South African Venture Capitalist, Keet van Zyl, Unpacks How You Can Become Funding Ready Keet van Zyl, one of South Africa's top Venture Capital investors unpacks what he looks for in a start-up, what your pitch deck should include, and the red flags that investors walk away from. Would your start-up make the cut?

You're reading Entrepreneur South Africa, an international franchise of Entrepreneur Media.

Vital Stats

- Player: Keet van Zyl

- Company: Knife Capital

- Claim to fame: Keet is a Venture Catalyst with extensive high-growth investment experience. In 2010 he co-founded growth equity fund manager Knife Capital.

- What they do: Knife Capital is an independent growth equity investment firm focusing on innovation-driven ventures with proven traction. By leveraging knowledge, networks and funding, Knife Capital aims to accelerate the international expansion of entrepreneurial businesses that achieved a product/market fit in a beachhead market. They have offices in Cape Town and London and invest via a consortium of funding partnerships, including SARS section 12J Venture Capital

- Company: KNF Ventures and Draper-Gain Investments.

- Visit: www.knifecap.com

Why would you choose to back Gazelles over Unicorns, and what does this investment strategy mean for start-ups looking for investment in South Africa?

Unicorns are start-ups (sometimes without an established performance record), valued at $1 billion or more, normally pre-public listing (IPO).

Gazelles are young post-commercialisation phase businesses that are able to scale and maintain a high revenue growth rate off a decent base over a prolonged period. In the US, this is usually well in excess of 20% year-on-year for a period of three to four years or more, starting from a revenue base of at least $1 million. My view is that in South Africa this range should be a sustainable year-on-year growth rate of 30%+ for three years or more off a revenue base of at least R5 million.

If I could know for sure that a start-up was going to turn into a Unicorn, I would obviously choose to back it over a Gazelle. But that is just the thing: The risk/return ratio of chasing mythical African Unicorns with a very low probability of actually achieving Unicorn status is not necessarily a viable investment strategy. There are enough entrepreneurs out there who are building sustainable high-growth businesses requiring opportunity funding to accelerate growth through access to knowledge and market access networks.

Many South African start-up investors require businesses to have proven traction to de-risk investments to some extent (and many of those who don't, do so after gaining a few battle-scars). Start-ups looking for investment should first bootstrap to some extent or get enough funding from the so-called "three Fs' (friends, family and fools) to gain some momentum in one or more key traction verticals before approaching the more formal early-stage investors.

As an investor, do profitable businesses that solve real, meaningful problems attract your interest? Why?

Absolutely — profitable businesses that solve real, meaningful problems attract our interest for investment as long as they are still in their growth phase (as opposed to maturity/ harvesting phase). At the core of any successful start-up lies a good product/service and a large addressable market for that product/service.

This enables a start-up to grow or scale and become sustainable. Businesses that solve real, meaningful problems have a better chance of aggressively penetrating their identified target market and profitability is a great traction milestone. Too many start-ups focus on building a solution looking for a problem to solve — instead of the other way around.

What separates a good pitch from a great pitch?

I've seen thousands of start-up pitches through the years, and unfortunately most of them miss the mark by a long way. The better ones contain all the key components of a pitch, but the really great ones tell a brief but engaging story that follows a "Hearts — Minds — Wallets' narrative in a true authentic way. This includes first appealing to the "hearts' of potential investors by taking them through a journey to get them excited about the opportunity. Then the entrepreneur has to augment the story with facts and a solid business case to win their "minds', concluding with a clear "ask' of the funding requirements and how this investment could positively affect their "wallets'.

How can an entrepreneur determine whether their business is funding ready or not?

Venture capital should not be the go-to funding choice for everyone starting a business. It is an inspirational metaphor at the bleeding edge of entrepreneurship. There are many other credible funding mechanisms out there across the debt/equity spectrum, and entrepreneurs should assess the criteria based on where they are in their business growth cycle, and then gauge their funding readiness.

A venture backable business has a high growth trajectory of at least 30% to 40% year-on-year for the foreseeable future with a clear exit strategy for investors to realise returns of at least five to ten times the money invested (in South Africa this is most likely a trade sale to a large strategic investor that can scale the product, intellectual property or team by utilising its already established distribution channels).

Entrepreneurs have to ask themselves whether their growth goals can be achieved without venture funding — in which case bootstrapping is the way to go. And lastly whether the current founding team can embrace trading ownership (and thereby some element of control) in the business for a financial partner.

