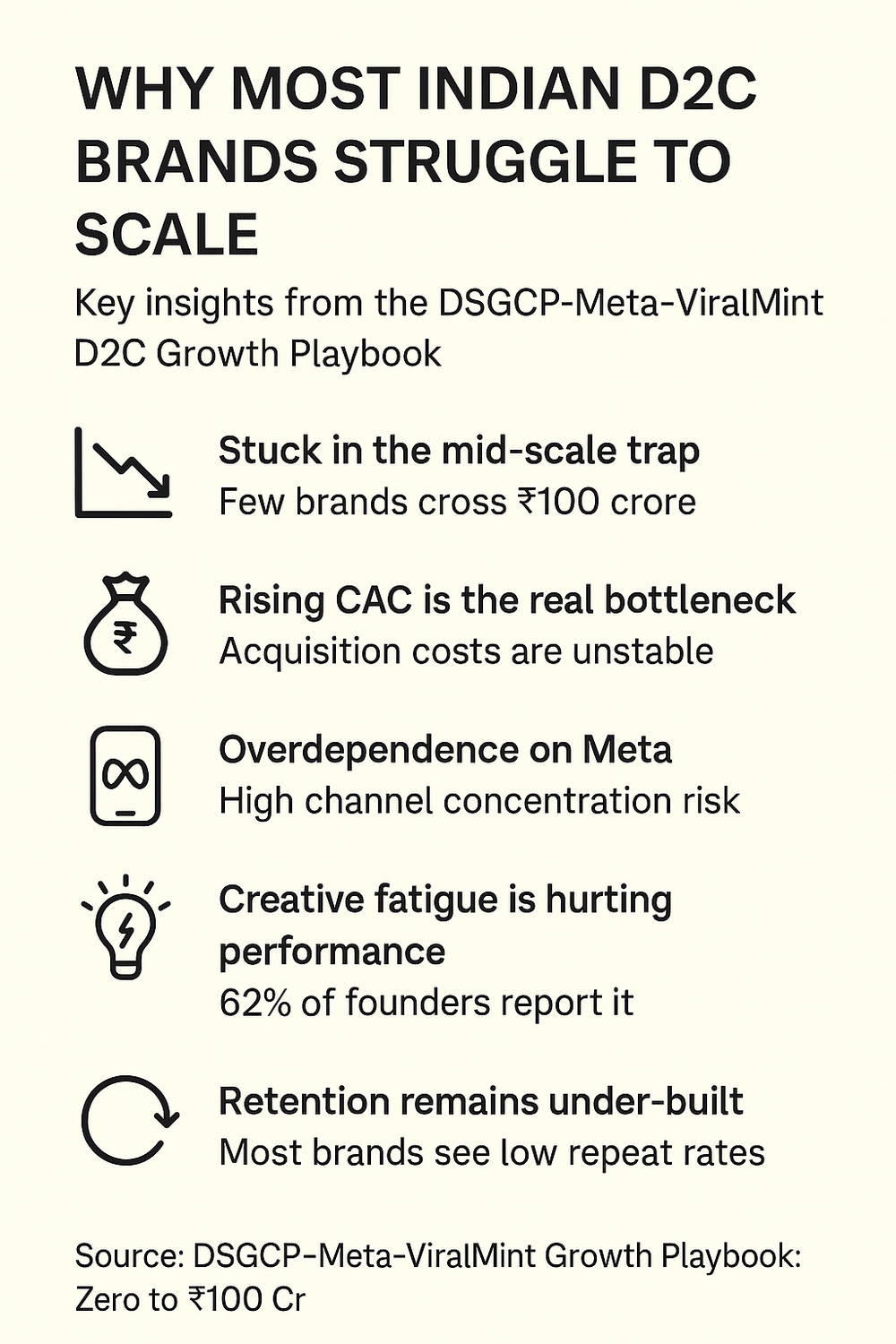

Why Most Indian D2C Brands Fail to Cross INR 100 Crore Mark A DSGCP playbook based on insights from 100+ founders reveals how rising CACs, creative fatigue, weak retention and overdependence on digital channels are keeping most Indian D2C brands stuck below ₹100 crore

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

India's D2C ecosystem has grown rapidly over the past five years, but scale remains elusive. While thousands of brands have launched and many have crossed early revenue milestones, only a small fraction manage to break past INR 100 crore in annual revenue. According to a new report by DSG Consumer Partners, Meta and Viralmint , based on a survey of over 100 Indian D2C founders and operators, the problem is not demand or product-market fit, it is how brands attempt to scale.

