Funding Slows, but Big Deals, IPOs and Acquisitions Continue in Dec 06–11 Week Selective Deals This Week

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

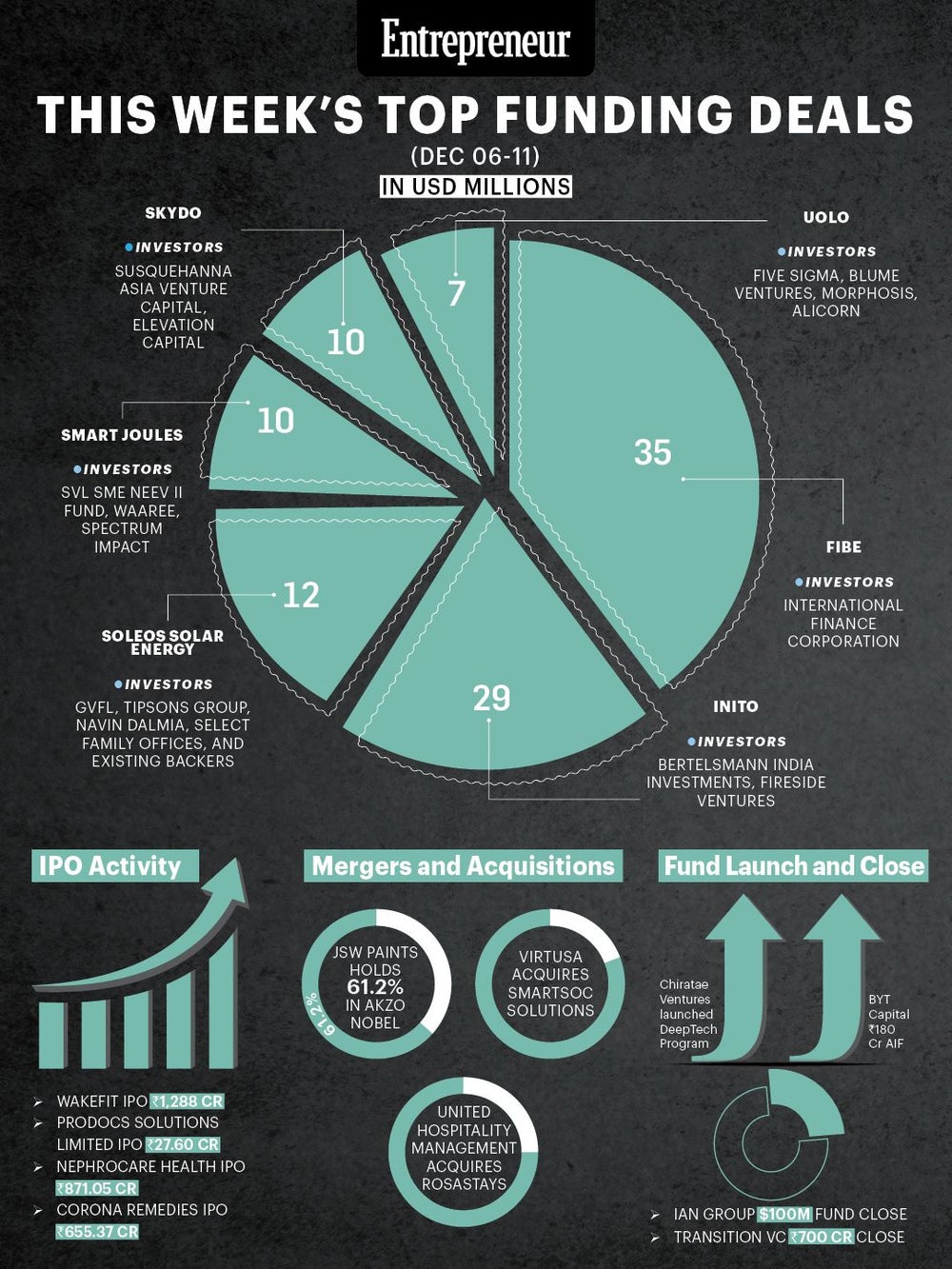

Funding momentum in the Indian startup ecosystem slowed during the week of December 06 to December 11, 2025, even as selective late stage and growth rounds continued to close. According to Tracxn, overall funding activity declined by around 42 percent compared to the previous week of November 28 to December 04. Alongside funding announcements, the week also saw multiple IPO openings, strategic acquisitions, and notable fund launches and final closes.