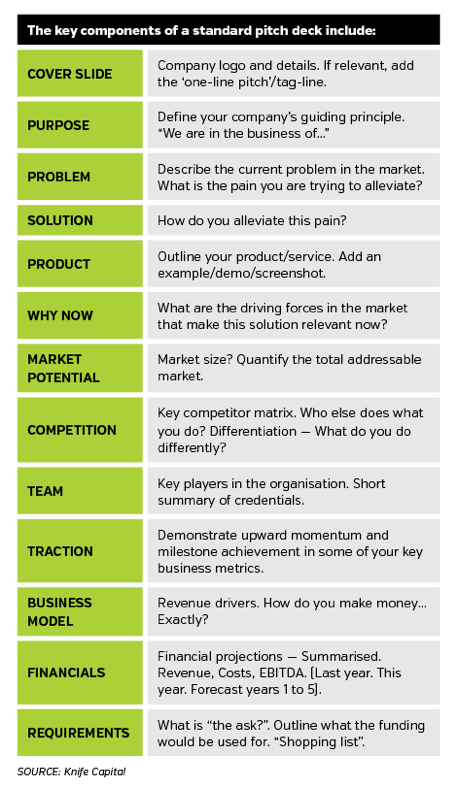

In order to facilitate the funding process, it is advisable for entrepreneurs to always have the following elements at hand: A one-page teaser document containing a summary of the business and funding requirements; and a business pitch deck, with a detailed financial model and a virtual data room containing key business documentation for investor scrutiny.

What do so many start-ups not understand about funding?

The largest deal origination sources of start-up funding in South Africa come through warm referrals. It is simply not good enough to find the email address of a venture capitalist and send through a cold email expecting a positive outcome. Study the investment mandates of potential funders, build an investor universe of preferred partners and do some homework to figure out a way to get referred.

And then: The 8020 principle is as alive in entrepreneurship today as it was in Pareto's pea garden. 20% of start-ups have 80% of the disruptive solutions and will receive 80% of the funding. One only has to watch one episode of Idols to realise that many people have an inflated sense of their own abilities. There is a very fine line between a tenacious entrepreneur who does not take no for an answer where success is inevitable despite the setbacks, and a lost cause. Start-up entrepreneurs need to figure out on which end of this spectrum they are.

Lastly: Like it or not, at some level all roads lead to the assumptions behind your financial model. We've heard it all from the ever-present "these projections are conservative' to "real life won't mimic excel anyway so what's the point of building a model?'… Build a model! And make it granular. We know there will be pivots, delays, underestimation of costs, corporates who pay late, and so on. But we need to agree on the basic set of metrics that reflect the commercial DNA of the business at this point in time.

Do you believe most businesses can be bootstrapped?

Yes and no — to some extent and at certain stages of the business. The one thing that start-ups who believe in themselves must jealously guard is the management team's equity ownership in the business. Risk funding will generally result in the start-up founders having to share this equity with outside parties. The more one can bootstrap while increasing value, the better in the long run for the founders — but not to the detriment of the business.

What is the role of bootstrapping versus funding in a vibrant market?

Bootstrapping is a viable option for most lifestyle businesses where growth is slower, but a start-up is a high growth potential company in search of a repeatable and scalable business model. If the business solves a real, meaningful problem and the business model is scalable, it's a question of time before competitors establish themselves in the market.

This means that the window of opportunity for growth and market penetration is closing, and while bootstrapping could be ideal, by the time the start-up gets to "Point B' — the goalposts may have moved. Funding in a vibrant market can accelerate growth and ensure that windows of opportunity are not missed.

What red flags immediately warn you off investment opportunities/start-ups?

My number one red flag is a culture clash. Either between us as investors and the entrepreneurs, or subtle politics within the entrepreneurial team. We've learnt the hard way that the one thing that you can't fix with money is a toxic corporate culture.

Most other fundamental business gaps can be closed with enough investment. Knife Capital has an internal [subjective] measure for assessing corporate culture in companies called the "Speed of Climbing Stairs Index'. The theory is that there is a direct correlation between staff morale/corporate culture, and the speed at which employees will climb a proverbial staircase at the office. If it's not fast enough, we will not invest.

Other red flags include questionable ethics, lack of product/market fit, cash flow management issues and entrepreneurs betting on a product as opposed to building a multi-product sustainable business.

What specifically do you look for in your investments?

- A Solid Investment Case: This comprises a good product/ service with a competitive advantage; a large addressable market for that product, a strong management team, a scalable business model, funding to accelerate growth and an achievable realisation strategy.

- Awesome People: Start-up investment is a long journey to success and we feel that we may as well embark on that journey with amazing people.

- Strong Culture: The company culture needs to be solid in order to celebrate the successes as well as survive the setbacks.

- Execution Capabilities: The value of an idea without execution capabilities is zero. So we look for the ability to execute.

- Proven Traction: There needs to be some element of momentum that can be demonstrated or quantified.