Amitabh Kant Asks Insurers And Pension Companies To Back Startups: Report As per the report, a slowdown in investor funding has forced many startups to re-analyze their business projections, halt new experimentations, triggering layoffs across the sector

By Teena Jose

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

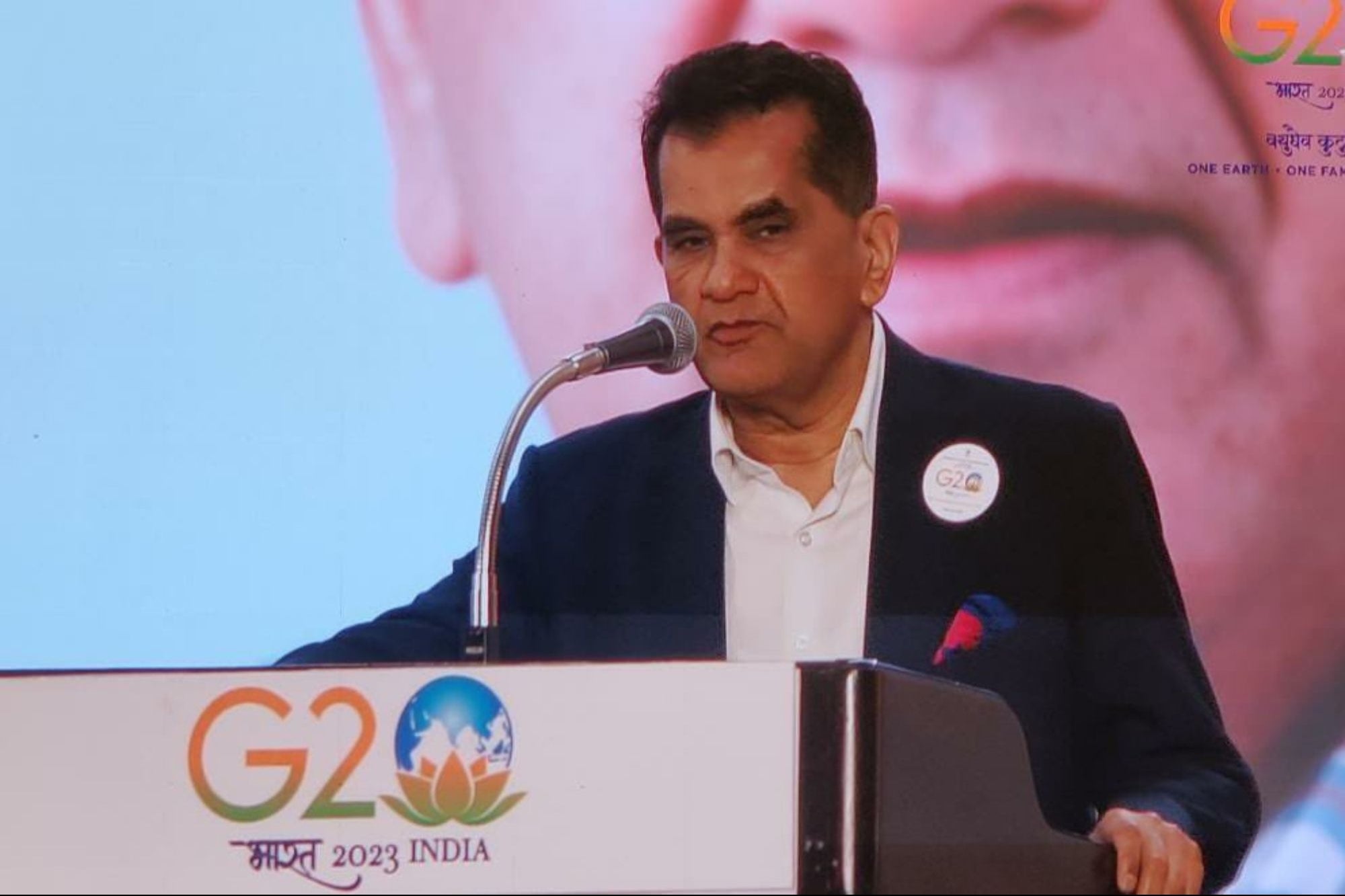

Amitabh Kant, India's G20 Sherpa, at a summit in New Delhi on Tuesday, has said that insurance companies and pension funds must back startups, according to a TOI report.

"The challenge is that Indian insurance companies and pension funds are still not investing in startups. There's a vast amount of investable sums. They must be asked to put more and more resources into Indian startups," said Kant in a statement.

As per the news report, a slowdown in investor funding has forced many startups to re-analyse their business projections, halt new experimentations, triggering layoffs across the sector. Analysts at Bain & Company estimated that as many as 20,000 employees may have lost jobs last year. Along with that, investments into startups declined to $25.7 billion in 2022 from a record $38.5 billion in 2021 as rising cost of capital on the back of steep increase in interest rates by global central banks pushed investors to remain on the sidelines.

Currently, regulations do not specifically permit insurance companies and pension funds to invest directly in startups. There have been certain amendments in 2020-21 where insurance companies were permitted to invest in 'fund of funds', which could invest in startups, but not directly into startups, the report noted.

"Startups, which are particularly building green initiatives and operating in segments like deep tech, cloud, robotics will gain traction. The focus should be to go green. Valuation and capital will flow into these startups," said Kant.