97% of Americans Qualify – IRS Just Gave You $118,976.24 Tax-Free (How to Collect)

Is your retirement savings in need of a boost? If so, you are in luck. Roth IRA contribution limits will finally increase in 2023. What exactly does that mean? Basically, you…

This story originally appeared on Due

Is your retirement savings in need of a boost? If so, you’re in luck. Roth IRA contribution limits will finally increase in 2023.

What exactly does that mean? Basically, you can increase your retirement nest egg even further.

But, let’s pump the brakes a little. You may be wondering, what are Roth IRAs? This is similar to a regular IRA but with some awesome tax benefits. With Roth IRAs, you can contribute after-tax money. As a result, your retirement income will be tax-free when you retire.

Another key difference? The withdrawal of Roth IRA contributions is penalty-free, but the withdrawal of Traditional IRA contributions before age 59 1/2 is subject to a 10% penalty. Furthermore, each type of IRA has different contribution limits and eligibility requirements.

But, wait, there’s more. The new contribution limits let you save more money every year without fear of Uncle Sam taking too much. So, if you’re already contributing to a Roth IRA, you could increase your contributions even further. In case you haven’t started, now is the ideal time for you to do so. By raising the retirement savings limits, you’ll be able to maximize your retirement savings even more.

No wonder I consider a Roth IRA the best retirement tool out there.

It’s time to pull out the calculators and crunch some numbers because Roth IRAs have a bright future ahead of them.

Roth IRA limits for 2023

This is the first time in over four years that Roth IRA limits have been increased. For 2023, Roth IRA contribution limits are as follows:

Individuals can contribute $6,500 to Roth IRAs in 2023. “Catch-up contributions” are also available to plan participants who are 50 and older.

The income cap on Roth IRA contributions, however, prevents everyone from contributing. In order to qualify, you must meet certain income guidelines. In some cases, a Roth IRA isn’t even available to people with high incomes.

Depending on your income bracket, Roth IRA contributions might be “phased out.” In other words, you cannot contribute the full amount to a Roth account.

Based on your tax filing status, here are the Roth IRA income limits and phase-outs.

Couples filing jointly:

- A couple with a modified adjusted gross income (MAGI) under $218,000 may contribute the full amount.

- Reduced contributions are available to couples with MAGIs between $218,000 and $227,999.

- It is not possible to contribute to a Roth IRA if your MAGI is more than $228,000.

Separate filings for married couples:

- A reduced contribution is available to couples with a MAGI under $10,000.

- Those with a MAGI of $10,000 or more cannot contribute to Roth IRAs.

Individuals filing a single tax return:

- Contributions can be made up to the full amount by single filers with a MAGI of under $138,000 per year.

- Contributions are reduced for individuals with MAGIs of $138,000 to $152,999.

- Roth IRAs are not available to individuals with an annual income of $153,000 or more.

To help you make the most of your Roth IRA contributions, here are some additional tips:

- Even if your employer offers a retirement plan, you can contribute to a Roth IRA.

- Roth IRA contributions can be withdrawn at any time without penalty. Any earnings you withdraw will, however, be subject to tax.

- Earnings from Roth IRAs are tax-free. If you withdraw the money in retirement, you will not be taxed.

I always advise that you consider speaking with a financial advisor if you’re considering contributing to a Roth IRA.

Roth IRA Benefits

I already mentioned this above. But, Roth IRAs are one of my favorite retirement tools. One of the reasons I am such an advocate is that it provides a wide range of benefits.

- Tax-free growth. Within a Roth IRA, your investment earnings and contributions are tax-free. If you withdraw money in retirement, you won’t owe any taxes on it.

- Tax-free withdrawals. Roth IRA contributions and earnings can be withdrawn tax-free and penalty-free if you meet certain requirements. A minimum of five years holding in the account is required, as well as being at least the age of 59 ½.

- There is no minimum distribution requirement. A Roth IRA does not have a required minimum distribution (RMD), unlike a traditional IRA. As a result, you won’t have to start taking withdrawals from your Roth IRA until you’re at least age 55.

- Flexibility. A Roth IRA allows you to withdraw your contributions at any time, without penalty or tax. In comparison to a traditional IRA, this gives you more flexibility.

- Portability. If you want to change financial institutions, you can transfer your Roth IRA to another custodian. With traditional IRAs, this is not always possible.

Other benefits of a Roth IRA:

- There may be additional tax credits available to you, including the Saver’s Credit.

- Despite exceeding the income limit, you may be eligible for a “backdoor Roth IRA” conversion.