Top Funding Deals

Fibe (USD 35 million)

Founded in 2015 by Akshay Mehrotra and Ashish Goyal, Pune-based Fibe is a digital lending platform offering personal loans, long term credit products, loans against mutual funds, and digital fixed deposits. The company also focuses on impact driven lending across healthcare, education, and solar rooftop installations, catering to salaried professionals and emerging borrowers.

- Investor: International Finance Corporation

Inito (USD 29 million)

Bengaluru-based Inito was founded by Aayush Rai and Varun AV and operates an at home diagnostics platform focused on reproductive health. Its core product is an FDA registered fertility monitor that tracks hormones such as estrogen, LH, PdG, and FSH using a smartphone attachment. The company is expanding into broader health markers including thyroid and testosterone testing.

- Investors: Bertelsmann India Investments, Fireside Ventures

Soleos Solar Energy (USD 12 million)

Founded in 2017 by Bhavesh Rathod, Soleos Solar Energy is headquartered in Ahmedabad and provides engineering, procurement, and construction services for commercial, industrial, and ground mounted solar projects. The company also offers solar finance, insurance, investor services, and long term operations and maintenance, while manufacturing its own solar modules.

- Investors: GVFL, Tipsons Group, Navin Dalmia, Select family offices, and Existing backers

Smart Joules (USD 10 million)

Delhi-based Smart Joules was founded in 2014 by Arjun P Gupta, Sidhartha P Gupta, and Ujjal Majumdar. The company operates in the energy efficiency space through its financed Energy as a Service model. Its offerings include JoulePays, the DeJoule building management system, and JouleCool, a cooling as a service solution for commercial buildings.

- Investors: SVL SME Neev II Fund, Waaree, Spectrum Impact

Skydo (USD 10 million)

Founded in 2022 by Movin Jain and Srivatsan Sridhar, Skydo is a Bengaluru-based B2B cross border payments platform. The company enables Indian businesses to receive international payments through virtual foreign accounts, simplified forex compliance, faster INR conversion, and free Foreign Inward Remittance Certificates, targeting exporters and global service providers.

- Investors: Susquehanna Asia Venture Capital, Elevation Capital

Uolo (USD 7 million)

Uolo was originally founded in 2013 by Pallav Pandey, Ankur Pandey, and Badrish Agarwal as a school communication platform. In 2020, the business was acquired by Uolo Edtech, where Pallav Pandey became co-founder and CEO. Based in Gurugram, the company now partners with schools to supply textbooks and offers a home practice learning app for students.

- Investors: Five Sigma, Blume Ventures, Morphosis, Alicorn

IPO Activity

IPO Activity

Wakefit's public issue worth INR 1,288 crore opened on Monday, December 8, drawing attention from investors tracking consumer focused brands.

Prodocs Solutions Limited launched its book-build IPO of INR 27.60 crore, which opened for subscription on December 8 and closed on December 10, 2025. Nephrocare Health also entered the public markets with its book build issue of INR 871.05 crore, opening for bidding on December 10 and scheduled to close on December 12.

Meanwhile, Corona Remedies concluded its book-build IPO of INR 655.37 crore, with the issue opening on December 8 and closing on December 10, indicating steady interest in pharmaceutical and healthcare listings.

Mergers and Acquisitions

JSW Paints completed the acquisition of a majority stake in Akzo Nobel India after purchasing 60.76 percent shares from Akzo Nobel NV and its affiliates. Following an earlier open offer that secured 0.44 percent from public shareholders, JSW Paints now holds a 61.2 percent stake in the company.

US-based Virtusa announced the acquisition of Bengaluru-based SmartSoC Solutions, a semiconductor engineering and integrated circuit design services firm. The transaction value was not disclosed. Separately, United Hospitality Management officially entered the Indian market through the acquisition of boutique hospitality brand Rosastays.

Fund Launch and Close

Chiratae Ventures announced the launch of the Chiratae Sonic DeepTech Program aimed at supporting deeptech founders from Seed to Series A stages. The initiative is designed to accelerate early innovation across advanced technology sectors.

BYT Capital launched its maiden INR 180 crore Category II Alternative Investment Fund focused on deep tech and scientific innovation. The firm plans to invest in 18 to 20 startups, with initial cheques ranging from INR 3 crore to INR 6 crore, while allocating over half the fund for follow-on investments.

On the fund closure front, IAN Group completed the final close of its USD 100 million IAN Alpha Fund, targeting early stage companies across artificial intelligence, space technology, semiconductors, climate innovation, and healthcare. Transition VC also closed its debut fund at INR 700 crore, exceeding its original target of INR 400 crore.