2021

• Headquartered: Bengaluru

• Founders: Varun Sadana, Aman Tekriwal, Vineet Khanna

• Funding Amount: USD 30 Million

• Investors: Venturi Partners, Nippon India Alternative Investments, Titan Capital Winners Fund, Fireside Ventures, RPSG Capital Ventures, Sauce VC, Saama Capital

Olyv (FinTech)

Olyv is a digital lending and financial wellness platform offering instant personal loans, credit health tracking, digital gold savings, and micro-insurance products. Designed for underserved consumers, the AI-driven platform partners with RBI-registered lenders to deliver paperless, quick credit and financial management tools.

• Inception: 2016

• Headquartered: Bengaluru

• Founders: Rohit Garg, Amit Chandel, Vinay Singh, Jayant Upadhyay

• Funding Amount: USD 23 Million

• Investors: The Fundamentum Partnership, SMBC Asia Rising Fund

Pandorum Technologies (Biotech & Healthcare)

Pandorum Technologies (Biotech & Healthcare)

Pandorum Technologies develops regenerative therapies using bio-engineering, 3D bioprinting, and exosome-based treatments. Its pipeline includes bioengineered corneas, liver organoids, and lung regeneration therapies targeting corneal blindness, fibrosis, and organ damage, positioning the firm at the forefront of tissue engineering innovation.

• Inception: 2011

• Headquartered: Bengaluru

• Founders: Arun Chandru, Tuhin Bhowmick

• Funding Amount: USD 18 Million

• Investors: Protons Corporate, Galentic Pharma, Ashish Kacholia, Noblevast Advisory, Avinya Fund, Burman Family

Showroom B2B (B2B Commerce & Supply Chain)

Showroom B2B operates a digital marketplace connecting apparel manufacturers directly with retailers. The platform offers curated collections, quality assurance, streamlined procurement, and logistics support to improve margins and assortment diversity for fashion retailers across India.

• Inception: 2020

• Headquartered: Delhi NCR

• Founders: Abhishek Dua, Shubham Gupta

• Funding Amount: USD 17 Million

• Investors: Cactus Partners, Zephyr Peacock, Jungle Ventures, Accion Ventures, NBD Ventures, Lighthouse Canton, Alteria Capital

EverBrands (Food & Beverage)

EverBrands India, part of Everstone Group, builds and scales better-for-you food and beverage brands. The company operates Subway outlets in India and manages Lavazza Coffee, F&H Coffee, and Dilmah Tea distribution through its hospitality and café operations network.

• Inception: 2017

• Headquartered: New Delhi

• Funding Amount: USD 15 Million

• Investors: Playbook Partners

BigHaat (AgriTech)

BigHaat runs a digital agriculture marketplace offering seeds, fertilizers, pesticides, nutrients, and farm equipment. It also provides crop advisory services using data on soil health, weather patterns, and crop conditions through its multilingual digital and call-based support platform.

• Inception: 2015

• Headquartered: Bengaluru

• Founders: Sateesh Nukala, Sachin Nandwana, Kiran Vunnam

• Funding Amount: USD 10 Million

• Investors: Bidra Innovation Ventures, JM Financial, Ashish Kacholia

Mergers & Acquisitions

M&A activity remained active across fintech, logistics, and healthcare nutrition segments. Rainmatter, the investment arm of Zerodha, acquired a majority stake in PensionBox for USD 2 million to strengthen retirement planning solutions. Bertelsmann acquired a majority stake in Lets Transport to expand logistics technology capabilities. Meanwhile, USV Private Limited acquired a 79% stake in Wellbeing Nutrition for INR 1,583 crore, marking a major consolidation in the nutrition and wellness sector.

Fund Launches & Closures

Healthcare-focused W Health Ventures announced an initial close of INR 550 crore for Fund II. Global HealthX surpassed USD 15 million in healthcare investments and plans to deploy an additional USD 8–10 million in 2026. Java Capital launched its third fund targeting INR 400 crore to support deeptech startups. Additionally, IIT Madras Research Park and Unicorn India Ventures partnered to launch a INR 600 crore deeptech-focused fund.

IPO Activity

The IPO market witnessed strong momentum this week. Aye Finance launched its INR 1,010 crore IPO, open from February 9 to February 11, 2026, drawing investor interest in MSME-focused lending. Meanwhile, Fractal Analytics opened its INR 2,833.9 crore IPO during the same period, signaling robust public market appetite for AI and analytics-driven enterprises.