Creating a Retirement Plan When You’re Self-Employed

There are plenty of perks to self-employment — you can create your own schedule, maintain creative control over your work and more efficiently pursue your passion. However, one downfall is…

This story originally appeared on Due

There are plenty of perks to self-employment — you can create your own schedule, maintain creative control over your work and more efficiently pursue your passion. However, one downfall is not having an employer retirement plan to ensure your financial future.

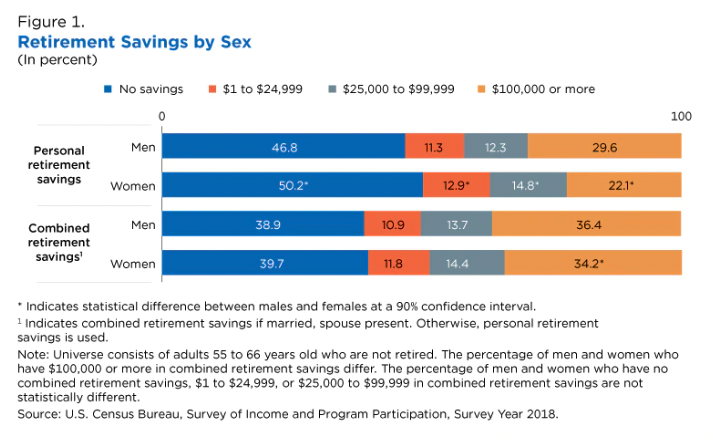

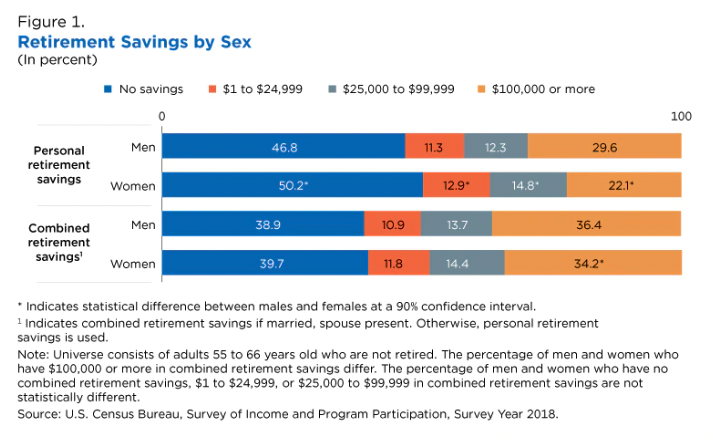

According to the U.S. Census Bureau, 49% of Americans ages 55-65 are financially unprepared for retirement. Women, in particular, account for most individuals with zero retirement savings at 50%.

Self-employment means you have to put away sufficient funds for your future retirement on your own. Thankfully, there are options to help you secure enough savings even without a traditional 9-to-5 career.

Why You Should Save for Retirement

We may grow accustomed to a particular lifestyle throughout our working lives. In addition to a roof over our heads, our incomes allow us to enjoy life’s simple pleasures like eating out, entertainment, travel, gift-giving, shopping and more.When we retire, many of us have only the savings in our bank accounts and our Social Security benefits. For many people who opt out of contributing to a retirement plan, living out their golden years requires considerable sacrifices and the potential for financial hardship.

You may make excuses for not investing in your post-retirement future, but there are plenty of reasons why you should reconsider your stance, such as the following:

- Social Security benefits are often not enough to maintain your current lifestyle.

- You don’t want to burden your children with your financial struggles.

- A retirement plan gives you access to a tax-deferred retirement account that lowers your taxes.

- Investing in your retirement account allows you to enjoy your nonworking years more comfortably with less worry.

For self-employed individuals who believe their Social Security benefits will help them get by after retiring, the Social Security Administration (SSA) begs to differ.

The SSA states that Social Security benefits only amount to 40% of your highest 35-year earnings at retirement age. Additionally, financial advisers agree that you likely need about 70% of preretirement income — including Social Security, personal savings, investments and other retirement accounts — to live comfortably without an income.

