Will Uber Apply The Same Strategy In India That It Used In China? Both sides have about $300-400 million annually to burn on customer and driver-side subsidies, and they have Didi as common investor.

By Ritu Kochar

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

The recent developments in the taxi aggregator space have been an eye opener and no, this is no exagerration. Most of these firms, enjoy the privilege of securing big cheques as funds from various sources and investors, but keep exhausting their resources and lose on business because of various reasons. Lack of knowledge of implementing the business locally is one of them. And that is where brands like China's Didi Chuxing have proved that they have a upper hand.

Uber, one such big brandhad total confidence in its worldly knowledge of taxi business. However, by implementing the same stratgey in China, that yielded good results for them in the US market, they did commit a mistake. They underestimated the strength of local cab companies, such as Didi Chuxing, and entered the China market in 2014, without fully understanding the chinese culture, its business dynamics and consumer behavior. On the other hand, Didi had tight connections with local government; had made an ally with all the local taxi drivers and expanded into services such as buses that Uber ignored. In simple words, they played the whole game better!

Three years went by, during which Uber bled and used all it had. Finally, it had no option, but sell its china subsidiary to the local rival. Not only was this a huge change of guards, but also gave motivation and confidence to all those small local business striving to make it big in the world.

We have seen a similar story in India! Not only has our homegrown Ola been moving head to head with Uber, but reports say that Ola is now averaging 1 million rides daily (this number could not be independently verified), which is almost three times the size of Uber. The latter is working extensively on getting a grip on the locals, but Ola seems to be winning the race; at least for now.

What's interesting here is Uber China generates higher revenue when compared to India. However, in order to acquire customers and reduce cash burn, the company has now merged with Didi Chuxing in China, getting an additional investment of $1 billion. The question here is - with Ola leading Uber in terms of revenue generation and customer acquisition; will Uber apply a similar strategy in India going forward?

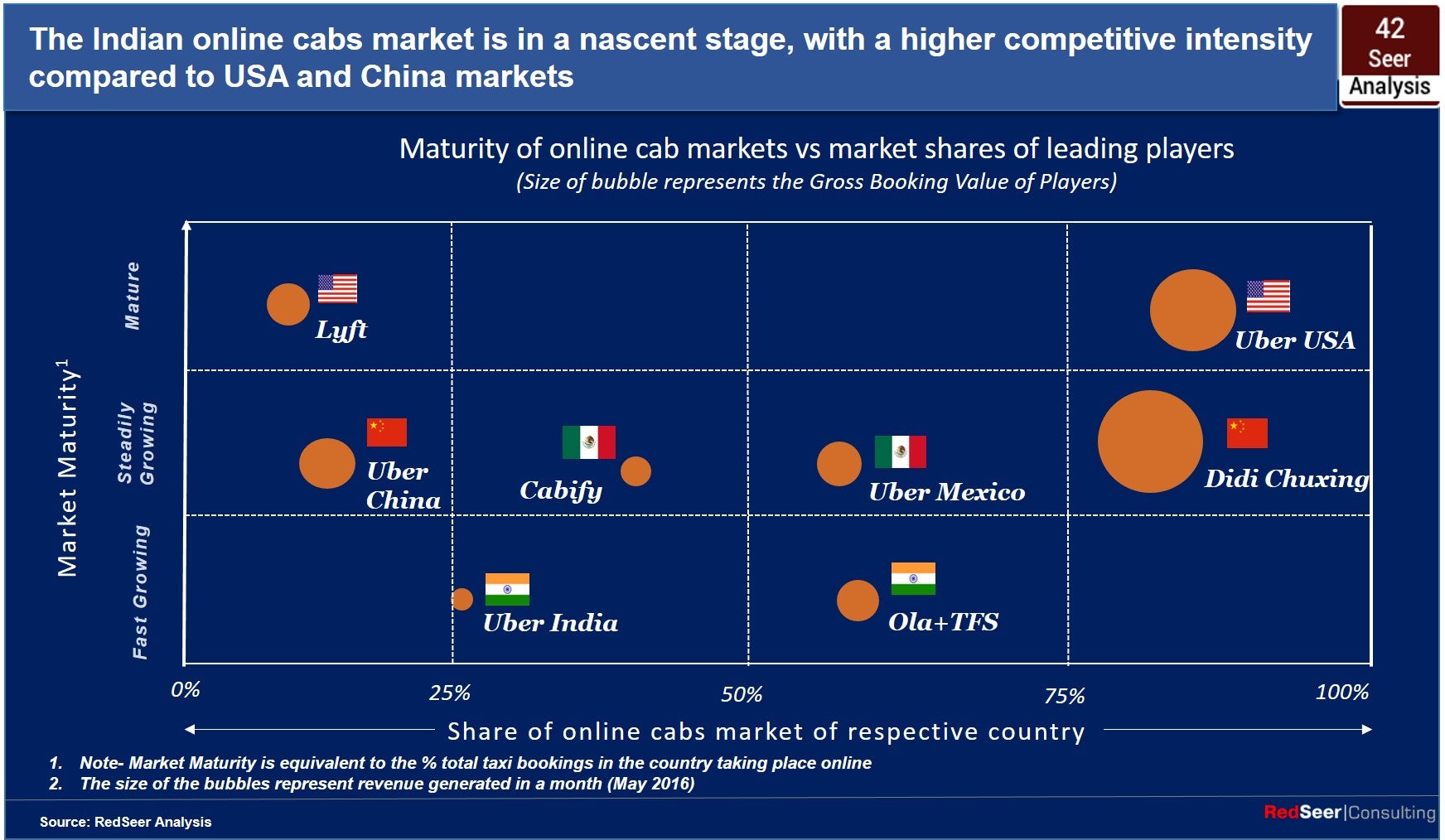

According to a recent survey by RedSeer Consulting, the Indian online cab market is at a nascent stage with higher competitive intensity, compared to China and USA markets. Previously, Ola had formed an alliance with Southeast Asia ride-hailing start-up Grab, China's Didi and U.S. operator Lyft against Uber. The result is evident in the graph below, which shows that when the maturity of the company was compared to their respective market share, Ola cabs generated much more revenue and had many more booking than Uber.

This also means that now that Uber is done with China, it would focus more on markets such as India and Southeast Asia to take on the local businesses and make up for the mistakes they have made in China. According to reports, an investor who did not want to be named said, Ola will have to make life difficult for Uber, there's no other way ."For Uber, this is one big market left, after China. They will give it all."

"Looks like Uber is marching towards an IPO, which will need to be priced at least at $100 billion to provide a decent return to its most recent investors, which have come in at $60 billion and more.This could be an indication that they will reduce or eliminate their high-burn strategies in India," he added.

Both sides have about $300-400 million annually to burn on customer and driver-side subsidies, and they have Didi as common investor, so it's too soon to make a judgment. However, Satish Meena of Forrester Research believes, "Things will depend on the relation Ola and Didi share. Though I feel it's early to write off Ola, at the moment. In terms of investments, Didi is putting almost ten times the money in Uber compared to Ola so it would be interesting if Ola finds a new backer."