- In the event of your death, your beneficiaries will not have to pay taxes on Roth IRAs.

The downside of Roth IRAs.

Of course, Roth IRAs aren’t perfect. A Roth IRA does have some disadvantages, including:

- Contribution limits. Roth IRA contribution limits are lower than those for traditional IRAs. In 2023, individuals will be able to contribute up to $6,500 to a Roth IRA.

- After-tax contributions. Roth IRA contributions are after-tax, so you won’t get a tax deduction the year you make them. If you’re currently in a high tax bracket, this can be a disadvantage.

In general, Roth IRAs are an excellent option for saving for retirement. There is no requirement to make minimum distributions, and they can grow and withdraw tax-free. Before you decide to invest in a Roth IRA, you must consider the contribution limits and after-tax contributions.

You should also consider the following factors before deciding whether a Roth IRA is right for you:

- The tax bracket you are currently in. Roth IRAs are a good option if you are in a high tax bracket now. Since your tax rate is likely to be higher in retirement, you can pay taxes on your contributions now.

- Retirement goals. It may be a good idea for you to contribute to a Roth IRA if you plan on retiring early. The reason for this is that your money will have a longer time to grow tax-free.

- What your investment horizon is. You may be able to benefit from a Roth IRA if you plan to invest for the long term. Because of this, your money will be able to grow tax-free for a longer period of time.

ChatGPT Compound Interest Calculations

- So, you might wonder where this $118,976.24 figure comes from. Let’s use ChatGPT to find out.

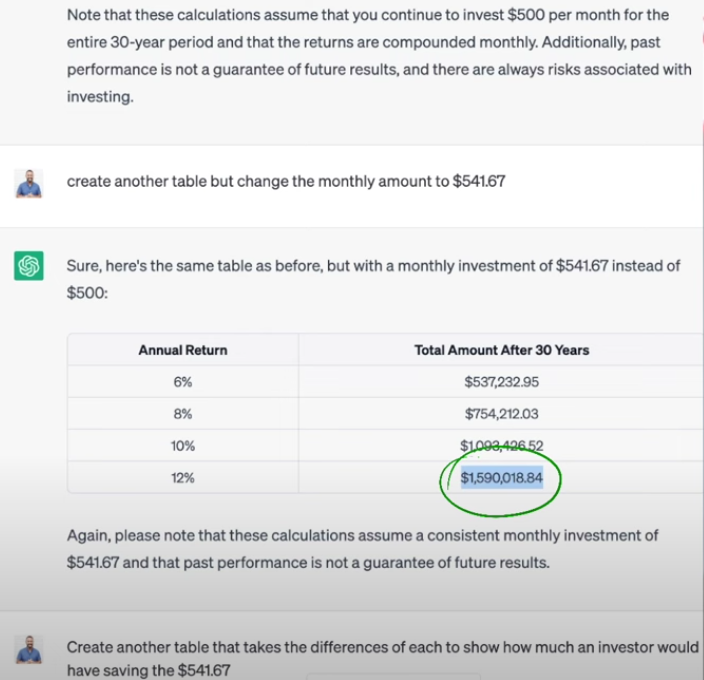

It’s just so much fun to use this learning model. For example, I used ChatGPT to create a table that shows $500 a month invested for 30 years. I also wanted it to show the different returns for six, eight, ten, and twelve percent. That would be $1,471,042.08.

How about if we increased that amount from $500 to $541.67? That’s $1,590,018.84.

As for the math, I am sure you know where I am going. With ChatGPT, that comes out to a difference of $118,976.24.

Due to the IRS increasing Roth IRA contribution limits, an extra $41 per month can give you a significant increase.

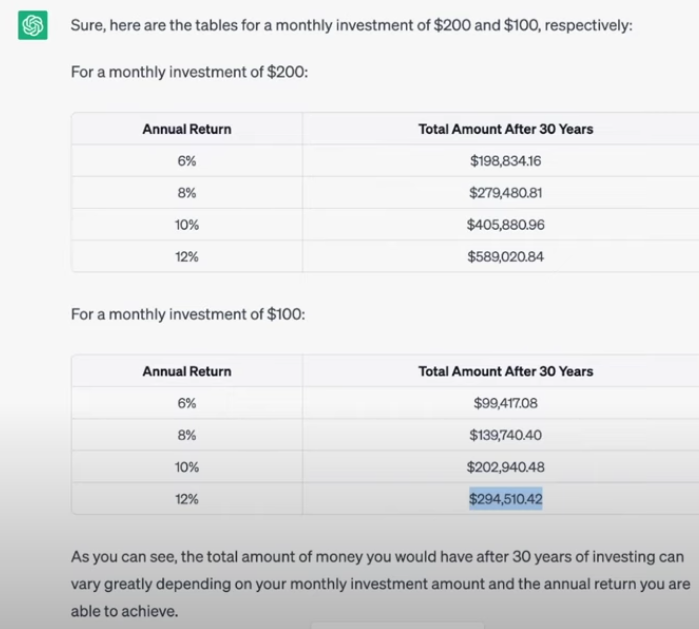

But, what if you can’t swing the $541 a month? Well, you’re still in luck.