The report shows that around 60–65 per cent of Indian D2C brands remain stuck in the INR 1–50 crore revenue band, with very few reaching the INR 100 crore mark. This stage marks the point where early traction exists, but growth begins to strain unit economics, teams, and operating systems.

Insights from over 100 D2C founders reveal that India's fastest-growing brands win on fundamentals rather than speed alone. Clear product-market fit, disciplined data tracking, strong unit economics, creative velocity, and an early focus on retention consistently separate scalable brands from those that plateau. Founders also admit that performance marketing mistakes, pricing missteps, and weak creative systems slow growth far more than budget constraints. In a booming D2C landscape, capability gaps in operations, brand-building, and supply-chain depth are widening the divide between breakout brands and those stuck in the performance plateau.

Industry observers argue that this is where many brands mistake rapid online growth for sustainable scale.

As Devangshu Dutta, Founder & CEO, Third Eyesight, explains, "Scaling up online can be very rapid, but is also capital-hungry in terms of CAC. Given the intense competition, the lack of customer stickiness and the power of platforms, there is a constant churn of marketing spend which is a huge bleed for growing brands."

CAC Inflationis The Real Constraint

One of the clearest findings from the playbook is that acquisition efficiency, rising CAC and unstable ROAS, is the single biggest blocker to growth, cited by more founders than funding or category expansion. Moreover, over 70 per cent of brands rely on Meta as their primary acquisition channel, increasing vulnerability to auction pressure and platform-driven volatility.

Dutta links this directly to the limits of a digital-only mindset. "Limited offline expansion can trap brands in narrow urban digital markets, blocking broader scale," he said.

This over-reliance on online performance marketing often leads to growth that looks strong on dashboards but weak on cash flow.

Highlighting their report, Pooja Shirali, Vice President, DSG Consumer Partners, said, "Across over 90 consumer brands we've partnered with at DSGCP, one truth is clear: brands that master Meta's ecosystem don't just grow, they change their entire trajectory through strategic clarity and disciplined execution. The real drivers of scale have less to do with viral moments, and everything to do with the long-term fundamentals that make milestones like the first INR 100 crore predictable, not accidental."

Why Omnichannel is Unavoidable

The report suggests that brands that scale sustainably are those that reduce overdependence on paid digital acquisition and expand their distribution footprint. However, offline expansion brings its own complexity.

Dutta stresses that omnichannel is not an optional add-on, but a strategic shift. "D2C brands must adopt an omnichannel approach, blending online with offline retail for sustainable and scalable reach. Clearly the channels work very differently and management teams have to be prepared and capitalised for the long haul to tackle acquiring customers with channel-appropriate strategies," he adds.

This aligns with the DSGCP report's broader insight that scale breaks down when brands fail to adapt operating models as they grow.

Even within digital channels, performance weakens over time. The playbook finds that 62 per cent of founders report creative fatigue, where repeated creatives fail to sustain ROAS despite higher spends. At the same time, 55 per cent admit to under-investing in CRM and retention, with most brands reporting repeat purchase rates of just 10–30 per cent.

Both the data and expert opinion point to a common theme: brands that cross the INR 100 crore mark are structurally different. They obsess over unit economics, processes, and capital efficiency rather than topline growth alone.

As Dutta puts it, "Scalable brands that cross the growth hump have leadership obsessed with unit economics and omnichannel execution rather than chasing vanity metrics. Cash always was and is king, especially at early stages of growth."

He adds that execution strength matters as much as strategy. "They are able to grow and steer teams that build and replicate processes fast rather than spending time, effort and money reinventing all the time, and do so without constant CXO intervention."

As competition intensifies and capital becomes more selective, the next generation of INR 100 crore D2C brands is likely to be defined not by speed, but by the ability to compound cash flows, institutionalise processes, and scale distribution beyond digital platforms..