Fund launch

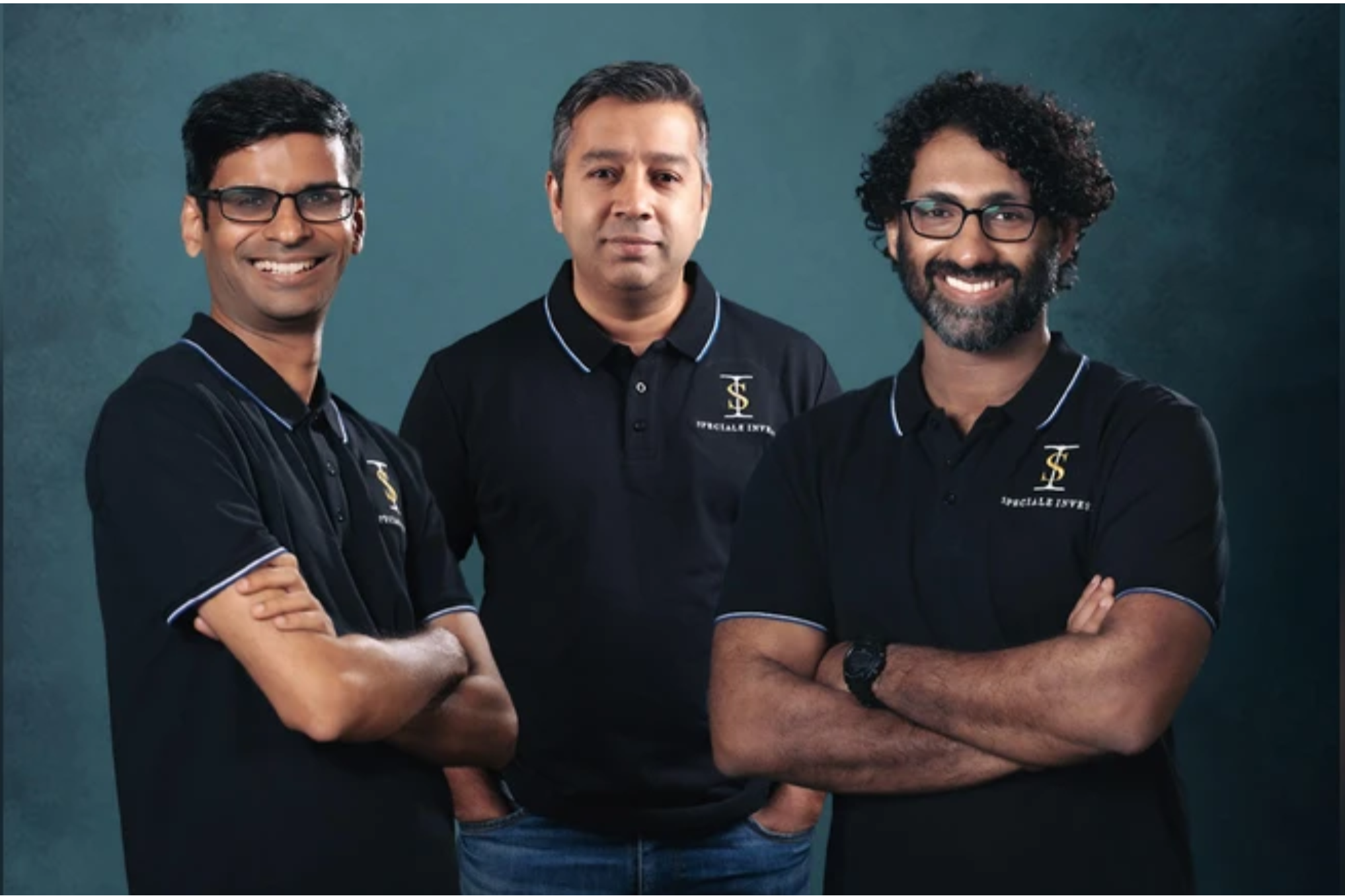

Speciale Invest Launches INR 1,400 Cr Fund for Deep Tech Startups

Growth Fund II plans to back around 12 to 15 startups, with average investments ranging between USD 5 million and USD 8 million.

ISFB Launches INR 25 Cr Fund to Back Student Founders

It will provide early stage capital, structured mentorship and operational support, allowing students to work on building companies while continuing their undergraduate or postgraduate studies.

BYT Capital Launches INR 180 Cr Fund for Early DeepTech Ventures

BYT Capital plans to invest in 18 to 20 startups, with initial cheques between INR 3 crore and INR 6 crore.

Veloce Fintech Launches INR 300 Cr Fund to Support MSMEs and Startups

Veloce Fintech aims to invest in 20–25 firms across diverse sectors by 2026, offering funding between INR 3 crore and INR 15 crore.

Japanese VC Firm Unleash Capital Closes INR 300 Cr Maiden Fund for Fintech Bets

The fund has invested in seven Indian startups and targets 12–15 companies overall, with cheque sizes ranging from INR 5 crore to INR 18 crore.

BizDateUp Launches INR 1,000 Cr Pulse Fund I

The fund targets AI, SaaS, fintech, healthtech, deeptech, defense, aerospace, gaming, EVs, renewable energy, and regtech, with strong emphasis on tier II and tier III cities.

IIM-Calcutta Innovation Park Launches INR 50 Cr Fund for Cleantech Startups

The fund will be deployed over the next 12 to 18 months to support startups working in clean energy, climate resilience, sustainable agriculture, and waste-to-value solutions.

Equirus Launches Offshore Small-Cap Fund from GIFT City for Global Investors

With a minimum investment requirement of USD 150,000, the fund focuses on listed small-cap companies in India that exhibit strong fundamentals, scalable business models, and high growth potential.

Kettleborough VC Launches Second Fund with INR 80 Cr Target

The firm plans to back about 10 companies, issuing initial seed cheques ranging from USD 300,000 to USD 500,000, with significant reserves allocated for follow-on investments.

Shaan Patel Asset Management Launches INR 200 Cr Category III AIF for HNIs

The fund adopts a flexi-cap approach, investing across large, mid, and small-cap stocks, with a maximum allocation of 10% per stock.

Kriscore Capital Announces First Close of INR 100 Cr Debut Fund

The fund plans to back 16–18 tech-driven startups at pre-seed and seed stages, focusing on exceptional founders innovating across India's digital consumer boom, China+1, GenAI, global exports, and Net Zero 2070 themes.

IXP Launches INR 200 Cr Fund to Boost Biotech Innovation

The portfolio will comprise 20-25 B2B startups spanning Pre-seed to Series A stages, addressing innovation gaps in areas such as pharmaceuticals, biotechnology, medical technology, specialty chemicals, agrotechnology, and nutraceuticals.

Eximius Ventures Launches USD 30 Mn Fund II to Back 25-30 Startups

Fund II aims to invest in 25-30 startups across fintech, AI/SaaS, frontier tech, and consumer tech, offering USD 500K initial cheques while reserving 50% for follow-on investments in high-potential companies.

SamVed Launches USD 50 Mn Fund to Back Early-Stage Tech Startups in India

SamVed targets early-stage investments of USD 80K–USD 120K, with up to USD 1 million for pre-Series A, focusing on startups addressing gaps in education, healthcare, finance, and lifestyle sectors.

Recur Club Unveils INR 150 Cr Fund to Boost D2C Growth in Quick Commerce

This special fund targets loan disbursal within seven days.