4 Retirement Plan Options for the Self-Employed

Saving for retirement is critical, especially if you’re self-employed. Sole proprietors have numerous options, but these four savings plans are the most common.

One-Participant 401(k)

Company employees may have the opportunity to participate in a 401(k) retirement plan. Self-employed individuals can still contribute to a 401(k) — however, it’ll only be for one participant.

A one-participant 401(k) works the same way as a workplace retirement plan, meaning you make pretax contributions that get taxed when you begin making withdrawals starting at 59 1/2. Some people may refer to these 401(k) plans as individual 401(k), solo 401(k), uni-401(k) or self-employed 401(k).

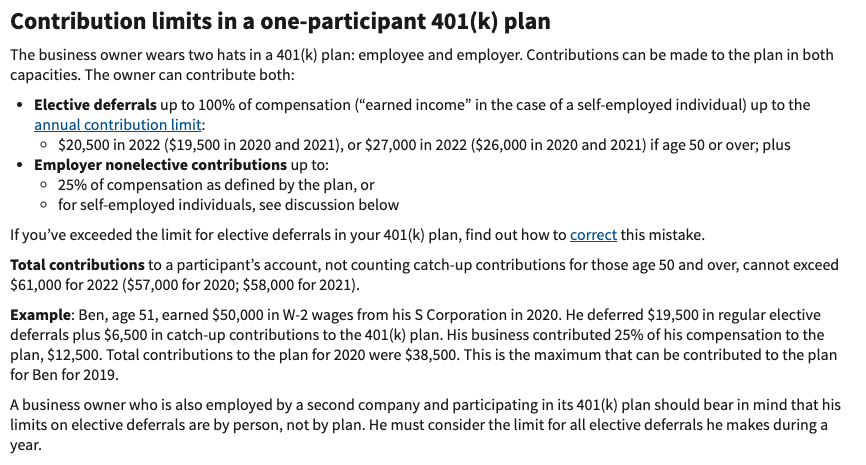

Contributing to a solo 401(k) is possible, regardless of age or income. As of 2022, individuals can contribute up to $61,000, while anyone over 50 can add a contribution of $6,500 in catch-ups.

Self-employed workers might want to consider the following benefits of opening a one-participant 401(k) account:

- Some contributors can save more than they would with other retirement plans.

- You can contribute 100% of your net adjusted self-employed income — up to the maximum limit — for the year as an employee or 25% of self-employed earnings as an employer.

- You can borrow up to 50% of your 401(k) for a loan, but you must repay the amount in five years.

- A Roth solo 401(k) is also possible for tax-free retirement withdrawals.

The time you begin withdrawing from your solo 401(k) determines how many taxes or penalties you’ll accrue. The Internal Revenue Service (IRS) requires you to start receiving distributions at 72 years old, whether you’re retired or not.

Meanwhile, the IRS may tax up to 10% on early distributions unless it meets a qualifying exemption, such as a disability, medical care deductions or if it’s going to a beneficiary following a death.

Traditional or Roth IRA

Traditional and Roth Individual Retirement Accounts (IRAs) are excellent savings plans to consider contributing to if you’re self-employed. However, their eligibility, tax and distribution rules differ.

Traditional IRA

A traditional IRA is independent of a workplace retirement plan and tax-deferred, meaning you won’t be taxed on your contributions until you begin to withdraw money from your account at the federal retirement age. Like a 401(k), you must make your first withdrawal no later than age 72 — however, you can continue contributing until you’re 70.

To be eligible for tax deductions on contributions to your traditional IRA, you must meet specific criteria related to your income, filing status and whether you have coverage by a workplace retirement plan. For example, the maximum tax deductions for self-employed filers in 2022 are as follows:

- Single filers without workplace retirement coverage: Eligible for a maximum $6,000 tax deduction on any modified adjusted gross income (AGI) or $7,000 if you’re over 50

- Joint filers without a workplace retirement coverage: Eligible for a maximum $6,000 tax deduction on any modified AGI or $7,000 if you’re over 50

- Joint filers without a workplace retirement plan whose spouse has coverage: Eligible for $6,000 if joint earnings are $204,000 or less.

