How To Budget and Lower Automotive Expenses

Smart ways to save money over your vehicle’s lifetime

Vehicle costs are the second-largest expense in the U.S. after housing, which makes an automotive budget a critical part of any financial plan. Budgeting means more than saving money for the vehicle purchase. You pay for your car over the entire life cycle of the vehicle, and a savvy car budget takes into account ongoing costs and occasional expenses, such as insurance, gas and repairs.

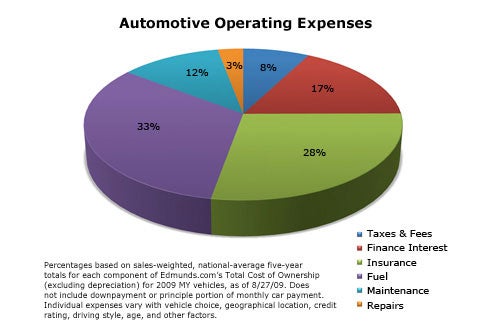

Using Edmunds data, we’ve estimated where money is spent on automotive goods and services over a typical ownership period of five years. We’ll show you how to keep vehicle-related costs in line with your income by buying smart, and show you how to lower operating expenses in every area.

Buying Smart Now Prevents Problems Later

Edmunds recommends that the total of all vehicle expenses stay within 20 percent of your gross wages. This is achieved by buying the right car at the right price with the right loan–topics we’ve covered extensively in our Buying and Strategies areas.

Several key tips that can keep you from getting in over your head:

- Buy what you can afford. Use Edmunds’ Affordability Calculatorto obtain a personalized “shopping range.”

- Make fuel economy a priority.

- Avoid vehicles with poor reliability ratings. Read what current owners say about specific vehicles in our Forumsand what our editors think of brands’ reliability in our Long-Term Road Test Blog.

- Compare vehicle warranties before you buy, but don’t give undue weight to free scheduled maintenance programs.

- Once you’ve narrowed your choices to two or three vehicles, look up their True Cost to Own®, which compares the costs of vehicle ownership over a five-year period. You may find that the car that is more expensive to drive off the lot is actually less expensive over the long haul.

- Finally, shop for a good loan before you buy to avoid paying too high an interest rate.

How To Cut Operating Expenses

Let’s say you’ve already got a car or two in your driveway, and you’re not ready to sell or trade it in yet. As a car ages, vehicle operating expenses like taxes, fees and loan interest go down, while maintenance, repairs, fuel and insurance typically rise. Over the life of the car, though, some expenses will set you back more than others.

As the chart above indicates, insurance premiums and fuel together make up a whopping 61 percent of vehicle operating expenses over the five-year period, while loan interest, perhaps surprisingly, makes up just 17 percent. Below, we’ll discuss how to save in all these areas.

Taxes and Fees: 8 Percent

State taxes and fees can be thought of as operating costs that you pay up front during the car purchase, so saving money in this area can only happen when you initially buy or lease.

If you live where there is no state vehicle sales tax (Alaska, Delaware, Hawaii, Montana, New Hampshire or Oregon), you’re already in luck.

No matter where they live, most Americans can deduct state and local vehicle taxes on their federal tax return if they purchase a new passenger vehicle between February 17 and December 31, 2009, courtesy of the American Recovery and Reinvestment Act of 2009.

Some states also tax customer cash rebates, good to know if you’re trying to decide whether to choose a low APR versus cash back. Our article ” What Fees Should You Pay?” reveals the states that tax incentives.

If you use your car for business, you may be able to lower your taxes by leasing instead. You can also choose a hybrid or alternative-fuel vehicle that is eligible for federal (and sometimes state) tax benefits. See ” Save Money with Hybrid and Diesel Tax Credits, Car Donations and Car Leasing” for more details. As always, be sure to consult a tax professional about whether you qualify for any deduction or credit.

Loan Interest: 17 Percent

The majority of buyers finance their new car. But many people don’t realize that, like houses, car loans can be refinanced. If your credit score has improved, interest rates have dropped since your original loan date, or if you suspect you got taken for a ride in the finance office of the dealership (a common occurrence due to shopper naiveté and the tight credit market), shopping for a better loan deal can lower your monthly payments for the life of your loan.

Insurance Premiums: 28 Percent

Auto insurers have been cutting prices to stay competitive during tough economic times. So if you haven’t priced out your policy recently, comparison shop your insurance. Our article, ” Edmunds.com Editors Shop for Auto Insurance on Their Personal Cars,” will show you exactly how we did it for our own rides.

For many more tried and true ideas, see ” Top 10 Ways To Lower Your Car Insurance Bill.“

Fuel Costs: 33 Percent

Because gas prices and miles traveled fluctuate, the percentage of your monthly automotive budget spent on fuel will vary. You’ll find ways to save on gas comprehensively detailed at our Fuel Economy Center, but here are three of the biggest money-savers:

- Take your foot off the gas. If you learn to accelerate less abruptly and coast more, your fuel-efficiency will improve significantly. Use cruise control whenever possible.

- Price shop for fuel. Use sites like FuelGaugeReport.comor GasBuddy.comto find the cheapest gas in your area. Or go to Costco if you’re a member, where gas is generally sold 10-15 cents cheaper per gallon than the local average.

- Explore gas rebate credit cards, some of which offer up to a 5 percent ongoing rebate on all fuel purchases.

Maintenance: 12 Percent–Repairs: 3 Percent

While some maintenance and repair work, especially on sophisticated electronics systems, should be performed at the dealer, routine maintenance can be done for less money at an independent garage or oil change shop (see ” Corner Garage vs. Dealer Service Department“).

Before you go the independent route, though, learn about when you can save money with aftermarket car parts and when you should pony up for the manufacturer’s brand.

No matter where you repair your car, there are still savings to be had. Dealership service departments, lube and oil change chains, and some independent repair shops offer coupons or specials–sometimes up to 30 percent off retail prices. Check your mail, e-mail and especially local newspaper inserts for coupons.

If you forget to bring your coupons to the shop, telling the service advisor where you saw his advertisement can often net the same result. Bringing in your car midweek or making a service appointment online can often qualify you for a discount as well.

Shop ‘Til Your Costs Drop

There’s a recurring theme in all this: Saving money requires comparison shopping. Fortunately, the internet excels at helping consumers do this quickly and easily. If you’re able to lower your automotive expenses in just one or two areas, such as insurance or fuel, you’ll make gains that are well worth your effort.

Copyright Edmunds.com. All Rights Reserved.

More From Edmunds.com

Vehicle costs are the second-largest expense in the U.S. after housing, which makes an automotive budget a critical part of any financial plan. Budgeting means more than saving money for the vehicle purchase. You pay for your car over the entire life cycle of the vehicle, and a savvy car budget takes into account ongoing costs and occasional expenses, such as insurance, gas and repairs.

Using Edmunds data, we’ve estimated where money is spent on automotive goods and services over a typical ownership period of five years. We’ll show you how to keep vehicle-related costs in line with your income by buying smart, and show you how to lower operating expenses in every area.

Buying Smart Now Prevents Problems Later

Edmunds recommends that the total of all vehicle expenses stay within 20 percent of your gross wages. This is achieved by buying the right car at the right price with the right loan–topics we’ve covered extensively in our Buying and Strategies areas.