If we used ChatGPT again, what would it look like if you saved $100 or $200 a month tax-free? A 12% return on $100 per month over 30 years would amount to $294,510.42. For $200 per month over 30 years, the return would be $589,020.84.

Overall, it would be foolish not to take advantage of an amazing retirement tool like the Roth IRA. And, best of all? You don’t need thousands of dollars to make such a smart investment.

Final Words of Advice About the Roth IRA

Overall, investing in a Roth IRA is a smart move if you follow these tips:

- Choose a diversified portfolio. By investing in a variety of asset classes, such as stocks, bonds, and mutual funds, you are diversifying your portfolio. As a result, your risk will be reduced, and your potential returns will be maximized.

- Rebalance your portfolio regularly. Your portfolio will need to be rebalanced over time to meet your investment goals and risk tolerance.

- Contribute as much as you can afford. You’ll have more retirement savings the more you contribute. Make sure you increase your contributions annually if you can.

Roth IRAs are one of the best ways to save for retirement. You can start by contributing at least a small amount per month, even if you can’t afford much. It takes time for money to grow, so the sooner you start saving, the better.

FAQs

What is a Roth IRA?

The Roth IRA is a type of individual retirement account (IRA) that lets you make contributions after tax. The money you contribute has already been taxed, but you won’t have to pay taxes on any earnings or withdrawals in retirement.

Why should you consider a Roth IRA?

The following are some of the benefits of opening a Roth IRA:

- Tax-free growth. When you leave your Roth IRA investments in the account until retirement, they can grow tax-free.

- Withdrawals from a Roth IRA are tax-free. The earnings from a Roth IRA will not be taxed when you withdraw them in retirement.

- No required minimum distributions. Unlike traditional IRAs, Roth IRAs have no required minimum distributions (RMDs). The money in the account can be kept indefinitely and withdrawn whenever you wish.

- It is flexible. It is possible to withdraw contributions from a Roth IRA at any time, without incurring any penalties.

Are there any drawbacks to Roth IRAs?

The following are some drawbacks of opening a Roth IRA:

- No upfront tax deduction. Roth IRA contributions cannot be deducted from your taxes, unlike traditional IRA contributions.

- Contribution limits. Roth IRA contribution limits are lower than traditional IRA contribution limits.

- Income limits. Income limits may restrict your Roth IRA contributions.

What investments can I hold in a Roth IRA?

There are a wide variety of financial assets that can be held in Roth IRAs, including stocks, bonds, mutual funds, and ETFs. Collectors’ items, such as art, antiques, and stamps, are not allowed.

What is the 5-year rule for Roth IRAs?

Until you have contributed to a Roth IRA account for at least five years, you cannot withdraw earnings tax-free.

Withdrawals of Roth IRA contributions without penalty may still be permitted if you don’t meet the 5-year rule. However, earnings will be subject to income tax and a 10% early withdrawal penalty if you do not meet an exception.

Five-year rules are subject to the following exceptions:

- You are at least 59 ½ years old.

- You have a disability.

- The money is being used for qualified education expenses.

- Your first home is being purchased with the money.

- After a person has died, they are entitled to a qualified distribution.

The 5-year rule applies to every Roth IRA account. In other words, if you own multiple Roth IRAs, you must keep track of the 5-year period for each account.

The post 97% of Americans Qualify – IRS Just Gave You $118,976.24 Tax-Free (How to Collect) appeared first on Due.

Is your retirement savings in need of a boost? If so, you’re in luck. Roth IRA contribution limits will finally increase in 2023.

What exactly does that mean? Basically, you can increase your retirement nest egg even further.

But, let’s pump the brakes a little. You may be wondering, what are Roth IRAs? This is similar to a regular IRA but with some awesome tax benefits. With Roth IRAs, you can contribute after-tax money. As a result, your retirement income will be tax-free when you retire.