Filers who earn between $204,000 and $214,000 might qualify for a reduced tax deduction on their traditional IRA. Otherwise, any earnings over $214,000 are not eligible.

Roth IRA

Unlike traditional IRAs, contributions to Roth IRA accounts are taxed beforehand and accumulate tax-free the longer the money sits in the account. You also receive tax-free distributions when you hit retirement age. However, taking funds out before you turn 59 might subject the withdrawal to fees and other penalties.

Another critical difference between traditional and Roth IRAs is that you can contribute to the latter your entire life without withdrawing money if you don’t want to.

Depending on your annual salary, you may or may not be able to use a Roth IRA for retirement planning. As of 2021, joint filers can contribute up to $6,000 yearly unless they have a modified AGI of $208,000. Likewise, single filers cannot contribute if they have a modified AGI of $140,000 or higher.

A Roth IRA allows you to invest in assets that could benefit you in your retirement years. For example, some account holders use their IRA accounts to put money into rental properties. Of course, there are several restrictions on what you can do with an IRA-owned rental unit.

Prohibited transactions — doing business with disqualified persons, using the property as a personal retreat, or doing maintenance and repairs yourself — carry severe financial implications.

The property might also be subject to income taxes, such as Unrelated Business Income Tax (UBIT) for business conducted inside the IRA or Unrelated Debt-Financed Income (UDFI) when you use leverage to take out a loan for property acquisition. You also risk termination of your Roth IRA account, at which point the IRS might penalize you.

Simplified Employee Pension (SEP) IRA

Self-employed individuals or business owners may want to open a SEP IRA, in which investments are tax-deductible until retirement. At that point, income tax applies to any withdrawals.

A SEP IRA is ideal for business owners with only a few employees since the IRS requires employers to contribute an equal percentage of their compensation on their workers’ behalf. For example, if you intend to invest 15% of your compensation, you must contribute 15% of your employee’s compensation to their plan.

If you oversee employees, the IRS mandates that all participants are 21 or older, have worked for you for three of the last five years and earned at least $650 from you in 2021.

Since an employer is the only person who contributes to a SEP IRA, those in business for themselves may like the flexibility and ease of managing this particular retirement savings plan.

A SEP IRA’s contribution limits are much higher than those of traditional and Roth IRAs. In 2022, sole proprietors can contribute a maximum of $61,000 to a SEP IRA or no more than 25% of their income.

SIMPLE IRA

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is another retirement option for self-employed individuals — but it may be more beneficial for small-business owners.

Like a traditional IRA, SIMPLE account holders contribute pretax income and only pay taxes upon withdrawal at retirement age.

The 2022 individual contribution limit is $14,000 for SIMPLE IRAs — in comparison, a 401(k) allows a maximum contribution of $20,000 while traditional and Roth IRAs limit you to $6,000. You may also contribute catch-ups if you’re over the age of 50.

Business owners must have less than 100 employees working for them tobe eligible. Additionally, owners and sole proprietors must not have contributed to other retirement plans within the last calendar year.

SIMPLE IRAs are easy to set up, but remember that other retirement plans have much higher contribution limits you can meet.

No Better Time to Save for Retirement Than Now

Having control over your career and time is great, but it’s critical to secure your financial future by creating a retirement plan. If you’re not currently saving, start now. The more you contribute toward your golden years, the more comfortable you’ll be.

The post Creating a Retirement Plan When You’re Self-Employed appeared first on Due.

There are plenty of perks to self-employment — you can create your own schedule, maintain creative control over your work and more efficiently pursue your passion. However, one downfall is not having an employer retirement plan to ensure your financial future.

According to the U.S. Census Bureau, 49% of Americans ages 55-65 are financially unprepared for retirement. Women, in particular, account for most individuals with zero retirement savings at 50%.