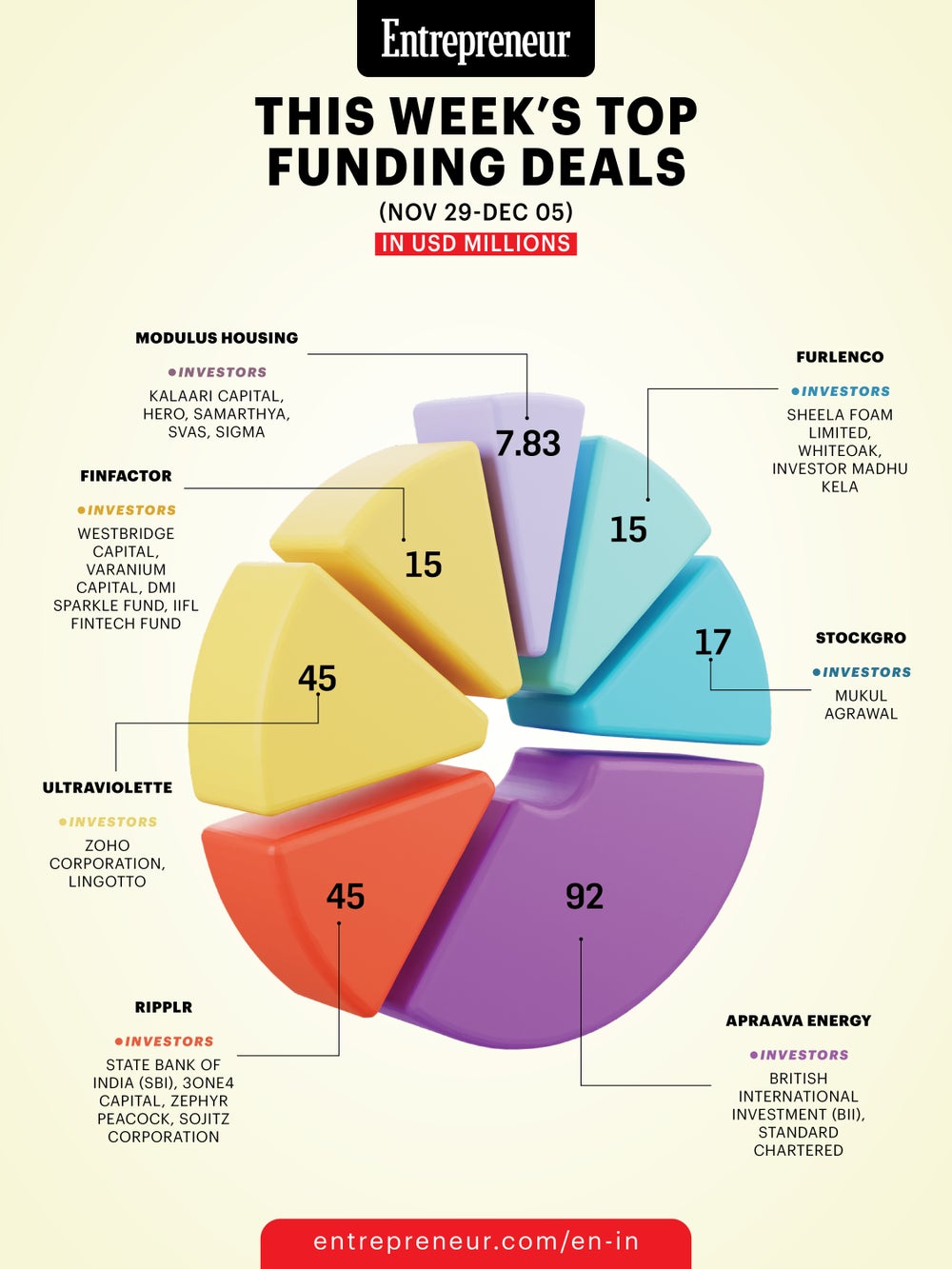

Apraava Energy, Ripplr, Ultraviolette Lead This Week's Startup Funding Activity Here is a quick look at the top funded startups for the week of Nov 29 to Dec 05.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

India's startup ecosystem recorded notable funding activity this week, with investors backing ventures across energy, mobility, fintech, distribution and modular infrastructure. The deals highlighted growing interest in sustainable energy solutions, digital finance infrastructure, and AI supported platforms. From electric motorcycles to open finance gateways, a diverse mix of companies secured capital to expand operations and strengthen technology capabilities.

