How to Create a Simple Budget

Having a business budget in place is an essential part of running a business.

Opinions expressed by Entrepreneur contributors are their own.

This article is part of the Spend Smart series. Read more stories

Whether you’re launching your first business or have years of experience as an entrepreneur, the importance of having a budget cannot be overstated. Creating a budget for your business will provide a guideline for expected income and expenses and enable you to compare your anticipated financial goals with the actual numbers. In essence, it will serve as a barometer for how your business is performing. It will also enable you to plan ahead and determine any changes that should be considered.

A budget can be created in a way that is most comfortable for you. You can use pencil and paper, a computer spreadsheet program or business accounting software. While you may also choose the time period (monthly, quarterly, annually) the budget may encompass, consider creating a monthly budget so you can compare the forecasted numbers with the actual numbers at closer intervals.

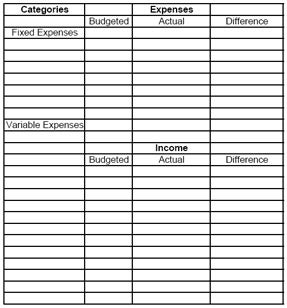

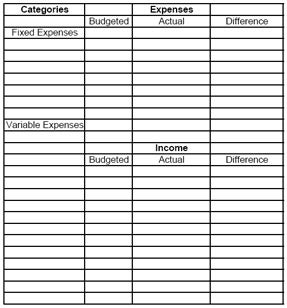

To create a budget, you’ll need to set up a page or spreadsheet as demonstrated below

- Adjust accordingly. During these tough economic times, entrepreneurs may be seeking ways to trim expenditures to increase cash flow. If your business expenses need to be reduced, determine which items are nonessential to your business and cut those items.

- Consult a professional. Consider consulting a trusted CPA, financial advisor or banker to help you create a budget. A trusted professional can help get you started on a budgeting system that will work best for your individual needs.

Having a business budget in place enables you to plan ahead, prioritize your allocation of funds and gauge whether your financial predictions are being met. It will also enable you to make educated decisions to enhance your business operations with added clarity and efficiency.

Whether you’re launching your first business or have years of experience as an entrepreneur, the importance of having a budget cannot be overstated. Creating a budget for your business will provide a guideline for expected income and expenses and enable you to compare your anticipated financial goals with the actual numbers. In essence, it will serve as a barometer for how your business is performing. It will also enable you to plan ahead and determine any changes that should be considered.

A budget can be created in a way that is most comfortable for you. You can use pencil and paper, a computer spreadsheet program or business accounting software. While you may also choose the time period (monthly, quarterly, annually) the budget may encompass, consider creating a monthly budget so you can compare the forecasted numbers with the actual numbers at closer intervals.

To create a budget, you’ll need to set up a page or spreadsheet as demonstrated below

- Adjust accordingly. During these tough economic times, entrepreneurs may be seeking ways to trim expenditures to increase cash flow. If your business expenses need to be reduced, determine which items are nonessential to your business and cut those items.

- Consult a professional. Consider consulting a trusted CPA, financial advisor or banker to help you create a budget. A trusted professional can help get you started on a budgeting system that will work best for your individual needs.

Having a business budget in place enables you to plan ahead, prioritize your allocation of funds and gauge whether your financial predictions are being met. It will also enable you to make educated decisions to enhance your business operations with added clarity and efficiency.