Apraava Energy (Energy Solutions)

Apraava Energy is an integrated energy enterprise operating across renewable power, conventional generation, transmission, and smart metering. Formerly known as CLP India, it has built a broad energy portfolio that includes wind and solar projects, coal and gas generation, and customer centric energy services.

● Inception: 2002

● Headquartered: Mumbai

● Founder: Rajiv Ranjan Mishra

● Funding Amount: USD 92 Million

● Investors: British International Investment and Standard Chartered

Ripplr (Distribution Technology)

Ripplr offers a full stack distribution as a service platform (DaaS) tailored for FMCG and consumer brands. Its technology supports brand onboarding, store digitisation, warehousing, transport and last mile delivery. With real time visibility tools and predictive analytics, the company aims to optimise the entire distribution chain for improved efficiency and transparency.

● Inception: 2019

● Headquartered: Bengaluru

● Founders: Abhishek Nehru and Santosh Dabke

● Funding Amount: USD 45 Million

● Investors: State Bank of India, 3one4 Capital, Zephyr Peacock and Sojitz Corporation

Ultraviolette (Electric Mobility)

Ultraviolette builds performance focused electric motorcycles and supporting charging infrastructure. Its F77 range includes models such as Mach 2, SuperStreet and Recon, while the X 47 introduces a crossover design. The company also operates the UV Supernova fast charging network and incorporates AI driven riding technology through Violet AI, with future plans to enter racing and broader two wheeler categories.

● Inception: 2016

● Headquartered: Bengaluru

● Founders: Narayan Subramaniam and Niraj Rajmohan

● Funding Amount: USD 45 Million

● Investors: Zoho Corporation and Lingotto

StockGro (Investment Advisory Tech)

StockGro (Investment Advisory Tech)

StockGro functions as a social investment and advisory platform connecting users with SEBI registered market experts. It provides stock advisory services, portfolio support and capital market learning tools. The company recently launched Stoxo, an AI powered research assistant that blends analyst inputs with user generated insights to offer more contextual guidance for business analysis.

● Inception: 2020

● Headquartered: Bengaluru

● Founder: Ajay Lakhatia

● Funding Amount: USD 17 Million

● Investor: Mukul Agrawal

Furlenco (Rental Commerce)

Furlenco operates a subscription based furniture and appliance rental service with monthly and annual plans. Its offerings include free maintenance, deep cleaning, relocation help and product swapping. The company also caters to customers interested in refurbished products or purchase options, presenting an alternative to traditional ownership models.

● Inception: 2012

● Headquartered: Bengaluru

● Founder: Ajith Mohan Karimpana

● Funding Amount: USD 15 Million

● Investors: Sheela Foam Limited, Whiteoak and Madhu Kela

Finfactor (Open Finance Infrastructure)

Finfactor, the parent entity of Finvu Account Aggregator, provides open finance solutions including a multi AA gateway for consent based data exchange. It also offers AI powered bank statement analysers, loan monitoring tools, collections support and wealth management solutions. The platform helps financial institutions enhance underwriting and customer experience through integrated data driven processes.

● Inception: 2019

● Headquartered: Pune

● Founders: Manoj Alandkar and Munish Bhatia

● Funding Amount: USD 15 Million

● Investors: WestBridge Capital, Varanium Capital, DMI Sparkle Fund and IIFL Fintech Fund

Modulus Housing (Modular Infrastructure)

Modulus Housing develops modular and portable structures suited for rapid deployment in healthcare, defence and housing. Its products include MediCabs, which serve as portable medical units, and lightweight site offices built with green concrete technology. The company offers solutions for both temporary and permanent infrastructure requirements.

● Inception: 2018

● Headquartered: Chennai

● Founders: Shreeram Ravichandran and P Gobinath

● Funding Amount: USD 7.83 Million

● Investors: Kalaari Capital, Hero, Samarthya, SVAS and Sigma